Introduction

The goal of this blog article is to help demystify the world of investing and to provide information that will actually be useful to you so that, you can start investing immediately. In the beginning portion of this blog, we’ll address the most common myths surrounding stocks, the stock market and why they are just myths. Then, we’ll look at the most famous investor of all times and what makes him so good at picking great stocks using an investing method known as Value Investing.

Next, you’ll learn about the various types of investments you can actually buy and why you can invest in them. These are not theoretical examples of what might work for investors. Rather, they are actual investments you can choose from and learn more about before buying them. We will also go through why by reinvesting using the earnings, it can have such a huge positive impact on your finances, and how the magic of compounding really does work in your favor. Following that, we’ll cover the best strategies to use when deciding how often you should purchase investments.

For those of you who want to get right to the point and start investing right away, the remaining sections will take you step-by-step through each process. From registering your online broker account, to making your very first stock purchase, and how to access your earnings whenever you want them. Again, this blog article is really meant to help to you, regardless of whether you have zero experience in investing, some experience in investing and even bad experience in investing.

“The first step is you have to say that you can” – Will Smith.

(A) Story of John Part 1

Today, I am very excited because I will be meeting up with my friend John for a cup of coffee. I’ve not seen him for over a year due to our tight schedules. John is a great guy who works very hard and spends whatever little free time he has with his family. Honestly, I’m not sure how he does it though. Anytime we’d speak on the phone he sounded exhausted and said he was always struggling to keep up with everything.

After our last conversation I suggested we meet up so we could discuss what’s been happening and maybe some ways I could help him out. This interested John so he agreed to meet with me at my office to talk about it in more detail. You see, for the past several years I’ve been pretty successful with my investments and businesses, and I’m always willing to help out others to do the same. Having our coffee, we sat down and started discussing about his situation.

So John, tell me, how’s everything going? Financially, I mean. John replied, not so good, it’s tough you know. I’m working 40-60 hours a week depending on what my boss wants me to do at the office, and I’m struggling to keep up on all my payments. Between the mortgage, monthly bills, credit card debt, and my kids always needing money for school, it’s really tough. My wife, Natalie and I are doing the best we can but it’s not enough. We’re always worried about having money for the future, be it for us or our kids.

That’s why I wanted to meet up with you. I heard that your company does something with investing and know that you’re doing really well. So, I thought I’d come and see how you do it and learn more. I looked him right in the eye and said, well, I’m really glad you’re here John because you and I are going to fix your situation right now.

(B) 5 Myths of Investing in Stocks

I asked John what he knew about investing and about generating passive income. His reply was one I’ve come to hear quite often. He said, what little he knew about investing came from movies like The Wolf of Wall Street (2013), Wall Street 2: Money Never Sleeps (2010), Too Big To Fail (2011), or came from listening to advices from brokers, newspapers, radio, etc. He thought investing was something only rich people do because they already have money and for them to lose it away is no big deal.

Sadly, this is what many people believe as well, that investing in the stock market is something only rich people do and that it’s just like gambling in a casino. It’s just a game of luck and you can lose all of your money so quickly, so why bother investing at all. This is simply not true. If an individual investor thinks this way, it’s a sure bet that they will eventually gamble away all their money.

It reminded me of a famous quote by Paul Samuelson who said, “Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.” John and I had a good laugh for a moment and I then said, that if you think investing is just like gambling, you’re doing it completely wrong. It takes planning, patience, careful research, and time.

If an individual investor is willing to spend a little time learning about the stock market, how it works, and what to do to minimize their risk, well then, they will do very well financially. John then said, that’s great to hear but to be honest, I’m still confused from what I’ve heard about investing and from what your telling me now. Hearing this, I decided to explain to him the five myths of investing and why they are really just myths. After all, once you get past the myths you can then look at what is real and make some very good decisions.

With investment fiascoes like Enron, Lehman Brothers, the Libor or London Whales scandals, and financial analysts’ giving conflicting or bad advice, an investor’s confidence can be low in the stock market. Many investors wonder whether or not investing in stocks is really worth all the hassle and confusion. Sure, bad things had happened in the past and possibly will happen in the future but those are because of people who chose to commit bad or harmful actions against others.

This does not always happen as there are many investors who choose to do good, and help others improve their financial situations in an honest way. It’s important to always keep a realistic view of the stock market, but to also keep in mind the more you know the better off you will be when it comes to making decisions regarding your investments. Regardless of the reasons, be it real problems or not, common myths about the stock market often arise. These are the top five myths most people believe today

MYTH #1 INVESTING IN STOCKS IS JUST LIKE GAMBLING (I.E. GUESSING STOCK PRICES)

This reason alone causes many people to shy away from investing in the stock market. Often times, people will confuse the two words of investing and gambling/trading/speculating to mean the same thing. To make an investment means, to use money to purchase something offering profitable returns, especially interest, dividends, or income. Gambling means, to play a game of chance for wagering stakes, by using money or anything of value, to bet on its outcome. Which gamblers that you know has make money consistently? But I do know which casino has make money consistently from the gamblers. So who do you want to be? The one that gambles, or the one that owns/invest in the casino.

To understand why investing in stocks is inherently different from gambling, it’s important to know what it means to buy stocks especially one that has great value. To buy a share of a common stock is to take some ownership in a company. It entitles the owner of the stock to a share of the assets as well as a fraction of the profits that the company generates. Investors often, mistakenly think of shares as simply a trading vehicle, and they forget that the stock represents their ownership in a company.

By purchasing a share of a company’s stock you not only own a share of the company, but if the company is profitable they can issue dividends which are directly paid to it’s share holders. Alternatively, if the price of the stock goes up, you can sell it for a profit. Many view the stock market as something unpredictable which fluctuates up and down like a yo-yo, but in general its trend is always moving up. For example, if you buy Starbucks shares, you are a shareholder of Starbucks. Because you are a shareholder, you are entitled to its dividends. But our role is not to guess the stock price of Starbucks.

Since, the outlook for business conditions is always changing, so too are the future earnings of a company. Stock prices fluctuate because a company’s earnings also fluctuate year to year. All of this is okay since investing is done with the goal of it being for the long-term. Investors know that good companies will continue to do well and generate returns for their shareholders even if they occasionally have a bad year. This yo-yo effect becomes less of a concern as a company’s long-term growth continues to move in a forward and positive direction.

In the short-term, a company can survive without profits because of the expectations of future earnings, but no company can fool investors forever. Eventually, a company’s stock price can be expected to show their true value to its shareholders. If they are positive and consistent, then a company’s stock price will reflect this data and investors will profit from their investment. There are many ways of investing in stocks but the one that has been working close to a century is known as value investing.

Gambling, on the other hand, is a zero-sum game. What I mean to say, is that the goal of placing a bet or wager is to merely win money by taking it from a loser and giving it to a winner. No value is ever created. When a person chooses to gamble they have to place short-term bets hoping to win a lot of money quickly. And here-in lies the problem.

At best, a person who gambles may earn some money immediately but no matter how much they win, they will not be able to continually generate income in the future from the same bets. They will need to constantly place new bets hoping that they pay off. However, people forget that when gambling, the true winner is the house (i.e. The casino) because they control the stakes and payouts. As any experienced gambler will tell you, no matter who you are, the longer you keep betting, the house will always win.

By investing your money in the stock market, you help to increase the overall wealth of an economy creating more jobs for others. This allows companies to become more innovative and competitive increasing their production of better products and goods. All of which translates into an increase in their value and profits which benefit their shareholders. This is how investing is different from gambling. Investing creates long-term wealth generation, where as, gambling creates short-term gains if you win, and after the house takes its share first. Don’t confuse investing and creating wealth with gambling’s zero-sum game.

MYTH #2 THE STOCK MARKET IS AN EXCLUSIVE CLUB FOR BROKERS AND RICH PEOPLE

This is absolutely untrue. Any person, regardless of their financial background can invest in the stock market. What many people forget, is that, everyone had to start investing in order to become rich, even if it was only with one dollar. The purpose of the stock market is to be a place where anyone can buy or sell stocks. Not a place only rich brokers and investors work like those depicted in movies or television.

As Robert Kiyosaki says, “My rich dad also thought that the Hollywood version of investing was financial silliness. ‘Many people think investing is this exciting process where there is a lot of drama,’ he said. ‘Many people think it involves a lot of risk, luck, timing, and hot tips. But to me investing is a plan—an often dull, boring, and almost mechanical process of getting rich.’ For rich dad, the dull, boring, and almost mechanical process of getting rich was his formula based on his favorite game, Monopoly, a game he taught his son and me when we were kids.

That formula was simple: Buy four green houses. Exchange four green houses for a red hotel. At the time he was teaching us this formula, rich dad didn’t have his red hotel in real life. But by following his plan, he had a number of them within ten years.

Rich dad was adamant that this was not a difficult or complex process. He simply invested in a good deal and then “traded up” those investments when able. ‘One day,’ he said, ‘I woke up and realized I was rich.’

The question is, if investing is a matter of simply following a formula, then how come most people don’t follow the same formula? The reality is that most people do not want to follow boring formulas. They get dull. Most people start following a plan and then they get bored. The result of this is often a loss of money or breaking even. With the exciting and wild swings come fluctuations in money but never the slow, steady, measured growth a true investor looks for. ‘Most people think there is some magic to getting rich through investing,’ rich dad said. ‘Or they think that if it is not complicated, it cannot be a good plan. Trust me. When it comes to investing, simple is better than complex.’”

Just because many brokers or market advisors claim to be able to know the markets’ every turn, the fact is that, almost every study done on this topic has proven these claims are false. Most brokers are notoriously inaccurate and can be misleading. Years before, they were the only ones to have all of this information at their finger tips. Its meanings were clouded in mystery and difficult to interpret even if a non-professional brokers could get their hands on the same information. However, within the last few decades the internet has made the market much more open to the public than ever before. All the data and research tools previously available only to the brokerage firms are now there and easy to access for individuals to use as well.

MYTH #3 FALLEN ANGELS WILL GO BACK UP, EVENTUALLY

What do I mean by this? Well, often times amateur investors will think that a stock trading near its 52-week low is a good buy. Whatever the reason for this myth’s appeal, nothing is more destructive then to think this way. There is a Wall Street proverb that says, “Those who try to catch a falling knife only get hurt.” Meaning, when a stock is falling in price, don’t try to guess where it will bottom out. This can lead to costly mistakes causing you to loose money.

For example, suppose you are looking at two stocks:

- Starbucks (SBUX) had an all-time high last year with it’s stock price ending around $50, but has since fallen to $10 per share.

- Wells Fargo (WFC) has recently gone from $5 to $10 per share.

Which stock would you buy? Believe it or not, all things being equal, a majority of investors will choose SBUX, because they believe that it will eventually make it back up to $50 or similar levels again.

Thinking this way is the worst idea in investing! Price is only one part of the investing equation but value is the other larger part. The goal for any investor is to buy good companies at reasonable prices using a method known as value investing. Buying companies solely because their market price has fallen or has gone up will either get you nowhere or in a negative cash situation. This reminds me of a famous quote by Warren Buffett, who said, “Price is what you Pay, Value is what you Get.” We’ll talk more about him later but the point is, to always buy a good company at a reasonable price.

MYTH #4 STOCKS THAT GO UP MUST COME DOWN

The laws of physics do not apply to the stock market and if an investor believes this, they can make serious errors in their investing strategies. Unlike the physical world we live in, there’s no gravitational force to pull stocks back to an even or ground level. The stock market is always moving forward and upward even during those years when there are corrections or losses.

For example, in 1980, Warren Buffett’s company Berkshire Hathaway’s (BRK-A) stock price was at $167 per share which was a bit steep but fair since it’s considered a good company. Then, between 1990 and 1994, the price went from $7,455 to $17,250 per share. In 1998, it climbed to $78,305, in 2004 to $94,500, and in 2007 it moved to $141,600 per share. Had you thought that this stock was going to return to its lower initial position, you would have missed out on the subsequent rise to its current price of $215,824 per share over the years.

Of course it’s great to see a company’s highs but what about when there are market corrections in which the stock drops in price? Sure, this happens at various times during a company’s life span but a good company always recovers and gains in price just like the stock market overall in the long run. Berkshire Hathaway is no different. In 2000, and 2008, it’s price decreased by several thousand dollars but it always returned stronger and higher then before. The point, is that the stock price is a reflection of the company. If you find that it’s run by excellent managers, then there is no reason the stock won’t keep on going up. This graph shows the company’s performance over the past 45 years.

MYTH #5 A LITTLE KNOWLEDGE IS BETTER THAN NONE

Normally, this can be true in people’s daily lives as a little knowledge may be all you need in order to do something. However, it is not true when it comes to investing. It’s crucial in the stock market that an investor have a clear understanding of what they are doing with their money. Those investors who do their homework and put in the work are the ones that succeed.

Not everyone has the time or energy to research and learn how the market works, so they will seek a good financial advisor to help them decide what to do with their money. This may come from a company, a seminar, even a book, but the important thing is that they are learning why they’re investing their money and how it works. The cost of investing in something that they do not fully understand far outweighs the cost of speaking with an investment advisor.

Just like the old Wall Street saying goes, “What’s obvious is obviously wrong.” This means that knowing a little bit will only have you following the crowd making choices you don’t understand which could lead to costly mistakes. Successful investing takes a little hard work and effort but is definitely manageable for even those with busy and hectic lives. Another way to think of it, is imagine that a partially informed investor is like a partially informed surgeon. The mistakes they could make, could be severe, and cause injuries to their financial health.

John’s response to all of this was very positive as he said he never knew any of this information. He simply thought, that what everyone else had said about investing was true. This is not uncommon for many people, as we tend to form opinions from what information we can gather, even if it is clouded or inaccurate. I explained to John that it’s always important to form his own opinion and learn the best ways to invest his money in order to make it grow. The truth is, by investing in yourself and your own knowledge you will gain more then you ever thought possible.

Now, having dealt with John’s misbeliefs in the stock market I decided it was time we look at someone who is really successful at investing. What better example then to look at the man who is known as an investment guru and often times referred to as, ‘The Oracle of Omaha,’ Warren Buffett.

“If you really want to do something, you’ll find a way. If you don’t, you’ll find an excuse” – Jim Rohn.

3) WARREN BUFFETT – THE MAN WHO MADE VALUE INVESTING POPULAR

When I first asked John if he’d ever heard of Warren Buffett he looked at me a little puzzled at first and then said, sure, he’s the guy who owns the popular all-you-can-eat restaurant buffet’s right? Hahahahaha! I laughed out loud. If only that were true, then he might not only hold the title for being the most successful investor in the world but he might also be the heaviest too. Both John and I got a good laugh out of his remark and then he said, isn’t he the really rich guy known for investing? That’s right John, but there is a little more to him then just that, I replied. After my laughing died down a little I was able to talk more about who Warren Buffett is.

CHILDHOOD AND INVESTING

Born on August 30, 1930, in Omaha, Nebraska, Warren Buffett’s father, Howard Buffett, worked as a stockbroker and as a U.S. congressman. His mother, Leila Stahl Buffett, was a homemaker, and he was the second of three children with one older and one younger sister. Demonstrating a knack for financial and business matters early in his childhood, friends and acquaintances said that young Warren was a mathematical prodigy who could add large columns of numbers in his head. This talent is one he occasionally demonstrated later in his life as well.

As a child Warren often visited his father’s stock-brokerage shop, and wrote the stock prices on a chalk board in the office. At 11 years old he made his first investment, buying three shares for his sister Doris and three shares for himself, of Cities Service Preferred at $38 per share. The stock price quickly dropped to $27, but instead of panicking he and his sister held on to their shares until they reached $40. They sold their shares for a small profit, but regretted the decision when Cities Service shot up to nearly $200 a share not long after. Warren later said that this experience served him as an early lesson to having patience in investing.

FIRST ENTREPRENEURIAL VENTURE

By the age of 13, he was running his own businesses as a paperboy while selling Coca-Cola beverages, golf balls, magazines, and his own horse-racing tip sheet. He also filed his first tax return, claiming his bicycle as a $35 tax deduction to reduce his taxes.

Then in 1942, while in high school, Warren and a friend of his purchased a used pinball machine for $25. They installed it in a barbershop with the hopes of making money continually from other children playing it. Within a few months the profits they earned enabled them to buy even more machines. Warren owned pinball machines in three different locations before he sold the business for $1,200. By the age of 15, he amassed $2,000, bought a 40-acres farm and hired staff to run it. All the while using the nearly $10,000 in profits he earned to attend university.

HIGHER EDUCATION AND EARLY CAREER

After completing his Bachelor’s degree, he applied to Harvard Business School only to be rejected. This did not stop him from pursuing his dream of becoming a full-time investor though. Being influenced by Benjamin Graham’s book, The Intelligent Investor (1949), Warren enrolled at Columbia Business School to study under Graham who is considered an acclaimed economist and investor.

Earning his master’s degree in 1951, he started selling securities for his father’s firm Buffett-Falk & Company. After a few years, he then went to work for his mentor Benjamin Graham as an analyst at the Graham-Newman Corp. (GNC) There he worked closely with Walter Schloss and Graham, who was said to be a tough boss. Mr. Graham is considered the father of Value Investing which is what he and his business partner, Walter Schloss both practiced at their company. People familiar with the term value Investing in modern times might associate it with Warren Buffett and the analysis of a business’s ability to generate above-average and sustainable profit margins and cash flows to determine intrinsic value with a focus on the Income and cash flow statement. Buffett wants to find companies – companies that can grow intrinsic value over time. Buffett will always be the poster child for value investing.

The principles of Value Investing are to find good companies at a cheap price. This methodology proved to be very successful for any investor and Warren quickly learned how to apply these principles in finding good companies at a good price. In 1956, Benjamin Graham retired, closing his partnership allowing Warren to take his personal savings, which was over $174,000, and started Buffett Associates Ltd.

As he became more successful, he created and managed a total of 7 partnerships in just a couple of years. During which time, he met Charlie Munger, another very successful investor and future business partner. By 1962, Warren decided to take all his partnerships and place them under one company, called Buffett Partnerships Ltd. Forming this partnership in his hometown of Omaha, Nebraska he utilized the techniques learned from Benjamin Graham called Value Investing.

Warren was very successful in identifying undervalued companies using value investing, investing in them, and quickly becoming a millionaire. Buffett Partnerships Ltd., had a combined total value of $7.17 Million and Warren himself was worth over $1 Million. By 1965, he decided to invest in an undervalued textile company named Berkshire Hathaway.

At this point, I could see John’s eyes begin to close slightly giving me that look of partial boredom so jokingly, I told him that this is the year Warren Buffett became the first investor to go to the moon. Investing in a rocket ship, he and several of his business partners took a short trip to the moon and back for a mere $10,000 each. Shaking his head, John’s eyes flew open and he said, wait. He went to the moon? I never knew that. How could an investor go to the moon? He didn’t, I replied. I was just checking to see if you were still following me. I know this can seem a little dull but it’s really important to know this information since I’m not just describing Warren Buffett’s success story. What I’m really outlining is how he became wealthy through investing. The more you understand this concept, the better off you will be in your own investing success.

BUSINESS EMPIRE

Despite the financial success of the Buffett Partnership Ltd., Warren decided to close it in 1969. Having gained ownership of Berkshire Hathaway, he and Charlie Munger began buying assets in media (The Washington Post), insurance (GEICO) and oil (Exxon). Making Berkshire Hathaway (BRK.A) into a publicly traded company Warren became immensely successful, even managing to fix and profit from bad investments. Thus earning him the title, the ‘Oracle of Omaha.’k

In 1970, he began writing his now-famous annual letters to his shareholders which show everything the company has invested in and clearly outlines its future direction. These letters are sought after by many people who wish to learn what companies Berkshire Hathaway is investing in and how successful they are becoming as a result. For example, in 1979, Berkshire began the year trading at $775 per share, and ended at $1,310. At the time, Warren Buffett’s net worth reached $620 Million.

Over the course of the next forty-years, Berkshire Hathaway acquired stock in popular companies such as; American Express Co. (AXP), Costco Wholesale Corp. (COST), DirectTV (DTV), General Electric Co. (GE), General Motors Co. (GM), Coca-Cola Co. (KO), International Business Machines Corp. (IBM), Wal-Mart Stores Inc. (WMT), Proctor & Gamble Co. (PG), and Wells Fargo & Co. (WFC). Not only is Warren Buffett continuing to grow Berkshire’s earnings each year, he also is able to successfully weather the financial storms hitting the stock market.

Notably, the stock market crash in 1987 also known as Black Monday is considered the single worst financial loss in history. Many investors and companies lost a great deal of their investments including Berkshire Hathaway. Its share price dropped from $4,200 to $3,100 per share. But due to Warren’s strong investment style in value investing and his buying 7% of The Coca-Cola Company stock, Berkshire’s price rose to $8,000 per share by 1989.

Before the Dot-Com market crash in 2000, Berkshire’s price was around $57,000 per share and though it dropped a little due to the crash, by the end of 2001 it was trading for a little above $75,000 per share. Even with the Mortgage Crisis of 2008, Berkshire Hathaway’s share price remind high. Trading above $100,000 a share, less then a year after the Crisis it continued to climb even higher.

AS A BILLIONAIRE

In August 2014, the price of Berkshire Hathaway’s stock hit $200,000 a share for the first time and Warren Buffett’s net worth reached $64.2 Billion. As a long time philanthropist with a strong desire to give back to the world community Warren announced in 2006, that he will gradually give away 85% of his Berkshire holdings to five foundations in annual gifts of stock. With the largest contribution going to the Bill and Melinda Gates Foundation. His donation has become the largest act of charitable giving in United States history. In 2010, Warren Buffett and Bill Gates announced they had formed The Giving Pledge campaign to recruit more wealthy individuals for philanthropic causes.

Even with his net worth in the billions and his enormous charitable donations Warren has not stopped investing. Buying shares in companies such as; Precision Castparts (PCP), Phillips 66 (PSX), Kraft Heinz (KHC), Burger King/Tim Hortons (QSR), and taking ownership of Dairy Queen and Fruit of the Loom (BRK.B) in 2015. At 85 years of age he is not showing any signs of slowing down. He is continually building his wealth through investments and adding to his charitable donations, because as he once stated, “If you’re in the luckiest 1% of humanity, you owe it to the rest of humanity to think about the other 99%.”

WARREN BUFFETT’S WEALTH

As of June 2016, his net worth reached $66.5 Billion making him the third wealthiest man in the world, and the second wealthiest man in the United States. So how did he do it? Warren is famous for his folksy yet incredibly wonderful investment advice, but perhaps none of that advice sums up his investment philosophy better than this gem of wisdom offered up to his investors in 2013. “It’s better to have a partial interest in the diamond than to own all of a rhinestone.” Meaning, it’s much better to own a smaller piece of a great company then it is to own all of an average performing company.

His passion for numbers is rivaled only by his passion for bargains, and over the past 60 years, ‘the Oracle of Omaha’ has built a portfolio of top-tier companies that have made him one of the world’s richest men. Being an active equity investor that’s willing to take stakes in great companies even if he can’t buy them outright has served him extremely well. For example, during the last U.S. recession, he orchestrated money making deals with Goldman Sachs and Bank of America that reinforce his belief that it’s better to own a little of something that is valuable, than all of something that is not.

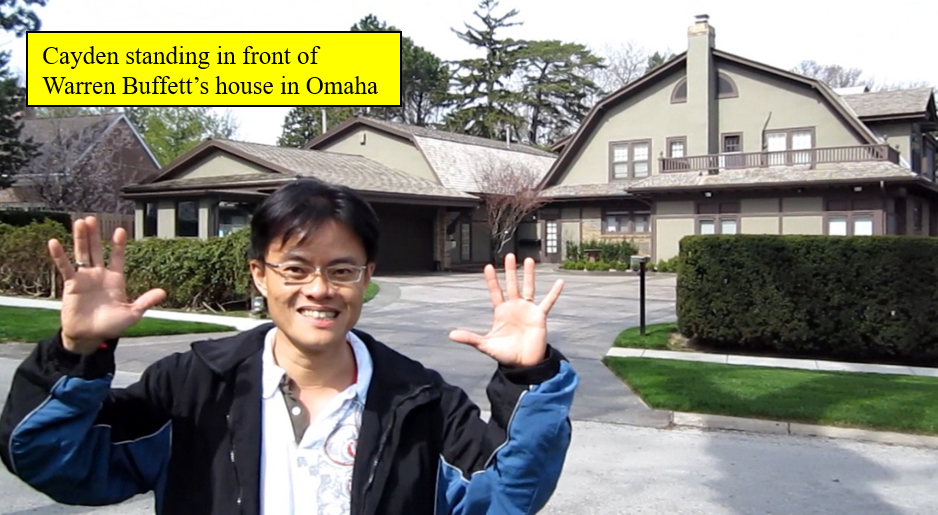

Well known for his frugality, Warren still lives in his Omaha home which he purchased for $31,500 back in 1958. He is always thankful to those who have supported and helped him along the way, and says that his best investment was buying Benjamin Graham’s book, The Intelligent Investor (1949), in 1949.

The Word ‘Value Investing’ is probably most closely associated with Warren Buffett than just any other investor in the world and that’s rightly so. After all, Buffett’s the fourth richest man in the world with a fortune worth about US$82.7B *(as of Apr 2019) that was built almost solely on investing in business and the stock market. Value Investing has indeed evolved a lot from Graham’s thinking to Buffett’s Current philosophy.

FUND MANGERS VS. SELF INVESTING

Looking a little surprised, John said, wow, I had no idea that he was such a successful investor from such an early age. Although, it seems like he had a bit of an advantage since his father was involved in the stock market, so, what about someone who has no experience in the market? I fear that I’d lose all my money picking the wrong stocks or that I wouldn’t have enough money to buy the really good stocks. Sure, that is of course everyone’s concern but the difference between Warren Buffett and other investors is that he researches what he will invest in first and determines if it is a good company before investing in them.

Right, that makes sense, but that sounds very time consuming and like a lot of work. I heard some people talk about using a fund manager. Someone who is a professional investor. Couldn’t I just use them and save myself the trouble of doing all the work? Plus, shouldn’t they know the best stocks to invest in since they are professionals who do this for a living? I mean, wouldn’t my chances be better giving my money to an expert to invest for me so they can make sure I make a lot of money from my investments? John replied.

Well my friend, you’re both right and wrong. It’s true that fund managers are professionals who spend their days’ investing other people’s money with the goal of making more for their clients. However, a fund manager is not responsible for what happens to their client’s money. If the investments, they make for their clients don’t do well or underperform the fund manager holds no responsibility. The fund manager gets paid everyday even when their clients are loosing money. What? But, I thought they only make money if their clients make money, said John.

Ahh, that is the misperception most people have. You see, fund managing firms are set up to invest money for their clients while collecting fees from them. They collect a premium on everything they do for you, sometimes even calling them will be charged to your account. Fees for these managers often run between 0.6% to 2% which can add up. It’s not to say that they won’t do their best to make you more money but their investment strategy is their own and may be very risky or a huge gamble. They will claim that they can make a lot of money quickly but what they don’t say is that it comes with a very real and very high risk.

Think of it this way. When you go to place a bet on a game of any kind, you usually have to give the money to a bookie to hold onto until the end of the game. So, if you win, you go back and collect your winnings, but if you lose, you don’t get anything back and the person who won gets your money. Now, regardless of what happens in the game the bookie makes money from you. That’s because they collect a fee from you anytime you make a bet and either way, win or lose, they make money. Fund managing firms operate in a similar fashion. I know this is a crude example but by giving your money to a fund manager you are essentially making a bet and win or lose they will make money from you.

To be honest with you John, the best advice I have for you or any investor for that matter is to learn from Warren Buffett’s example on how to be a good investor. Start by investing in yourself and learn about how the market works, then research companies you might be interested in investing in. Get advice from financial advisors if needed, but still do your own homework and learn about the investments before you put your money into them. It takes a little time and energy at first but it’s worth it in the long run.

Now, I understand that you like many other people don’t have a lot of time to spend researching how to invest in the stock market, but I would say to at least spend 10 minutes a day learning about the market. This way, you are always learning something about investing and you are moving forward toward your goal with investing. The only word of caution I would have is to be weary of fund managers and stock brokers. This is because they’re not always clear about their fee structures, and they usually are paid regardless of how you do in the stock market.

“There are a few investment managers, of course, who are very good – though in the short run, it’s difficult to determine whether a great record is due to luck or talent. Most advisors, however, are far better at generating high fees then they are at generating high returns. In truth, their core competence is salesmanship. Rather than listen to their siren songs, investors – large and small – should instead read Jack Bogle’s The Little Book of Common Sense Investing” – Warren Buffett.

WHAT’S BETTER? FUND MANAGERS OR INDEX FUNDS?

There has been a debate concerning the profitability fund managers provide compared to the stock market index funds. Between them, there is a bright distinct line dividing these two fundamentally different approaches to investing. Numerous studies have shown that index funds, with their low costs and ability to closely mimic the returns of markets both broad and narrow, steadily outperform the returns of most actively managed funds.

To better understand why there is a difference between the two, we need to look at the distinction between funds that are managed and those that are indexed. Actively managed funds are handled by an individual or team of managers. Successful management of a fund requires evaluations of a fund’s investing style, growth, risk and return profile, trading activity, costs, and performance. How well they score in these areas is important and can determine if an investor utilizes their services or not.

Index funds are passively managed, which means that their portfolios mirror the components of a market index. Because of this, the costs associated with an index fund are much lower then an actively managed fund. For example, the highly well-known Vanguard 500 Index fund is composed of the same 500 stocks as it’s counter part the Standard & Poor’s 500 Index. It is also based on the same market capitalization scheme and costs much less then an actively managed fund. So, let’s look at why index funds are performing so much better then those funds which are actively managed by fund managers.

ACTIVELY MANAGED FUNDS

Really, the big difference comes down to where do you think your money will give you the biggest return? This is usually the argument most people will make when siding with fund managers to invest your money. The idea being, that a well-run actively managed fund with a long-term performance record which is above their peer and category benchmarks are excellent investing opportunities. There are even a number of top-rated fund managers that consistently deliver exceptional yearly results.

These are all fantastic things to hear and generally would be enough to convince someone with little or no investing experience to decide on using a fund manager. I mean, why wouldn’t you? If a fund manager can continually give their clients high yearly returns, then why not invest with them? Well, something they may not mention, is that despite their impressive long-term records, even top-rated fund managers can have bad years. Also, in recent years, a number of fund management-related issues have received more public attention in the financial press than in the past. These fall under the general heading of fund stewardship and include such issues as a manager’s financial stake in a fund, performance fees and the composition of a fund’s board of directors. Article Title: Fund Management Issues, Author: Richard Loth.

When chosen properly, actively managed funds can bring significant benefits and advantages to an investors portfolio. Year after year however, the performance of most actively managed funds does fall short of whatever index is most appropriate for the funds’ benchmarks. Some will use the S&P 500 as a benchmark or various other indexes to compare against the performance of fund managers. In 2015, both The Washington Post & CNN Money, reported findings to support why indexes outperform fund managers with data collected by Morningstar. Article Title: Active vs. Passive: How fund managers stack up to index funds, Author: Jonnelle Marte.

Morningstar is considered to be a highly respected and reliable investment research firm that compiles and analyzes funds, stocks, general market data, and provides a source of independent investment analysis for all levels of investors. They conducted a comprehensive study and found that in 2014, nearly 86% of all fund managers under-performed compared to the S&P 500. Not to mention that, almost 89% of fund managers under-performed over the past five years, and 82% under-performed over the past ten years. But the real question is why? Are they just bad managers or are they taking huge risks and not doing their homework before investing their clients’ money? Article Title: 86% of investment managers stunk in 2014, Author: Matt Egan.

Well, it’s possible some fund managers fall into these groups but most certainly not all of them. The main reasons they consistently under-perform compared to the S&P 500 Index is because of two reasons. First, taxes are a major factor to take into account. High-turnover active funds can leave investors at a disadvantage, as more taxes are likely to be owed than with a low-turnover fund. Second, actively managed funds under-perform because of their high expenses. While you might reasonably expect higher returns from a lower cost actively managed fund than from a higher-cost actively managed fund, both are still likely to under-perform compared to index funds.

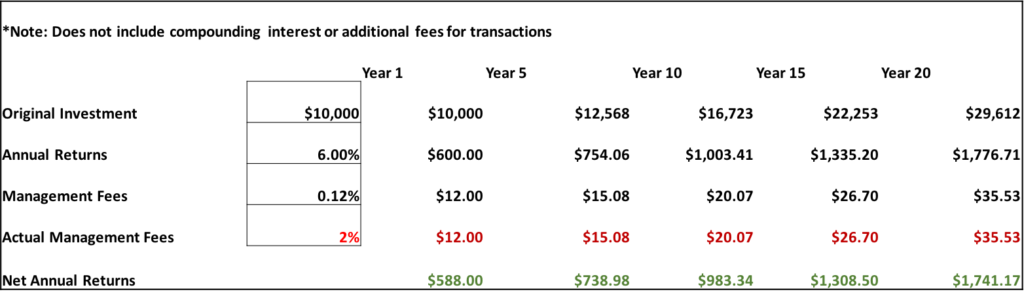

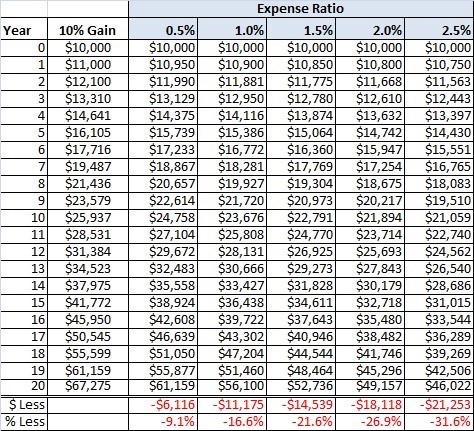

Thus, this is where the problem with actively managed funds exists. Yes, a fund manager can generate a lot of money with their investments because of their knowledge and background. Although, the fees you will pay so they can provide this service to you will be substantially high. To show you how this works we’ll look at a simplified example which only looks at the costs for using a fund manager. For example, let’s say you had $10,000 to invest in the stock market and decided to use a fund manager to actively manage your investments.

They will earn you an estimated 6% yearly portfolio return on your investments and their fee to do this for you will range between 0.89% – 1.2%. I know this doesn’t sound like much, but keep in mind that the reason for the difference is due to how much money you give to them to manage. The less you give them the higher their fees, so, for our example we will use 1.1%, as your $10,000 is considered to be a rather small amount.

In addition, to that fee you will also need to pay another 1.0% to a financial advisor who works with the fund manager in assisting you with your investments. So far, that means, you are paying 2.1% from your annual returns on your $10,000 investment. Which doesn’t sound so bad, at least until you calculate what it actually means. To know what this adds up to per year we will use the same formula they use. It’s calculated by taking the management fees (2.1%), divided by the yearly portfolio returns (6%), to get the total amount you pay in fees from your yearly returns, which actually totals 35%! Article Title: The Heavy Toll Of Investment Fees, Author: Rick Ferri.

2.1/6 = 0.35 or 35%! Now, take that annual fee of 35%, which again, is the total you’re paying from the annual returns gained on your investment, and multiply it by your yearly returns. Not including compounding interest or any other additional fees added due to transactions, here is what your return would look like. First, let’s calculate your returns by taking, 6%(yearly returns) X $10,000(investment) = $600 (net yearly returns). Then, to get the total cost of management fees we can either take 35% X $600 = $210 (fees) or take 2.1% X $10,000 = $210 (fees). This means you actually only earn $390 (net yearly returns – fees = actual earnings) from your investment.

Imagine for a moment that in 10 years from now, your $10,000 has continued to earn you 6% annually and the management fees remain the same. You would receive $4,110 in returns but you would pay $2,510 in fees. If we look at 20 years from now, you would receive $10,687 in returns growing your investment to $20,687 but you would have to pay $6,189 in fees. Look, I’m not trying to scare you or say that all management companies are the same but this is a very real example of how their fee structures work. I just want you to be fully informed and prepared before you consider using their services. The chart below summarizes this information for you to see clearly how it works.

INDEX FUNDS (ETFS)

Since the fees attached to having a fund manager are so high, what then is the alternative? The simple answer is Indexes. Index funds are easily understood, and provide a relatively safe approach to investing in broad segments of the market. They are used by less experienced investors as well as lifetime institutional investors with lots of investments. An easy way to understand index funds is to think of them as investing on autopilot.

Index investing is simple, relatively cheap, and continually generates good returns. Index funds provide:

- Simplicity. An Index makes broad-based market asset allocation and diversification easy.

- Management quality. Indexes eliminate investor concerns over management issues and reliability.

- Low operational expenses. Indexing is less expensive due to a lack of management fees, fewer costs, and less taxes.

- Performance. Multiple studies show that index funds have outperformed the majority of managed funds over a variety of time periods.

For these reasons fund managers continue to struggle in their performance compared to Index funds. What I mean, is that, yes it’s true many fund managers’ will earn a great deal back from their investment strategies but due to their high costs, they continually under-perform compared to their benchmarks. Those benchmarks being the S&P 500 or Dow Jones Indexes which measure a fund’s returns against the returns of a benchmark appropriate for that particular investment category. Time and again, the under-performance of actively managed funds against these index benchmarks is significant. Article Title: Is There a Case for Actively Managed Funds? Low-fee index funds do a better job of meeting benchmarks, but some see specific uses for actively managed funds.

Let’s go ahead and take your $10,000 and see what your yearly costs would be if you invested in Index Funds. To start with, you don’t have a management fee so that is eliminated from the equation but you do have an operational fee. This fee can range from as low as 0.03% up to 0.12%. The great thing about this fee is that it only depends on the Index you invest in and not on how much you invest. For our example let’s just keep it simplified and say your yearly return is the same as before at 6%. We’ll select 0.12% in operational fees just to give you an idea of the high end cost for owning an Index Fund.

Our calculations will remain the same, so 0.12% (operational fees) / 6% (annual returns) = 2% (total operational fees). Next, take 6% X $10,000 = $600 (net yearly returns). Then, take 2% X $600 = $12 (fees) or take 0.12% X $10,000 = $12 (fees). This means you actually earn $588 (net yearly returns – fees = actual earnings) from your investment. The chart below summarizes how much you could earn over the next 20 years.

To put it simply, after 10 years you would have earned $6,723 or $2,613 more from investing in an Index Fund versus using a fund manager. In 20 years, you would have earned $19,612 or $8,925 more! For some people, this may seem like a small amount to get excited over but to me and those who don’t like loosing money, these gains are huge! All I’m saying is that, you can earn a high amount either way but the costs associated with using a fund manager are much higher then that of investing in an Index fund. If you’re still not convinced, I’d recommend learning about the costs associated with both and then form your own opinion. That, or you can follow the advice of the greatest investor of all time, Warren Buffett. Let’s see what he has to say. Want to learn more? Read up on the fees associated with actively managed funds:

- Investopedia: Pay Attention To Your Fund’s Expense Ratio

- Forbes: The Heavy Toll Of Investment Fees

- Bloomberg: An Investor’s Guide to Fees and Expenses 2014

- Betterment: Why Index Fund Portfolios Win

- AdvisoryHQ: Financial Advisor Fees in 2016

4) AN EASY AND SIMPLE WAY TO BECOME WEALTHY RECOMMENDED BY WARREN BUFFETT WHY WARREN PREFERS INDEX FUNDS (ETFS)

In Berkshire Hathaway’s 2013 Annual Report, Warren Buffett wrote, “When Charlie and I buy stocks – which we think of as small portions of businesses – our analysis is very similar to that which we use in buying entire businesses. We first have to decide whether we can sensibly estimate the earnings range for five years out, or more. If the answer is yes, we will buy the stock (or business) if it sells at a reasonable price in relation to the bottom boundary of our estimate.

If, however, we lack the ability to estimate future earnings – which is usually the case – we simply move on to other prospects. In the 54 years we have worked together, we have never foregone an attractive purchase because of the macro or political environment, or the views of other people. In fact, these subjects never come up when we make decisions.

It’s vital, however, that we recognize the perimeter of our “circle of competence” and stay well inside of it. Even then, we will make some mistakes, both with stocks and businesses. But they will not be the disasters that occur, for example, when a long-rising market induces purchases that are based on anticipated price behavior and a

desire to be where the action is. Most investors, of course, have not made the study of business prospects a priority in their lives. If wise, they will conclude that they do not know enough about specific businesses to predict their future earning power.

I have good news for these non-professionals: The typical investor doesn’t need this skill. In aggregate, American business has done wonderfully over time and will continue to do so. In the 20th Century, the Dow Jones Industrials index advanced from 66 to 11,497, paying a rising stream of dividends to boot. The 21st Century will witness further gains, almost certain to be substantial. The goal of the non-professional should not be to pick winners – neither he nor his “helpers” can do that – but should rather be to own a cross-section of businesses that in aggregate are bound to do well.

A low-cost S&P 500 index fund (ETFs) will achieve this goal. That’s the “what” of investing for the non-professional. The “when” is also important. The main danger is that the timid or beginning investor will enter the market at a time of extreme exuberance and then become disillusioned when paper losses occur. (Remember the late Barton Biggs’ observation: “A bull market is like sex. It feels best just before it ends.”) The antidote to that kind of mistiming is for an investor to accumulate shares over a long period and never to sell when the news is bad and stocks are well off their highs.

Following those rules, the “know-nothing” investor who both diversifies and keeps his costs minimal is virtually certain to get satisfactory results. Indeed, the unsophisticated investor who is realistic about his shortcomings is likely to obtain better long-term results than the knowledgeable professional who is blind to even a single weakness.

My advice, put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors — whether pension funds, institutions or individuals — who employ high-fee managers.” Berkshire Hathaway Inc., 2013 Annual Report. Nebraska. Berkshire Hathaway Inc., 2013. pp. 21-22.

Basically, for an investor with little or no experience, investing in Index Funds (ETFs) and Bonds is the best way to go. By demystifying the world of investing, a new comer can easily get involved and not spend their days worried if their investment will provide good returns. This style of investing is truly what Warren Buffett believes is the best for anyone without the time to properly analyze stocks before investing. Additionally, Warren advises investors to always think of a few things before investing.

- You don’t need to be an expert in order to achieve satisfactory investment returns. But if you aren’t, you must recognize your limitations and follow a course certain to work reasonably well. Keep things simple and don’t swing for the fences. When promised quick profits, respond with a quick “no.”

- Focus on the future productivity of the asset you are considering. If you don’t feel comfortable making a rough estimate of the asset’s future earnings, just forget it and move on. No one has the ability to evaluate every investment possibility. But omniscience isn’t necessary; you only need to understand the actions you undertake.

- If you instead focus on the prospective price change of a contemplated purchase, you are speculating. There is nothing improper about that. I know, however, that I am unable to speculate successfully, and I am skeptical of those who claim sustained success at doing so. Half of all coin-flippers will win their first toss; none of those winners has an expectation of profit if he continues to play the game. And the fact that a given asset has appreciated in the recent past is never a reason to buy it.

- Forming macro opinions or listening to the macro or market predictions of others is a waste of time. Indeed, it is dangerous because it may blur your vision of the facts that are truly important. (When I hear TV commentators glibly opine on what the market will do next, I am reminded of Mickey Mantle’s scathing comment: “You don’t know how easy this game is until you get into that broadcasting booth.”)

Berkshire Hathaway Inc., 2013 Annual Report. Nebraska. Berkshire Hathaway Inc., 2013. pp. 20.

WHAT ARE INDEXES?

With a look of confusion John said to me, Well, that all sounds really good but I’m sorry, what is an index and what are index funds? That’s a great question! I’m so sorry John. Here I was getting excited and carried away about describing why investing in Indexes is a good thing and I forgot to explain what they are. The definition of what an index is goes like this: “An index is a statistical measure of the changes in a portfolio of stocks representing a portion of the overall market. It would be too difficult to track every single security trading in the country. To get around this, Indexes take a smaller sample of the market that is representative of the whole. Investors use indexes to track the performance of the stock market. Ideally, a change in the price of an index represents an exactly proportional change in the stocks included in the index.” Article Title: Index Investing: What Is An Index?

Basically, an Index is a way to track how the market is performing on any given day, and each Index is comprised of several companies’ stocks. There are several different types of Indexes which measure the stock markets performance in different areas depending on what you are interested in. An Index Fund is what you would buy if you wanted to own a portion of each of the companies which are included in that specific Index. They can be very expensive for new investors so there are alternative Indexes to invest in and they are called Exchange Traded Funds or ETFs. Let’s look at them and see why Warren feels they are a good investment.

MAJOR INDEXES

Although, there are many different types of Indexes covering all areas of the stock market the ones we’ll cover here are considered some of the largest in the United States. The first one, is the Standard & Poor’s 500 Index also known as the S&P 500 with ticker symbol SPX. It is an index of 500 of the largest corporations’ stocks which measures their value. These companies are chosen for their market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to provide a quick look at the stock market and economy. Since, it’s a market value weighted index with each stock weighed in proportion to its market value only an overall decline or increase in the market will result in the index moving down or up. The S&P 500 is one of the most commonly used benchmarks for the overall U.S. stock market.

Next, we have the Dow Jones Industrial Average with ticker symbol DJIA. It is one of the oldest indexes and contains 30 of the largest, most influential companies in the United States. Even though the DJIA is a good index, most people agree that the S&P 500 is a better representation of the U.S. market. This is because the Dow Jones is price weighted and a decrease or incline in all stocks in the DJIA, would not necessarily cause a change in the index.

Third, is the Nasdaq Composite Index which is market capitalization weighted and comprised of all stocks traded on the Nasdaq stock exchange totaling around 3,000. It includes some companies which are not based in the U.S. as well. Movement in the Nasdaq generally indicates the performance of the technology industry, and speculative stocks both in the U.S. and worldwide. Fourth, is the Russell 2000, another market capitalization weighted index comprised of 2,000 stocks. It is the best-known indicator of the daily performance of small companies in the market. Finally, there is the Wilshire 5000 which is also a market capitalization weighted index comprised of 6,700 companies. It is sometimes referred to as, the total stock market index, or the total market index, because all publicly traded companies headquartered in the U.S. are apart of it. Article Title: An Introduction To Stock Market, By Kate Schick.

INVESTING IN INDEXES

How investing in an index fund works, is that, the money you place into the fund is automatically invested in proportion to the individual stocks or bonds according to the percentage they represent in the index. To put it simply, your money is divvied up and invested into a percentage of each company in that particular index. For example, if IBM represents 1.7% of the S&P 500 Index, then for every $100 you invest in the Index or in the Vanguard 500 ETF Fund, $1.70 goes into the IBM stock. Now, the stock might be trading at $158 a share, but due to it being apart of the Index and ETF Funds, you now own a small percentage of IBM. The returns and dividends you earn are based on the average returns and dividends from all companies in the Index.

TYPES OF INDEX FUNDS

Here is a quick reference guide on the different types of Index Funds. This is helpful when deciding what you most want to invest your money into. Just be aware that Mutual Funds and Hedge Funds cost more and can be riskier investments then Index Funds or ETFs.

- Mutual Funds: These are investments which already comprise a balance of stocks, bonds, cash, etc. They are handled by a money or fund manger who invests the funds capital to earn capital gains and income for their investors. Generally, they have a higher rate of return compared to other Index Funds but be aware of two things. Fist, some Mutual Funds may have higher fees due to fund manager’s costs which decreases their overall earning potential for an investor. Second, they require a minimum investment starting around $3,000 going up to $10,000 or more.

- Hedge Funds: They are like mutual funds consisting of a various range of investments, lots of investors, and managed by a money manager. However, they are limited only to wealthy investors, are higher risk funds because they’re more aggressively managed, focused on higher rates of return, and are not regulated by the U.S. Security and Exchange Commission (SEC).

- Index Funds: They are similar to mutual funds but instead of owning a few stocks they own a majority of the companies on the market. Think of the S&P 500 which is an index fund comprised of the top 500 companies in the stock market today.

- Exchange Traded Funds (ETFs): Similar to index funds which are comprised of specific companies in the market, ETFs track index funds and mirror their fluctuating rates but they trade like stocks. Meaning, their prices will change throughout the day and that they are usually cheaper then index funds. For example, the Vanguard S&P 500 ETF (VOO) tracks the S&P 500 Index Fund giving similar rates of return but for a much cheaper price.

- The Key Features of investing in ETFs, in general are:

- ETFs are Simple – can be bought and sold just like a normal stock. When you invest in ETFs, you are buying shares of the ETFs essentially owning a tiny portion of the total fund.

- ETFs are Liquid – Liquidity is provided by the buyers and sellers of the ETFs in the secondary market and also by market who buy and sell ETF units on a continual basis

- ETFs offer Transparency – the bid and ask prices can be seen at any time when the market is open

- ETFs allow diversification – you can buy a basket of stocks and diversify yourself from the vagaries of investing in a single stock

- ETFs allow access to complicated markets,sectors, assets classes and countries

In Summary:

No doubt, investing in ETFs is growing popular in the recent years. For most investors, ETF investing can be seen as a logical first step towards getting started and subsequently, as a springboard into other investments.

So John, does that clear up any confusion you have on what Indexes and Index Funds are? Yeah, actually that helps a lot. I’ve heard some of these terms before but didn’t really know what they meant. In the past, some people have told me if I wanted to make a lot of money I should invest in Mutual or Hedge Funds since they don’t charge very much. But now, I understand that their small 1 – 2% fee really adds up and costs me a lot over time. Thanks for making that really clear and for explaining why ETFs are so much better to invest in, John replied. Your welcome, and I’m happy to hear that you agree ETFs are better long-term investments. To help you out even further, let’s look at some of the top ETFs to purchase and what their costs are.

TYPES OF ETFS

So, following Warren’s advise by putting 10% of our cash in short-term government bonds and 90% in low-cost S&P index funds, let’s look at which ETFs fit into this category. Before we get to the full list of index funds and bonds we’ll quickly go over a few key terms and their meanings. For our example, we will use the Vanguard S&P 500 ETF.

ETF Name is the full name of the index fund, e.g., Vanguard S&P 500 ETF.

Ticker Symbol or stock symbol is the abbreviated name used by stock exchanges around the world, e.g., VOO.

Expense Ratio is the annual management fee charged to shareholders of any ETF. This fee varies per ETF but typically you want to look for lower fees, e.g., 0.05%, because overtime it can add up to a larger amount. Here is an example of the costs from various expense ratio’s over a twenty-year period.

52 Week Range or stock price range for the previous 52 weeks the ETF has sold at per share, e.g., $165.96-$198.93 as of 7/20/2016. *Note: Prices change constantly and are never predictable.

Dividend Frequency is how often an ETF will provide you with dividends, e.g., Annually (1 time a year), Biannually (2 times a year), or Quarterly (4 times a year).

Ex-Dividend Date is the last amount paid to investors per share they own of any stock, ETF, or Bond, e.g., $0.95300 per share owned on 6/27/2016.

Category & Style are used to describe an ETFs market focus and asset size, e.g., U.S. Stock Market or Large Cap/Blend.

URL for more information will provide further details on a specific ETF or Bond, e.g., Vanguard S&P 500 ETF.

Okay, now that it’s clear what we’ll be looking at, how about we start reviewing these ETFs and Bonds. To make this easy on ourselves, let’s break this into a few sections so we can look at the various types of ETFs and Bonds, which will be varied by market exposure and pricing. Starting with, low-cost S&P index funds while keeping in mind these should comprise 90% of your investment portfolio. Then moving on to short-term government bonds comprising the remaining 10% of your portfolio.

LOW-COST S&P INDEX FUNDS – 90% OF PORTFOLIO LARGE MARKET CAPITALIZATION

These are ETFs which are comprised of companies whose total market capitalization or financial size is over $10 Billion dollars. They would include companies such as, Apple, Exxon-Mobile, Wal-Mart, Ford Motor Company, and so on. The benefit of owning these ETFs is that, you are purchasing a fraction of each company for a far less price then their individual stock prices.

Name: Vanguard S&P 500 ETF Ticker Symbol: VOO

Expense Ratio: 0.05%

52 Week Range: $165.96-$198.93 as of 7/20/2016

Dividend Frequency: Quarterly

Ex-Dividend Date: $0.95 per share on 6/27/2016

Category & Style: Large Cap/Blend (Mimic S&P 500 stocks)

URL for more information: Vanguard S&P 500 ETF

Name: Schwab U.S. Large-Cap ETF Ticker Symbol: SCHX

Expense Ratio: 0.03%

52 Week Range: $41.50-$51.53 as of 7/20/2016

Dividend Frequency: Quarterly

Ex-Dividend Date: $0.24 per share on 6/20/2016

Category & Style: Large Cap/Blend (Mimic Dow Jones Large Cap)

URL for more information: Schwab U.S. Large-Cap ETF

Name: Vanguard Total Stock Market ETF Ticker Symbol: VTI

Expense Ratio: 0.05%

52 Week Range: $91.58-$110.99 as of 7/20/2016

Dividend Frequency: Quarterly

Ex-Dividend Date: $0.47 per share on 6/14/2016

Category & Style: Large Cap/Blend (Total market exposure)

URL for more information: Vanguard Total Stock Market ETF

Name: iShares Core S&P Total U.S. Stock Market ETF Ticker Symbol: ITOT

Expense Ratio: 0.03%

52 Week Range: $76.41-$98.75 as of 7/20/2016

Dividend Frequency: Quarterly

Ex-Dividend Date: $0.48 per share on 6/14/2016

Category & Style: Large Cap/Blend (Total market exposure)

URL for more information: iShares Core S&P Total U.S. Stock Market ETF

Name: Vanguard Value ETF Ticker Symbol: VTV

Expense Ratio: 0.08%

52 Week Range: $72.25-$87.79 as of 7/20/2016

Dividend Frequency: Quarterly

Ex-Dividend Date: $0.48 per share on 6/21/2016

Category & Style: Large Cap/Value (Mimic MSCI US Prime Market)

URL for more information: Vanguard Value ETF

MID MARKET CAPITALIZATION

These are ETFs which are comprised of companies whose total market capitalization or financial size is between $2 – $10 Billion dollars. They would include companies such as, Harley-Davidson, Mattel, Western Union, and so on. The benefit of owning these ETFs is that, you are purchasing a slightly larger fraction of each company for a far less price then their individual stock prices.

Name: Vanguard Mid-Cap ETF Ticker Symbol: VO

Expense Ratio: 0.08%

52 Week Range: $102.85-$129.94 as of 7/20/2016

Dividend Frequency: Quarterly

Ex-Dividend Date: $0.47 per share on 6/14/2016

Category & Style: Mid Cap/Blend (Mimic MSCI US Mid Cap 450 Stocks)

URL for more information: Vanguard Mid-Cap ETF

Name: Schwab U.S. Mid-Cap ETF Ticker Symbol: SCHM

Expense Ratio: 0.03%

52 Week Range: $28.44-$43.52 as of 7/20/2016

Dividend Frequency: Quarterly

Ex-Dividend Date: $0.10 per share on 6/20/2016

Category & Style: Mid Cap/Blend (Mimic Dow Jones Mid Cap Total Market)

URL for more information: Schwab U.S. Mid-Cap ETF

Name: iShares Core S&P Mid-Cap ETF Ticker Symbol: IJH

Expense Ratio: 0.12%

52 Week Range: $109.03-$154.93 as of 7/20/2016

Dividend Frequency: Quarterly

Ex-Dividend Date: $0.61 per share on 6/21/2016

Category & Style: Mid Cap/Blend (Mimic S&P 400 Mid Cap Total Stocks)

URL for more information: iShares Core S&P Mid-Cap ETF

SMALL MARKET CAPITALIZATION

These are ETFs which are comprised of companies whose total market capitalization or financial size is between $300 Million – $2 Billion dollars. They would include companies such as, Papa John’s International, Buckle Inc., Celestica Inc., and so on. The benefit of owning these ETFs is that, you are purchasing a larger fraction of each company for a far less price then their individual stock prices.

Name: Vanguard Small-Cap Index Fund Ticker Symbol: VB

Expense Ratio: 0.08%

52 Week Range: $90.03-$122.50 as of 7/20/2016

Dividend Frequency: Quarterly

Ex-Dividend Date: $0.30 per share on 6/14/2016

Category & Style: Small Cap/Blend (Mimic CRSP US Small Cap)

URL for more information: Vanguard Small-Cap Index ETF

Name: Schwab U.S. Small-Cap ETF Ticker Symbol: SCHA

Expense Ratio: 0.07%

52 Week Range: $43.79-$58.04 as of 7/20/2016

Dividend Frequency: Quarterly

Ex-Dividend Date: $0.14 per share on 6/20/2016

Category & Style: Small Cap/Blend (Mimic Dow Jones Small Cap Market)

URL for more information: Schwab U.S. Small-Cap ETF

Name: iShares Russell 2000 ETF Ticker Symbol: IWM

Expense Ratio: 0.2%

52 Week Range: $93.64-$125.68 as of 7/20/2016

Dividend Frequency: Quarterly

Ex-Dividend Date: $0.62 per share on 7/06/2016

Category & Style: Small Cap/Blend (Mimic Russell 2000 Index)

URL for more information: iShares Russell 2000 ETF

SHORT-TERM GOVERNMENT BONDS – 10% OF PORTFOLIO

These are Bonds which are comprised of short-term U.S. government savings bonds, Treasury bonds, or Treasury inflation protected securities which are typically one to five years in length. The benefit of owning these is that, every year you will earn interest and when the bond matures you will receive your original invest back.

Name: Vanguard Short-Term Government Bond ETF Ticker Symbol: VGSH

Expense Ratio: 0.10%

52 Week Range: $60.68-$68.51 as of 7/20/2016

Dividend Frequency: Monthly

Ex-Dividend Date: $0.05 per share on 7/01/2016

Category & Style: U.S. Treasury Bonds (Barclays U.S. 1-3 Year Float Adjusted)

URL for more information: Vanguard Short-Term Government Bond ETF

Name: iShares Core 1-5 Year USD Bond ETF Ticker Symbol: ISTB

Expense Ratio: 0.12%

52 Week Range: $98.99-$101.57 as of 7/20/2016

Dividend Frequency: Monthly

Ex-Dividend Date: $0.17 per share on 7/01/2016

Category & Style: U.S. Treasury Bonds (Mature in 1-5 years)

URL for more information: iShares Core 1-5 Year USD Bond ETF

Name: Schwab Short-Term U.S. Treasury ETF Ticker Symbol: SCHO

Expense Ratio: 0.08%

52 Week Range: $50.37-$51.73 as of 7/20/2016

Dividend Frequency: Monthly

Ex-Dividend Date: $0.04 per share on 7/01/2016

Category & Style: U.S. Treasury Securities (Barclays U.S. 1-3 Year Treasury Bond)

URL for more information: Schwab Short-Term U.S. Treasury ETF

Name: iShares Core 1-3 Year Treasury Bond ETF Ticker Symbol: SHY

Expense Ratio: 0.15%

52 Week Range: $84.31-$85.35 as of 7/20/2016

Dividend Frequency: Monthly

Ex-Dividend Date: $0.05 per share on 7/01/2016

Category & Style: U.S. Treasury Bonds (Mature in 1-3 years)

URL for more information: iShares Core 1-3 Year Treasury Bond ETF

UNDERSTANDING WHERE TO START

Seeing the look in John’s eyes, I could tell he was a bit overwhelmed with all the information, but that he was also thinking a lot about which funds to purchase to provide him the highest levels of returns. I said to John that I know there are a lot of choices for you to choose from but to keep it simple when he first starts out. If you remember from before, Warren Buffett said to purchase 90% in low-cost S&P Index Funds but this can have different meanings for different investors.

Some investors perhaps have a bit more money to start with, so they can afford to purchase a few different ETFs from each level of market capitalization. For those investors with fewer funds like John it may be good to start with just purchasing one or two types of ETFs. Warren has even stated, that his suggestion is to purchase Vanguard’s ETFs because of their lower costs and good rates of returns. So, that might be a good help to those who are unsure what to start with. As always, do your homework! That means, spend a few minutes to learn about those ETFs you want to invest in and at least make sure you understand why you are investing in them.

This advice holds true for the short-term U.S. government bonds as well. Just purchasing them because a famous investor says so should never be enough. Make sure you understand why you are purchasing it, and that you could easily explain why its good for you to anyone. This will make it easier to have greater confidence in your purchases and not cost you too much time to learn about.

UNDERSTANDING THE WHY

Why would Warren Buffett, a highly successful investor himself, suggest this investment strategy for almost everyone to follow? Just so we’re clear, he doesn’t just say this as a general statement, he actually believes in this strategy so much he has set up a trust to follow this exact investment strategy for his wife after he passes away.

Not only that, but Warren believes so strongly in this investment strategy he has made the largest wager in investment history to prove his point. See, there are many financial groups and fund managers who disagree with Warren on the simplicity and effectiveness of this strategy. So, he decided the best way to prove his point was to bet a handful of hedge funds $1Million dollars that they could not outperform a low-cost Index Fund over a ten-year period. The winner will get to donate their winnings to the charity of their choice.

The bet started in 2008, with Warren choosing only one Index Fund, the Vanguard 500 Index Admiral Shares (VFIAX). His opponent is Protégé Partners, a money management firm in New York City and they choose five hedge funds. As of 2016, Warren Buffett’s single Index Fund is in a huge lead, earning him 65.7% in returns compared to his opponents who have only earned 21.9% with their five hedge funds.

This is a fantastic example of how profitable Index Funds/ETFs are, and how good an investor Warren Buffett is. I will always encourage you to do your homework and research what you want to invest in before you do so, but if you were to take any advice on how to invest, then it seems like Warren’s is really good. Here are some of the benefits of this investment strategy which is a lot more successful then any other strategy available to most investors.

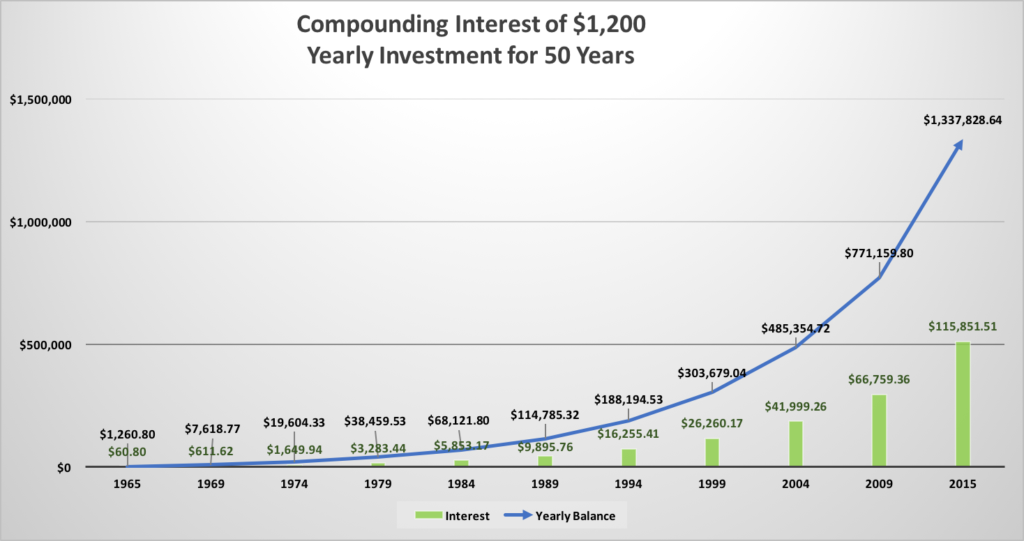

- By buying and holding ETFs and Bonds for many years and reinvesting dividends, your investments will increase in size due to the power of compounded interest.

- This method of passive investing in low-cost index funds, keeps fees as low as possible which maximizes your returns.

- You are maximizing tax efficiency by buying and holding for decades instead of days which can cost you a great deal in taxes.

- The strategy is easy to implement and very straight-forward making it a simple method to follow.

- You can sleep well knowing that you are following the greatest investor of all-times advice, Warren Buffett, and that it’s free advice! Article Title: How to Build a Warren Buffett Portfolio, Author: Blain Reinkensmeyer.

It’s easy to see why Warren is considered the greatest investor of all time and that he really does follow his own investment strategy advice. It’s good to note that I didn’t mention the Vanguard 500 (VFIAX) ETF fund as a potential fund to invest in since the minimum balance required is $10,000. However, Vanguard’s 500 S&P ETF (VOO) delivers the same results but with no minimum balance. Several of the larger financial reporting services agree with this strategy and it’s been reported by both Bloomberg and Investopedia, that by following Warren Buffett’s advice investing in low-cost Index and Bond Funds, any investor can do well. They have each recommend investing in Vanguard’s 500 S&P ETF (VOO) and iShares Core 1-3 Year Treasury Bond ETF (SHY).

RETURNS FROM INVESTING IN S&P 500 ETF

By this point I could see that John was getting more excited about the world of investing after hearing how easy it is to invest in good companies. That is when I informed him of the magic of compounding. Alright John, now that we’ve looked over several ETFs and Bonds we can start investing in right away, let’s focus on what to do with our earnings. You mean we don’t just spend the money we’ve earned from our dividends? replied John.

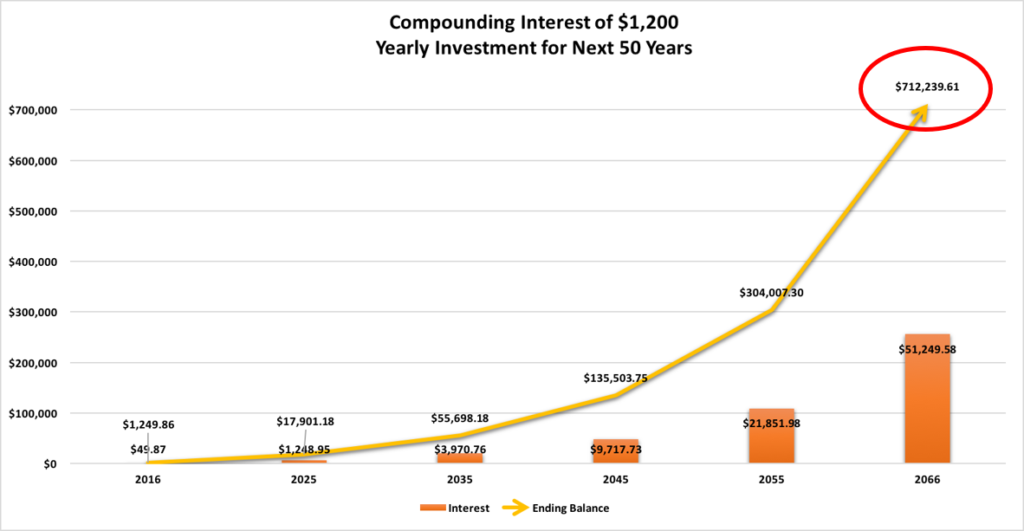

Yes, of course we can spend what we’ve earned from our dividends but then we would be missing out on the most magical gift of all. What’s that? John said. The magic of compounding. Compounding is truly amazing since it will help us increase our earnings by leaps and bounds. It was Albert Einstein who once said, “Compounded interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t… pays it.”

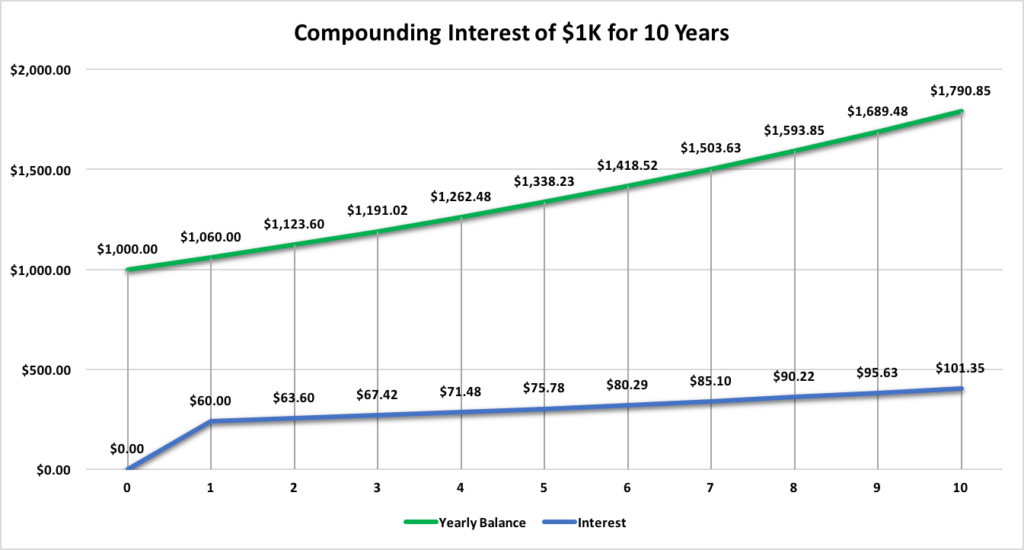

“The wonder of compounding (sometimes called “compound interest”) transforms your working money into a state-of-the-art, highly powerful income-generating tool. Compounding is the process of generating earnings on an asset’s reinvested earnings. To work, it requires two things: the re-investment of earnings and time. The more time you give your investments, the more you are able to accelerate the income potential of your original investment, which takes the pressure off of you.

To demonstrate how it works, let’s look at some examples. If you invest $1,000 today at 6%, you will have $1,060 in one year ($1,000 x 1.06). Now let’s say that rather than withdraw the $60 gained from interest, you keep it in there for another year. If you continue to earn the same rate of 6%, your investment will grow to $1,123.60 ($1,060 x 1.06) by the end of the second year. Because you reinvested that $60, it works together with the original investment, earning you $63.60, which is $3.60 more than the previous year.

This little bit extra may seem like peanuts now, but let’s not forget that you didn’t have to lift a finger to earn that $3.60. More importantly, this $3.60 also has the capacity to earn interest. After the next year, your investment will be worth $1,191.02 ($1,123.60 x 1.06). This time you earned $67.42, which is $7.42 more interest than the first year. This increase in the amount made each year is compounding in action: interest earning interest on interest and so on. This will continue as long as you keep reinvesting and earning interest.” Article Title: Investing 101: The Concept Of Compounding, By Investopedia Staff.

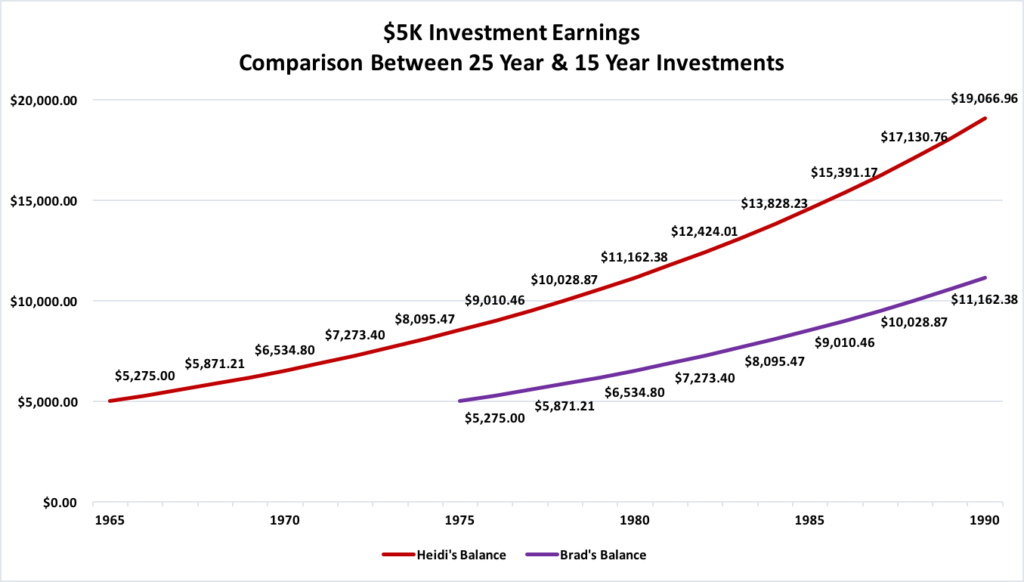

To illustrate this point further, let’s say there are two individuals, Heidi and Brad who started investing in 1965. Here is what their earnings would look like today when we apply this concept of compounding interest. Both Heidi and Brad are the same age, but when Heidi was 25 she invested $5,000 at an interest rate of 5.5%. To keep things simple, we’ll assume the interest rate was compounded annually. By the time Heidi reaches 50, her investment will be worth $19,066.96! Heidi’s friend, Brad, did not start investing until he reached age 35, and at the time he invested $5,000 with the same interest rate of 5.5% compounded annually.