In the latest Singapore Savings Bonds (SSB) offering for November 2022 that hit 3.21%, an all-time high record has grabbed interests among the public and various local headlines since it was first introduced in 2015.

Other than SSB, various local banks in Singapore have also raised their fixed deposit interests to attract investors to park their idle cash with the banks to earn higher interests.

With the rising interest rates now, one may consider if there is any other investment instruments that can offer even better interest rates or return for their invested capitals?

In this blog, we will explore one of the bonds offered by Money of Authority of Singapore (MAS) – Singapore Government Securities (SGS) bond to determine if this is another good investment vehicle we can consider to invest and grow our money!

WHAT IS A BOND?

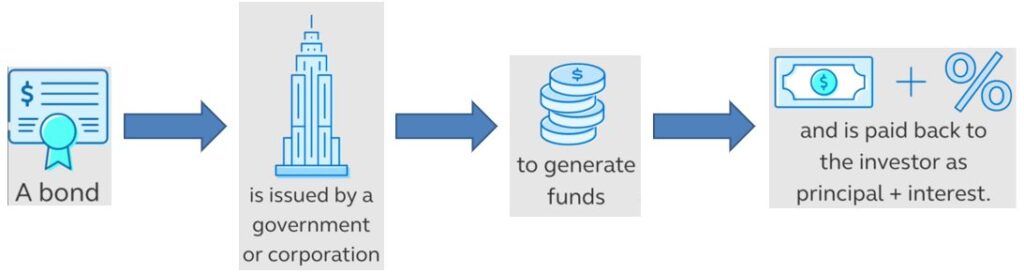

A bond is a fixed-income instrument that represents a loan made by an investor to a borrower (usually government or corporate) and the investor can earn interest income.

There are some term commonly used terms for bonds that investors should know before deciding to invest their hard-earned money into bonds.

- Coupon: Interest payment of the bond

- Maturity / Tenor: Holding duration of the bond

- Yield: The estimated return of bond where the yield is calculated as bond interest rate divided by current price.

- Face Value: Amount of bond’s worth when it’s issued. Also known as “par” value.

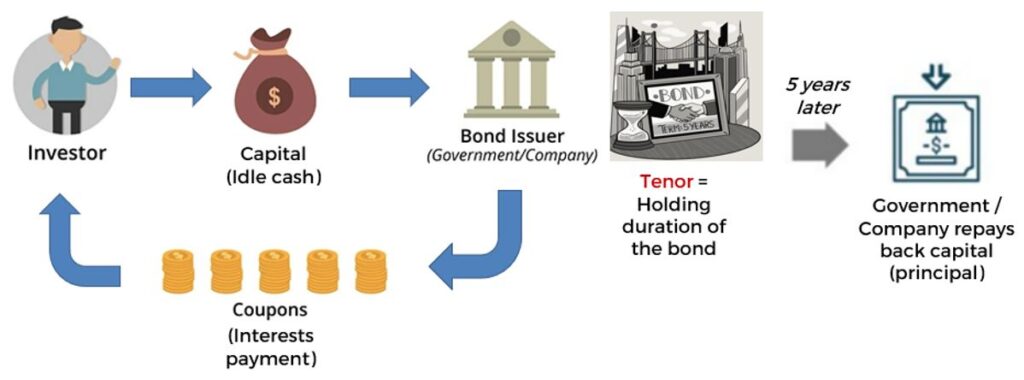

HOW DOES A BOND WORK?

Now that we know what a bond is and some of the important terms about bond, we want to buy bonds so that our money can work harder for us! But…how does a bond work?

The chart below illustrates the process flow of how a bond generally works:

When an investor is considering to invest their money into a bond, there are a few things that they need to consider:

- Interest rate / coupon of the bond

- Tenor of the bond

Once the investor researched that the bond is giving the best return for their money based on the rates and duration of the bond, then they may invest their capital (or idle cash) with the bond issuer, which is usually the government or a corporate. The bond issuer will then pay out regular coupons to the investor according to the bond agreement.

This interest payment process will repeat until the bond matures according to the tenor. For example, if the bond tenor is for 5 years, this means that the bond issuer will keep the investor’s capital for the next 5 years while paying out regular interests to the investor. When the bond matures after 5 years, the bond issuers will repay back the capital to the investor and the investor get to keep the interest payments for the past 5 years!

This is how money can work harder for the investor while the investor do nothing, except taking action to buy the bond. This is known as passive income! $$$

DIFFERENCE BETWEEN BONDS AND STOCKS

Some people might confuse the difference between a bond and a stock as both seems like similar kind of investment instruments that can generate returns, such as interests and dividends back to investors.

A bond is a debt instrument offered by government or corporate with a promise to pay back the principals with interests.

If a bond is issued by the government or sovereign, it usually poses lower risks as investors can get back their principals once the bond maturity expires. In addition, as the bond interest rate is fixed throughout the duration of the tenor, it is less responsive to the market fluctuations.

However, the bond may also generate lower earning potential for the investors because when the market’s interest rate increases such as an inflation event, the bond’s interest rates will not increase and remain the same rate when it was first issued. As such, the investor will receive regular coupon payments at the same interest rate throughout the whole bond tenor!

A stock is an equity instrument where the investor owns a share of the company by investing money into the corporation of their interests. If the company is doing well financially, they may generate dividends to their shareholders. Thus, the dividend yield for a corporate is not fixed and there is opportunity for the investor to earn more than bonds and offers better returns.

However, investor will also need to beware that although a stock is able to generate higher returns compared to bonds, it is highly responsive to market fluctuations. If there is any bad news about the corporate or changes in the market’s condition, the stock price of the corporate will also be affected. Hence, it may pose higher risks than owning bonds.

Investors are strongly advised to perform their own due diligence before investing their money into any stocks to avoid the lose of their capitals. But alas, without the knowledge of how to look for and invest in a good and yet profitable company, how can the investors determine which company is their best choice?

BONDS OFFERED BY MAS

There are a few types of bonds offered by MAS to both Individuals (retail investors) and Institutions (organizations that invests money on behalf of other people). In this article, we will only be covering Individuals category of the bond offering.

For the Individuals category, MAS offers 3 types of bonds to retail investors:

Some of the benefit that the investors can enjoy when they invest their money into MAS bonds offerings are:

- The bonds have AAA rating, meaning that the bonds are fully backed by Singapore Government, making them one of the lowest risk bond offerings.

- Investors get to enjoy regular interest payment (every 6 months) from their invested principals.

- As bond is one of the less risky investments, it is another good choice for investors to diversify their portfolio!

SINGAPORE GOVERNMENT SECURITIES (SGS) BONDS

SGS bonds is a tradable government debt securities or debt instrument that pay a fixed coupon (also known as interest payment) every 6 months. The bond maturities range from 2-50 years, which is 2, 5, 10, 15, 20, 30 or 50 years.

The SGS bonds can be purchased by both Singaporeans and foreigners who aged 18 years and above via two methods of sale:

- Auction – Uniform price auction via Competitive bidding or Non-competitive bidding.

- Competitive bidding – Investors bid for the lowest yield

- Non-competitive bidding – Investors accept the yield that was being set by most competitive bidders

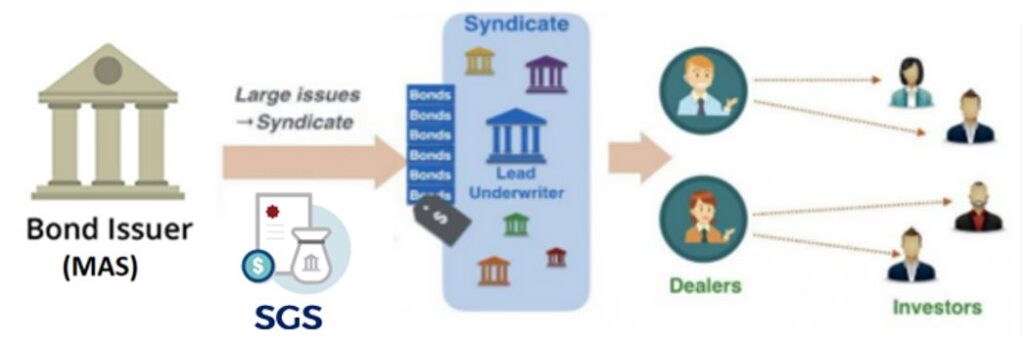

- Syndication – MAS will issue Public Notice for the bonds. Then the bond will be offered by a group of appointed banks, known as bookrunners to market and distribute to investors.

The diagram below illustrates the process flow of syndication:

Currently, there are 3 categories of SGS bonds offered to the public:

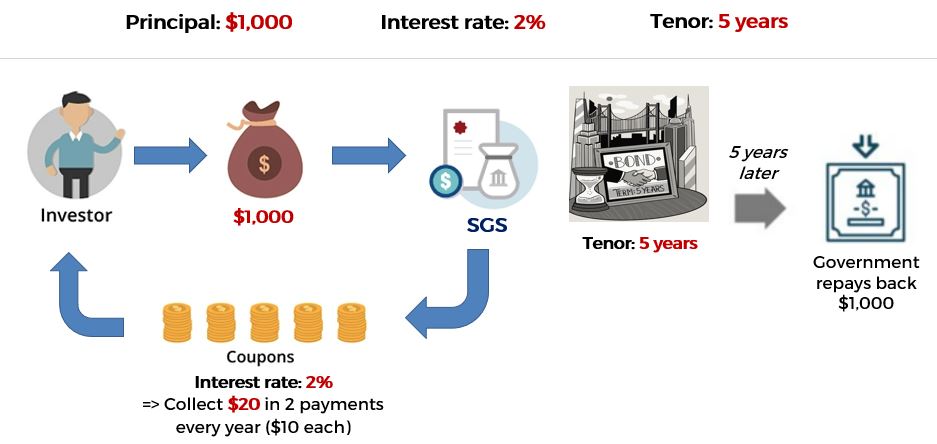

HOW TO EARN INTEREST INCOME FROM SGS

Here comes the fun part – How can I earn interest income from investing in SGS bonds?

Let’s show an example how this all works to earn that passive interest income from SGS!

PROS AND CONS OF SGS

But before we happily decide to put in our hard-earned money into SGS bonds, we will also need to consider about the pros and cons of investing in this bond!

The diagram below simplifies the pros and cons of investing in SGS bonds!

HOW TO PURCHASE SGS

Now that we are aware of the advantages and disadvantages of SGS bonds, how can we purchase this bond?

There are 2 main ways that one can purchase SGS bonds:

- Bid at Auction (primary offer) from MAS or via Syndication (MAS appointed bookrunners)

- Buy or sell (Trade) on Secondary Market

- DBS, OCBC or UOB physical branches

- SGX via security brokers

AUCTION OR SYNDICATION

Investor can purchase SGS bonds with cash, SRS or CPF funds when MAS announce on the application opening of bond auction. The minimum investment amount is $1,000 and in multiples of $1,000. However, there is no maximum limit of the bidding for the SGS bonds, but the max amount depends on the allotment limit of the auctions.

If the investor wishes to purchase Green SGS bonds, they will have to purchase from bookrunners via Syndication but only with cash. SRS or CPF funds is not allowed to purchase the Green SGS bonds via syndication.

SECONDARY MARKET

For Secondary Market, as the SGS bonds are sold on exchange markets, i.e. SGX, the investment amount for the bonds depends on the market conditions (supply & demand) of the SGX exchange.

INTEREST RATES COMPARISON

Next, we will also compare the rates of SGS bonds with the other common investment instruments in Singapore to determine if the interest rates offered by SGS gives the best bang for our money.

The last opening auction for SGS bonds in Oct 2022 was shown from the chart below:

Chart source: Seedly.sg

The coupon rate announced was 1.875% and the bond maturity tenor was for 30 years. This means that for the next 30 years, the investor will be receiving regular coupon payments of 1.875% every year until the bonds matures!

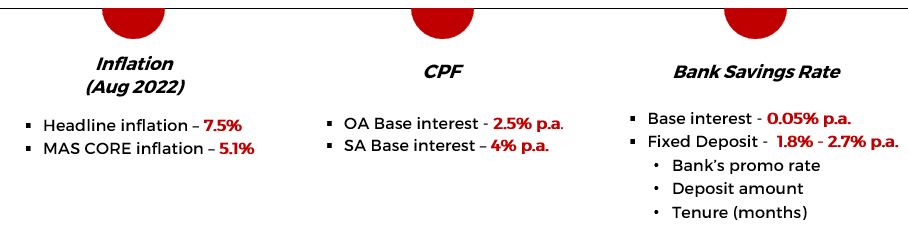

Now, we will compare to see if this latest SGS bonds rate can beat the latest inflation and the other investment vehicles!

In the diagram shown, we observed that with the current high inflation environment that the world is facing, there is no way that the SGS bonds can beat the latest MAS CORE inflation (5.1%)! Even though SGS bonds pay regular coupon rate of 1.875% to the investors for the October issued bond, the investor will still face a loss of interests of about -3.26%!

In addition, some of the months that SGS bonds issued was comparable to the CPF OA base interest (2.5% p.a.), it is still considered lower than the CPF SA base interest (4% p.a.).

Finally, SGS bonds offer higher interest rates than the local banks’ savings accounts base interest (0.05% p.a.). Due to the increment interest rates imposed by the US FED to combat high inflation, various banks have also increased their savings interest rate! Click here to find out more on the latest SG bank’s savings rate!

The fixed deposit offered by banks can be comparable with the SGS bonds’ rate when the banks are offering promo rate. In addition, investors have the flexibility to choose the tenure months to invest their capitals in fixed deposit. But the tenor of the SGS bonds depend on the monthly issuance by MAS.

We also compared the interest rates of Singapore Savings Bond (SSB) as it is the latest and hottest news on various local headlines due to the record high interest offered.

We observed that the latest interest rate offered by SSB is much higher than SGS’s 1.875%. In addition, there will be step-up interest rate every year for SSB but the interest rate is fixed for SGS throughout the bond tenor. This means that the coupon payment for SGS is fixed every year but there will be increment in interest payment for SSB!

And another main difference between SSB and SGS is that investors can redeem back their capitals at any months in full principal without any penalty imposed! But investors need to take note that the withdrawal is not immediate and may take up to 30 days.

However, there is no possibility for the investor to redeem back their principals if they put their money in SGS bonds. Penalty will be imposed for early withdrawal. This is as if the money is “locked up” with the government for the next few years (depends on the tenor of the bond)!

Although the investors can sell their bonds on secondary market as per informed on the MAS website, the probability of selling off the bonds also depends on the supply & demand of the bond on the SGX exchange market.

You can also read more on another MAS bond – T-bills here!

CONCLUSION

To conclude, SGS bonds is another good investment option for everyday folks to grow their savings as it has a rating of AAA and fully backed by Singapore Government. Thus, making it one of the lowest risk investment available to the Singaporean community! In addition, SGS bonds also offered fixed interest rate payment bi-annually and investors can sell off the bonds on the secondary market (SGX).

But, investors will also need to take note that with their money will be “locked up” with the government during the bond tenor period. In addition, the bi-annually interest payment is fixed and this may lower the earning potential. Should the investors need their capital back, they will be imposed with penalty for the early redemption, and it may also be challenging to sell their bonds on SGX if the bond demand is low.

Nevertheless, SGS is still considered a “safer” investment choice with better returns for most people compared to keeping their cash in a meagre interest of 0.05% p.a. in savings account.

Public are also aware that investing can help to grow their money for a comfortable and worry-free retirement life. Nevertheless, due to the uncertainty of the market conditions and unsure of how to determine a good & profitable company to invest in, this fear has stopped many people from taking action to invest.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.