Dividend stocks are known for regularly paying out a portion of their earnings to shareholders. This creates an additional income stream for investors in the stock market

However, how does one know if dividend stock is a good investment to invest and grow our wealth?

In this blog article, we’ll delve into U.S. dividend stocks, learn to identify strong dividend stocks, and consider crucial factors before investing.

You can also watch the deep dive analysis on dividend stocks on our YouTube Channel below!

We have written articles on various investing opportunities to invest and grow your money. Click on to find out!

WHAT IS DIVIDEND?

Dividend is a payment or a distibution of a portion of a company’s earning to its shareholders. This serves as a reward for the shareholders for their investment in the company.

Dividends are commonly paid by established companies, such as blue chip stocks where their strong financial performance are able to maintain and possibly increase dividend distributions year by year.

Dividend payments are voluntary, unlike bonds. Businesses aren’t obligated to declare dividends for shareholders, whereas bond issuers must pay regular interest to investors according to the bond agreement until maturity.

Investors invest in dividend stock mainly for 2 sources of returns:

- Regular income as a supplement to day job or replacement income in the golden years.

- Capital appreciation when the share price increases.

HOW DOES DIVIDEND WORK?

Now, one may wonder: “How do I get paid dividend from my investment in a company’s stock?”

Seeking Alpha

In the chart above, there are 5 dates that a dividend investor needs to take note of in order to receive dividends:

Declaration Date – Board of Directors announces dividend payment.

In-Dividend Date – Last day for new investors to buy stock and receive dividend.

Ex-Dividend Date – New shareholders will not receive dividend after purchase stock.

Holder of Record Date – Existing shareholders can receive dividend, but if sell the stock before this date, existing shareholders won’t be able to receive dividend payments.

Payment Date – Dividends paid out to shareholders.

U.S. DIVIDEND STOCK

U.S. dividend stock are usually found in well-established companies with popular brands and long operating history.

To ensure that investors invest in good and stable companies that can pay sustainable dividends over long-term, dividend stocks can be categorized into 2 categories:

1. DIVIDEND ARISTOCRATS

For a company to be recognized as a Dividend Aristocrats, there are 4 criteria a company needs to fulfil.

- Dividend Aristocrats are companies that have paid and raised their dividend payments for consecutive 25 years.

- The companies are high quality businesses with strong competitive moat and are found within the S&P 500 index.

- They have a minimum market cap size of $3 billion.

- An average of about $5 million daily share trading value (liquidity) for the past 3 months.

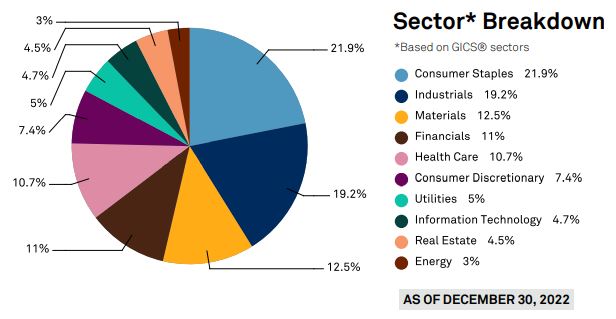

As of 30 Dec 2022, there are a total of 64 Dividend Aristocrats. If a company fails to fulfil one of the criteria mentioned above, its status of Dividend Aristocrats will be stripped.

Dividend Aristocrats are industry leaders with well-known brand names. They usually can generate reliable cash flow and impressive returns year over year. Hence, these companies can pay out consistent dividends to their shareholders which forms a reliable source of income for investors.

Dividend Aristocrats are mostly found in the stable and less volatile Consumer Staples and Industrials sectors, as opposed to fast-growing companies in the Information Technology & Communications sector.

Dividend Aristocrats Sector Breakdown

PROSHARES S&P 500 DIVIDEND ARISTOCRATS ETF (NOBL)

Dividend Aristocrats’ performance are tracked by Proshares S&P 500 Dividend Aristocrats ETF (NOBL). Dividends are distributed quarterly to shareholders quarterly with a dividend yield of 2.69% and expense ratio of 0.35% (as of 30 Sep 2022).

There are a total of 64 holdings in this ETF and the diagram below shows the top 10 holdings and the fund sector of the ETF.

Top 10 Holdings & Fund Sectors of NOBL

2. DIVIDEND KINGS

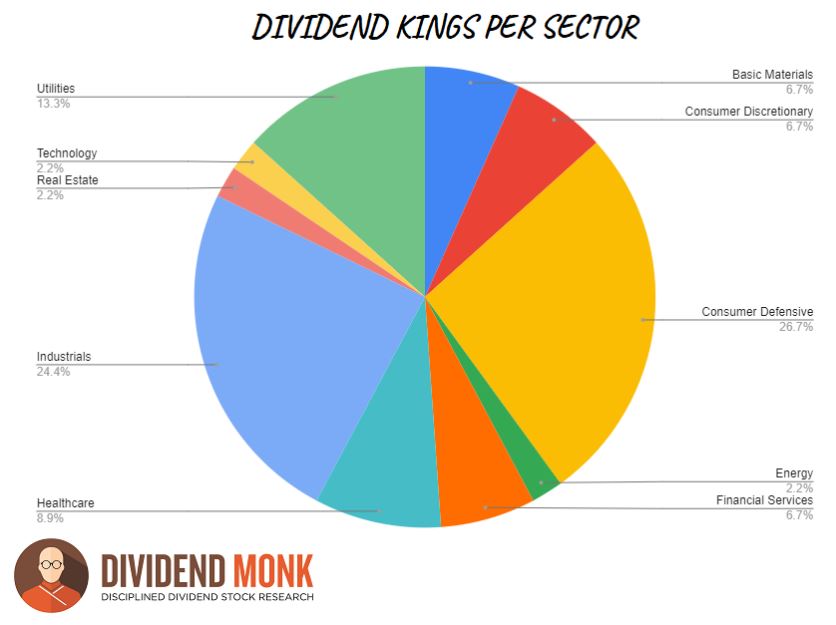

For Dividend Kings, these companies have paid & raised their dividend payments for consecutive 50 years. There are a total of 41 Dividend Kings in Jul 2022. Majority of the Dividend Kings are also Dividend Aristocrats.

Like Dividend Aristocrats, Dividend Kings are also consistent in paying dividends to their shareholders and able to increase the pay-out year over year.

However, one should take note that these companies are mostly well-established industry leaders and may have slower growth compared to young start-ups. As a result, some of the Dividend Kings performed under S&P 500 for the past decade and delivered lower capital gain growth.

In addition, it is not necessary for these companies to be in the S&P 500 index, but they are commonly found in the following sectors:

- Consumer Goods

- Industrials

- Utilities

- Healthcare

DIVIDEND STOCK METRICS

There are a few metrics that investors will check on to evaluate dividend stocks. In this blog, we will be looking into 3 metrics:

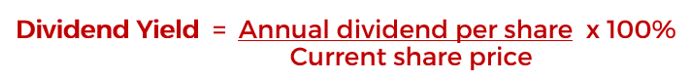

1. Dividend Yield – Percentage of dividends received for every dollar of share invested.

For example, if the current share price is at $10 and the annual dividend that an investor received per-share is $1, the dividend yield will be 10%.

2. Dividend per Share – Amount of dividend for investor to receive on per-share basis.

For example, if the investor owns 100 shares of the company and the dividend pay-out amount is $0.30 per share, the total dividend that the investor will receive is $30.

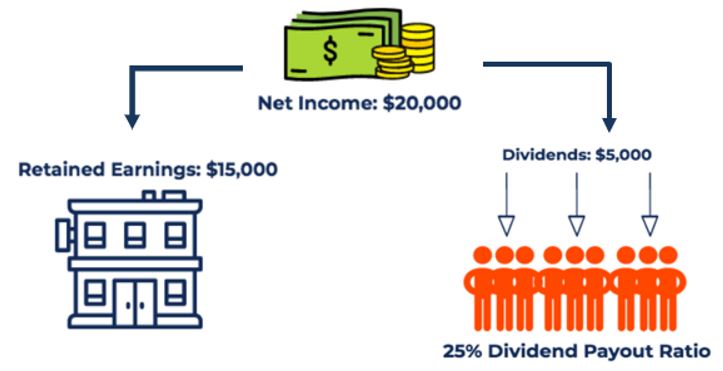

3. Dividend Payout Ratio – Percentage of a company’s earnings that is being distributed to shareholders as dividends.

As shown in the diagram below, if the company has generated $20,000 of earnings, the company will retain about $15,000 of the earnings to further expand the business. The remaining $ 5,000 will be distributed as dividends to shareholders. Thus, the dividend pay-out ratio for the company is about 25%.

Investor should take note that if the payout ratio of a company is declining year over year, it means that the company is retaining their earnings to further grow and expand the businesses. It does not mean that the company is having issue to pay dividends to their shareholders.

Investors can always refer to the Dividend Yield and Dividend per share to determine if the company is able to pay consistent and increasing dividends year over year.

We have done a deep dive analysis on 2 U.S. dividend stocks and 2 SG dividend stocks on our YouTube Channel. Click on the video below to watch!

THINGS TO TAKE NOTE ABOUT INVESTING IN DIVIDEND STOCK

Before one decided to invest into dividend stocks, they need to beware of certain misconceptions about dividends and taxes.

MISCONCEPTIONS ABOUT DIVIDEND STOCKS

Always look for high dividend yield.

If a company offers high dividend yields, investigate its financial performance to ensure it’s able to pay dividends for the long term by checking on the dividend payout ratio. If the payout ratio is high (usually >50%), this might indicate that the company is returning more of its profits to shareholders instead of reinvesting back to grow their businesses.

This is because when the payout ratio is high, larger portion of the business’s profits is being distributed to the shareholders and not reinvested back into the business. The business might have difficulty to expand and grow due to lack of capital if the dividend payout is too high.

Nevertheless, payout ratios can vary significantly across industries. Thus, it is advisable for the investors to investigate on the companies fundamentals, financials and future plans to determine the dividend sustainability.

Dividend stock is always a safe investment.

Many dividend stocks are blue-chip companies with robust financials, often perceived as safer, lower-risk investments compared to young startups.

This perception might be true in some sense, but some companies may be giving out dividends to placate frustrated investors when the stock is not growing (i.e. stagnant growth). It is as if the management is giving out dividends to shareholders as a consolation prize for lack of growth in the business.

In addition, some companies may even take on debt to sustain the high dividend yield, giving the impression that the company is able to consistently distribute high dividend payout and attract investors to purchase the stock.

If a company faces financial challenges and profits decline, management may struggle to maintain high dividends, leading to reduced payments. This can erode market confidence, causing the share price to tumble—a phenomenon known as the dividend yield trap. As a result, shareholders might experience not only lower dividend payments but also a potential loss in their investment’s capital gain.

WITHHOLDING TAXES

For Singaporean investors, there will be a 30% withholding taxes imposed whenever U.S. stocks or U.S.-domiciled ETF distribute dividends. This is because there is no tax treaty between U.S. and Singapore at the current time of writing.

The InvestQuest

30% of the dividends will be deducted directly from the investment account and the Singaporean investors will only receive 70% of the dividends.

Nevertheless, there is another workaround way for an investor to cut down on the taxes, to as much at 15%! That is to purchase U.S. stock or US-domiciled ETF via Ireland-domiciled ETF.

The InvestQuest

Due to the tax treaty between the U.S. and Ireland, the withholding tax imposed on an Ireland-domiciled ETF is only 15%. Currently, there is no withholding tax between Ireland and Singapore. Hence, the dividends received from an Ireland-domiciled ETF will not be taxed for Singaporean investors.

This could be positive for Singaporean investors seeking U.S. stocks or ETFs for dividend income. However, they should consider fees and expenses of Ireland-domiciled ETFs, as high expense ratios may reduce dividend returns.

CONCLUSION

In conclusion, dividend stocks can provide a reliable income source, as dividend-paying companies are often well-established with strong financial performance. This enables them to consistently increase dividends for shareholders year after year, particularly for Dividend Aristocrats and Dividend Kings.

It’s important to note that purchasing U.S. stocks or U.S.-domiciled ETFs may incur a 30% withholding tax on dividends, potentially reducing the earnings gained from dividends. Therefore, it’s crucial to perform due diligence to determine if the potential earnings from dividends outweigh the costs of investing.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.