Netflix had garnered attentions worldwide and the sensational talking topic on various media streams due to one of its phenomenal releases of the hit survival drama series – Squid Game.

For the past decade, Netflix has been leading the entertainment streaming industry with other competitors, such as Disney, HBO and Amazon Prime jumping on-board to streaming services, with the hope to gain a piece of the market share. This is due to the reason that more and more people are switching from cable TV subscriptions to online streaming.

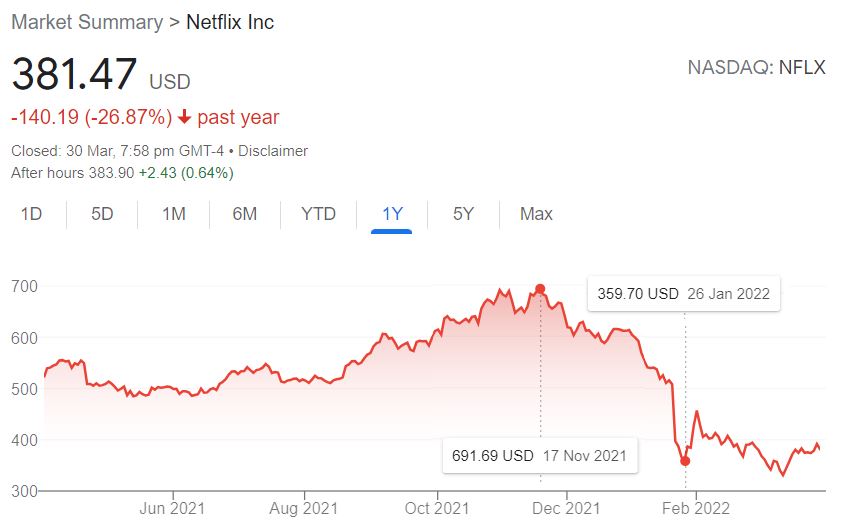

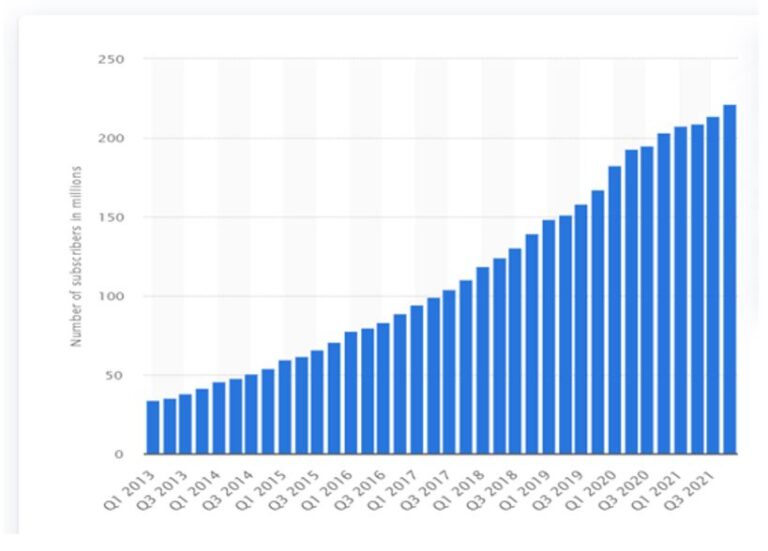

It has also been a soothing balm for people to spend the extra time at home when being ordered to stay indoor to fight the COVID-19 pandemic situation. The stay-at-home order had spiked up huge increment of membership subscriptions during that period. This helps to further boost Netflix share price to all time high of about USD $700 in Nov 2021 before the plunge of about 48.0% that followed in Jan 2022 that caused some panic selling among investors despite the past glittering results that Netflix has generated in the past 1 to 2 years.

What had caused the share price plunged in Jan 2022?

Does the share price really reflect the true fundamentals of Netflix?

Also, is it still a good time to invest in Netflix now despite the plunge?

In this blog, we will investigate into Netflix to see if there is any good investing opportunity for this leading streaming service company despite the sudden fall in share price.

INTRODUCTION

Netflix is currently the world’s leading subscription streaming service and original films production company. It acquires, licenses, and produces contents such as TV series, documentaries, and featured films to its subscribed members on any internet-connected devices without commercials.

Subscribed members are offered unlimited viewing of video entertainment anytime, anywhere they want on PC web browsers and application software installed devices such as smartphones, video games consoles, Blue-Ray players, smart TV and set-top boxes.

Netflix headquarter is located at Los Gatos, California, with international offices worldwide and production hubs in five cities – London, Madrid, New York City, Toronto, and New Mexico.

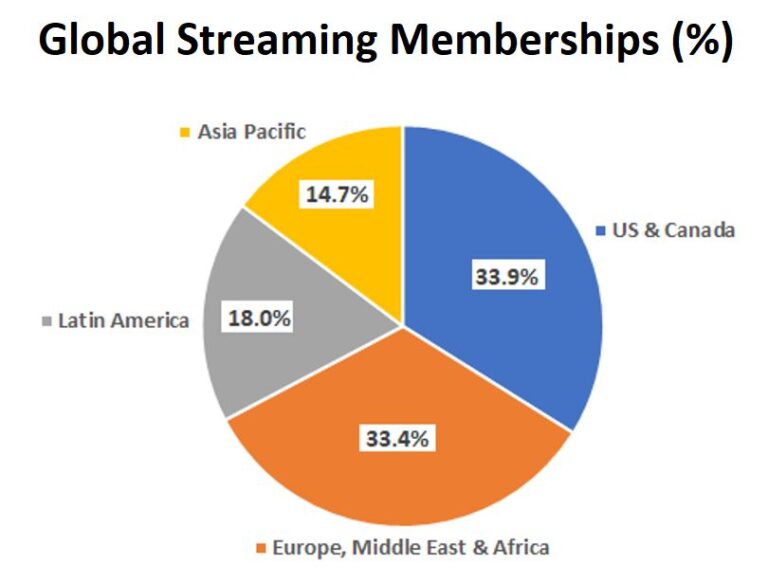

As of December 31, 2021, Netflix had over 222 million subscribers worldwide (except China, Syria, North Korea, Russia & Crimea), categorized in four main regions:

COMPANY BACKGROUND

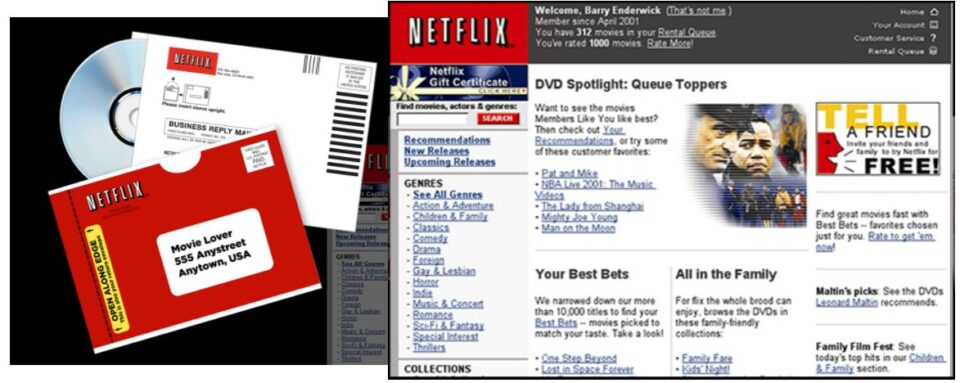

Netflix started in Aug 29, 1997, by Reed Hastings and Marc Randolph where they wanted to start a business in selling or renting a large category of portable items over the internet, like Amazon did with books in its early days.

When DVD was first introduced in the US in 1997, they saw the opportunity of DVD rental services by-mail. They tried to mail the DVD to their homes and found that it was delivered in good condition. This leads them to embark on starting the DVD sales and rental business online.

Since 2000, Netflix’s business model has been focusing on flat-fee unlimited rentals without due dates, late fees, shipping and handling fees or per-title rental fees.

Even though they were badly hit during the dot-com bubble in 2000 and had the intention to sell the company to the then industry leader – Blockbuster LLC, they manage to persevere the storm. In 2002, they launched IPO on Nasdaq with ticker symbol NFLX and US$15 per share.

With their subscription memberships surpassed 1 million in 2003, they issued a patent with US Patent & Trademark Office to cover their subscription rental services. This helped to protect their subscription service patent when Blockbuster introduced a similar DVD rental subscription program that infringed the patents and Netflix filed a lawsuit against them. The dispute was settled in 2007 with undisclosed terms.

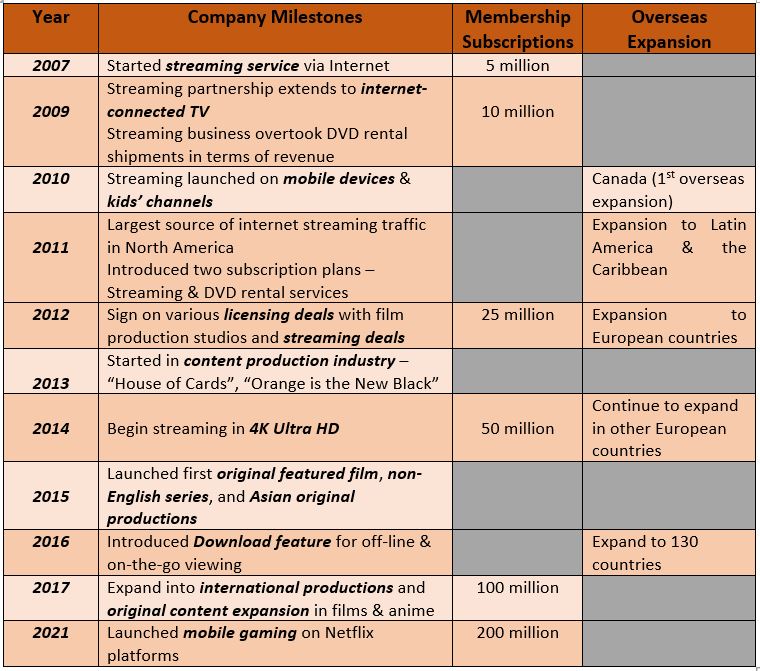

In the following years, Netflix has been experiencing phenomenal growth, both within US and overseas. From 2010 onwards, Netflix has begun its international operations in Canada, followed by Latin America & the Caribbean (in 2011) and European countries (2012-2014). In 2016, they have expanded to over 130 countries and streamed shows in 21 languages.

The table below summarizes the company’s milestones, subscription membership growths and overseas expansion since 2007, the beginning of streaming services to 2021.

REVENUE GENERATION

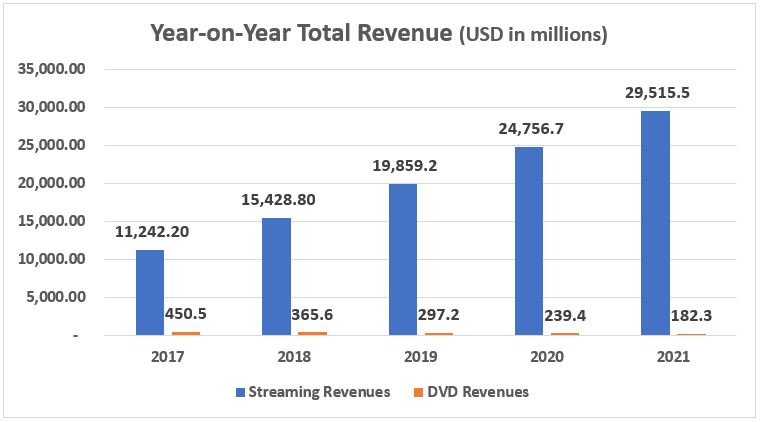

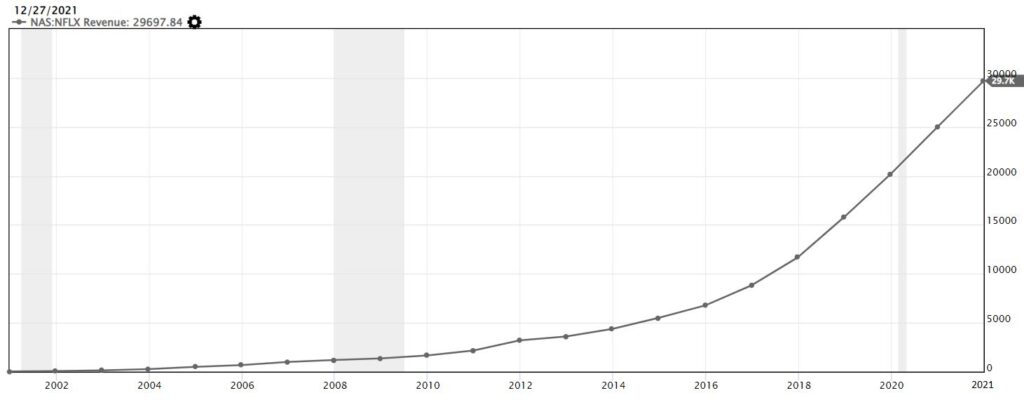

Netflix operates in one business segment and the revenue is mainly generated from monthly streaming membership fees for the content streaming services. About 99.4% of the revenue generated in 2021 was from streaming revenues. The DVD rentals service is only applicable within US region, and it contributed a mere 0.6% in 2021. The total revenues generated from the two sources was about $29.7 billion in 2021.

The chart below shows the revenue trend from 2017 to 2021. The streaming revenues has been increasing year-on-year from $11.2 billion to $29.5 billion, about 163.4% increment. However, the revenues for DVD rentals have been decreasing about 60% since 2017, from $450.5 million to $182.3 million in 2021.

This trend indicates that more consumers are preferring to watch their favourite shows via streaming on their internet-connected devices, which is more convenient and easily accessible compared to DVD rentals.

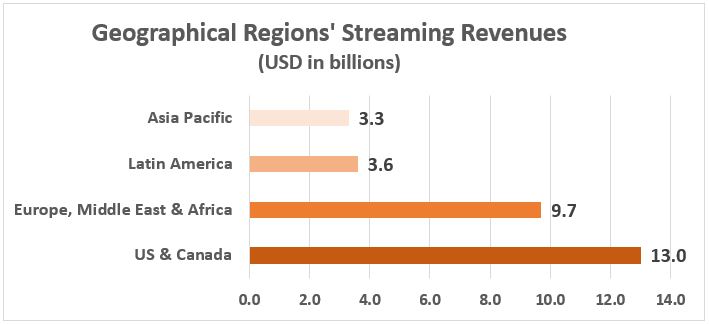

The streaming revenues are also categorized according to four geographical regions based on the chart below:

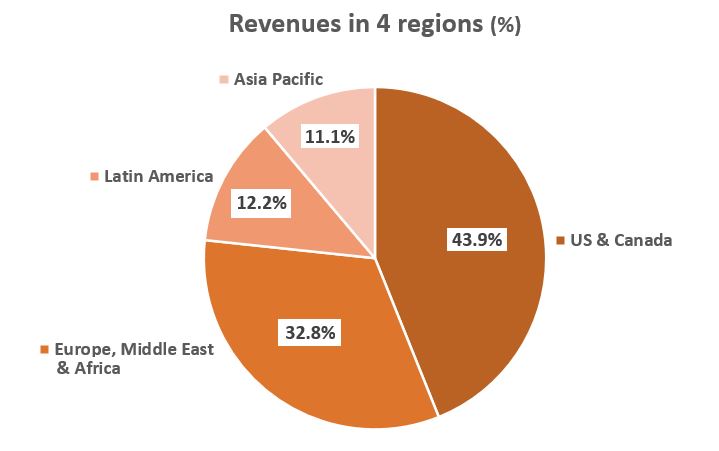

The pie chart below shows the percentage of revenues that was being generated from these four geographical regions in 2021.

From both charts, most of the streaming revenue in 2021 was being generated in the US & Canada region ($13.0 billion, 43.9%), followed by Europe, Middle East & Africa region ($9.7 billion, 32.8%), Latin America region ($3.6 billion, 12.2%) and lastly, Asia Pacific region ($3.3 billion, 11.1%).

After going through the background and the revenue generations of Netflix, it seems like this company’s revenue is growing strongly year after year! But can we really determine if Netflix is a good and valuable company to invest in based on only the annual revenue results?

PRODUCTS

Netflix provides streaming of entertainment contents such as TV series, documentaries, and featured films to its subscribed members without commercials. They have categorized the entertainment contents under three categories as displayed in the chart below:

Under Netflix Originals, these are for first run shows, and categorized under two types of contents: Owned & Licensed.

In the filming industry, first run refers to show that was available for public viewing for the first time. Whereas 2nd run is a repeat of the show broadcast after the show has completed its first run broadcasting schedule.

Since 2013, Netflix has started self-produce original productions, and this is categorized under Owned. Licensed refers to first run shows that was produced by other production studios, but Netflix acquired the licensing rights and distributed exclusively under their brand as Netflix Originals.

They also acquired and licensed other shows from other streaming companies and categorize them under 2nd Run movies & TV shows.

MEMBERSHIP PRICING FEES

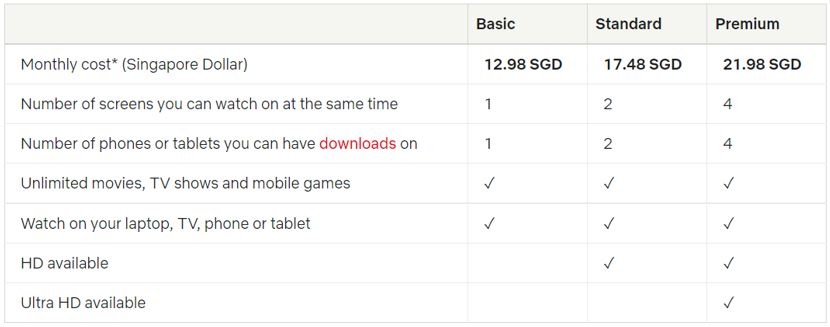

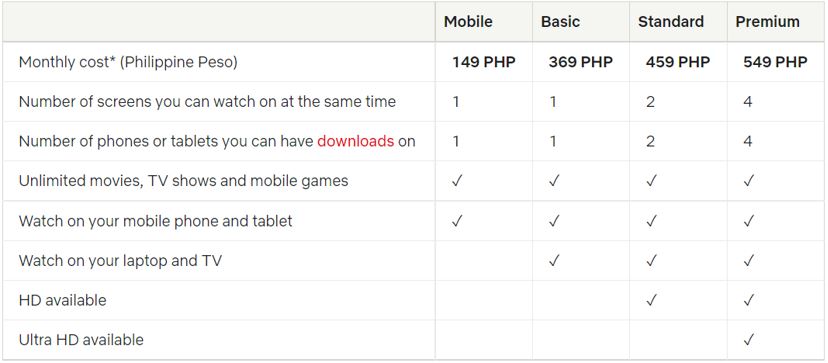

For the membership subscription fees, they have three tier of pricing – Basic, Standard and Premium.

The differences between the pricing tier are number of screens eligible to watch the contents simultaneously & download for off-line viewing. Standard pricing and Premium pricing also have different show content resolutions – HD or Ultra (4K) HD availability.

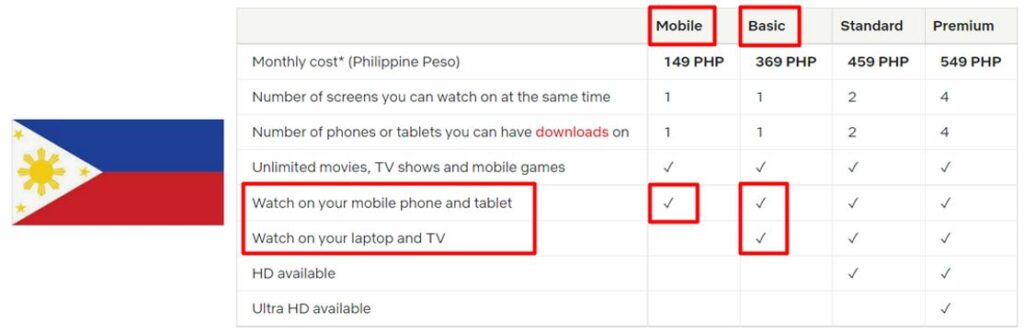

In addition, different countries may have slightly different pricing tier category. For example, in the Philippines, they have one more tier – Mobile, where members can watch the shows on the smartphone and tablet but not eligible on laptop or TV.

COMPETITORS

In their latest annual report 2021, Netflix has listed different competitors such as multichannel video programming distributors and other sources of entertainment that compete for the members’ moment of free time. This is known as “Winning Moments of Truth” where the consumers will choose which entertainment provider to spend their free time.

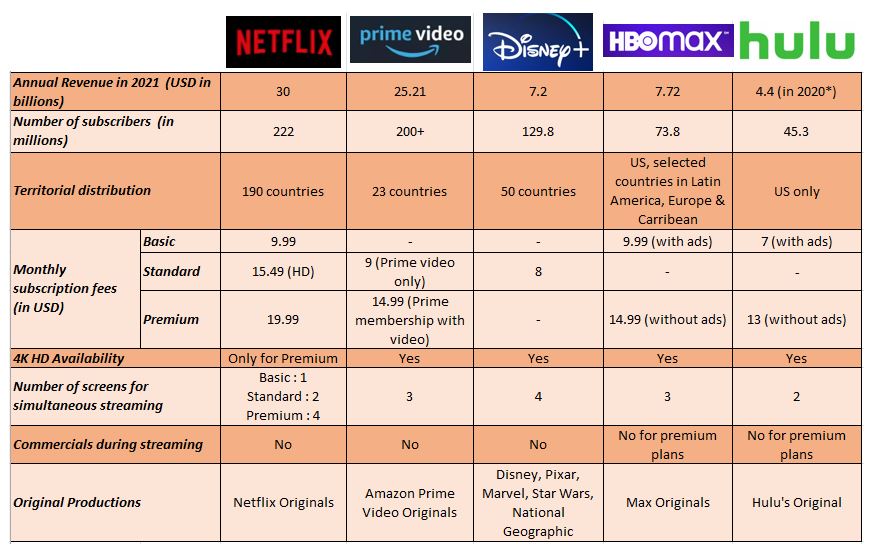

In this article, we will be focusing on other streaming entertainment providers and the chart below details some of the differences between streaming platforms.

*Hulu is currently owned by Disney (67%) since 2020

From the chart, we observed that Netflix has the most worldwide coverage, with 190 countries, then followed by Disney Plus (50 countries) and Amazon Prime (23 countries). In addition to that, Netflix has the highest number of paid subscribers (222 million), but Amazon Prime is also catching up quickly with 200+ million subscribers.

Due to the success of Netflix Originals, other streaming companies are starting to produce their own original contents so that this will create a sense of show exclusivity on their own platforms. With more streaming contents available, members will have more variety of shows to choose from and entice more consumers to sign up as paid members to watch the shows.

MOATS

Netflix has one of the highest number of subscribers compared to other competitors, approximately 222 million paid subscribers in 2021. They managed to increase their number of subscribers year-on-year due to several strategies that they implemented.

They launched Netflix Originals, where they had exclusive rights on first run shows that members can view it for the first time on Netflix platform. This exclusivity rights give Netflix the advantage to entice people to join their membership subscriptions as no other platform is allowed to broadcast the show during the first run.

As some shows are only available for viewing on the Netflix platform, there will be resistance among members to switch subscriptions to other streaming platforms as they might not be able to watch their favourite shows on the other platforms. Thus, the switching cost from Netflix to competitors is high.

To encourage more people to sign up for paid membership, Netflix launched content marketing website, Tudum in 2021 where the members can discover more about their favourite shows with extra contents, such as interviews with the casts, upcoming show details and many more. The website allows fans to deep dive into their favourite shows with exclusive show contents written by entertainment journalists and publication editors.

They also provided different methods for members across the geographical regions to watch the shows, whether it is at home or on the go. For example, in the Philippines, members can choose to subscribe the Mobile only plan to watch their favourite show on smartphone and tablet or the Basic plan where they can watch on PC and TV, in addition to mobile devices.

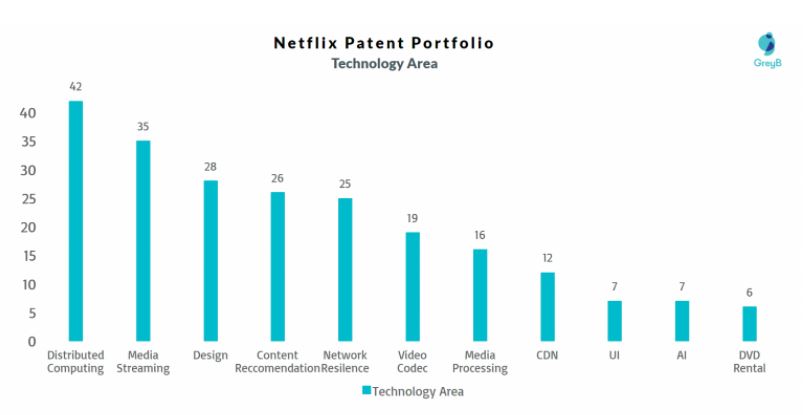

Netflix have registered their patents with the US Patent & Trademark Office to protect their technology prowess and avoid being copied by competitors. The chart below shows the technology area related patents that were registered.

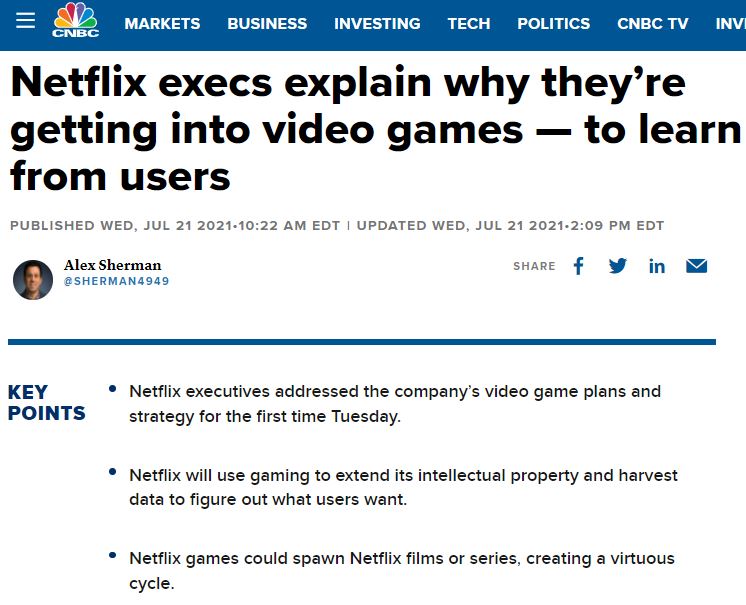

FUTURE PLANS

To keep growing and maintain their dominance in the streaming industry, Netflix has made plans to expand more contents providing to keep their existing members hooked on its service while attracting new subscription sign-ups.

Recent news has been reported that Netflix is getting into the gaming industry as they have been purchasing game developing studios since 2021. Some of the companies that they purchased are:

- Night School Studio (Sept 2021)

- Boss Fight Entertainment (Mar 2022)

- Next Games, creator of Stranger Things games (Acquisition in progress at the time of writing)

Netflix also made plans to produce more original contents to expand their streaming offerings to their subscription members. They have established new production hubs in five cities – London, New York City, Madrid, Toronto and New Mexico to produce higher quality original contents, telling interesting stories that people like to watch, such as Squid Game and Bridgerton.

From the products offered, competitive moats and exciting future plans, we can see that Netflix is currently dominating the streaming industry and intend to keep its industry leading position!

Nevertheless, it is also important for us to understand the company’s financial statements to better analyze the company and determine if it is a good company to invest our money. But alas, the financial terms and jargons might be too difficult and scary for a non-financial background person to understand and make an informed decision on the company’s financial situation.

At Value Investing Academy, we love to make things simple and easy to understand so that you can immediately kick start on your investing journey and easily breeze through a company’s financial situation. To learn more about it, click on the red button below!

FINANCIALS

Now we will deep dive into the nitty gritty part of the company – the financial statements, to determine if the company is able to generate consistent earnings and profitable.

The total revenue for Netflix has been increasing since it first launched its IPO in 2002 and reached $29.7 billion in 2021.

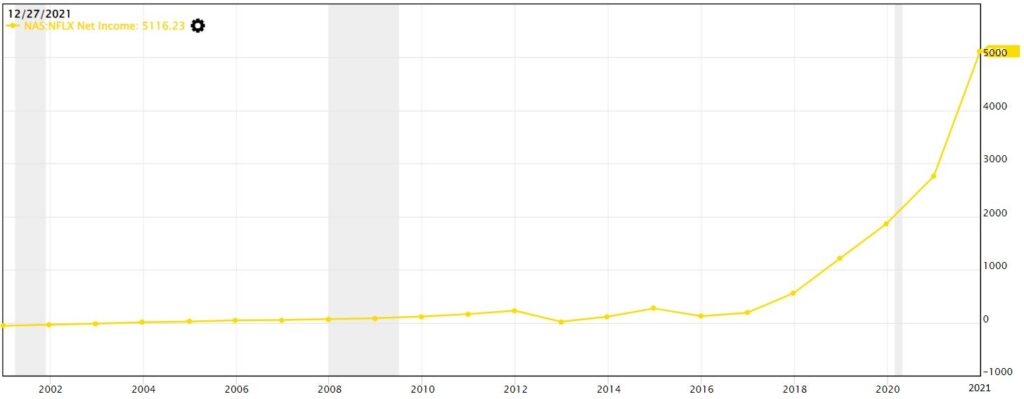

After deducting the business operation related expenses, we will obtain the net income (also known as profit) that the company has earned.

From the chart, the net income has been increasing since 2016 and in 2021, they have earned approximately $5.1 billion.

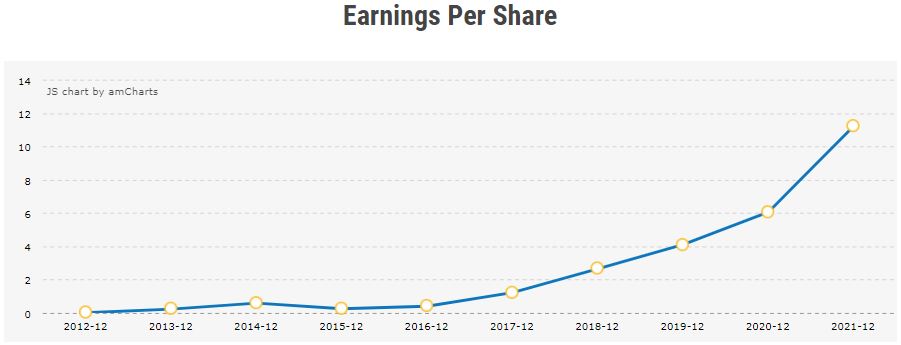

Then we look into its earnings per share (EPS), which tells us how much earnings the company generates if one share of the company is purchased. The formula for EPS is EPS = Net Income / Outstanding Shares. This means that if the EPS is $10, for every share invested, the investor can get back $10 from their investment in the company.

Based on the EPS chart, the trend is also increasing year-on-year, which is a good sign that the company is capable to generate more earnings from their business year after year based on the Value Investing methodology.

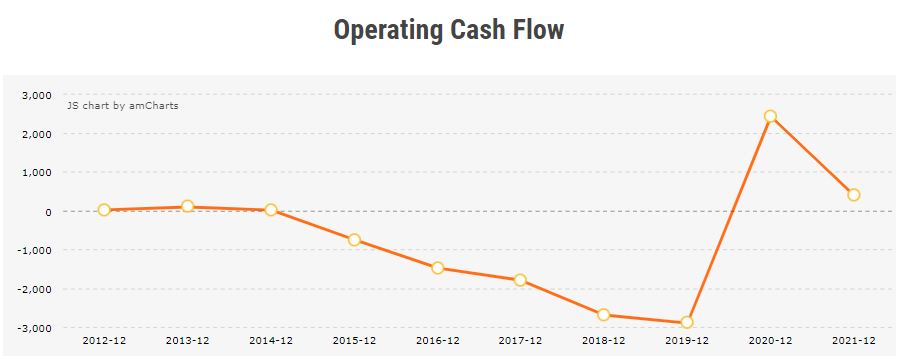

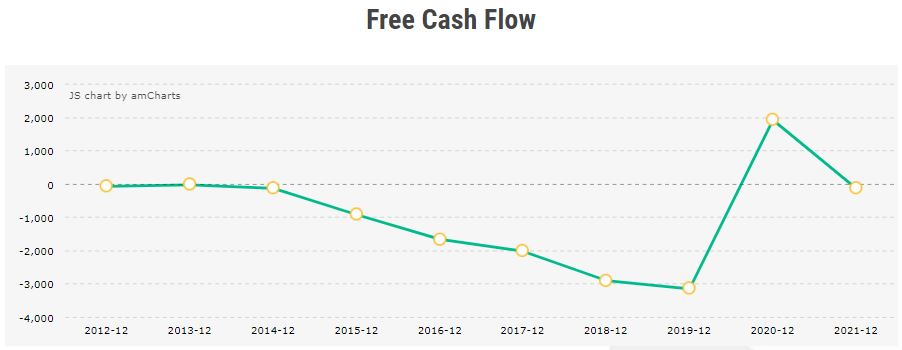

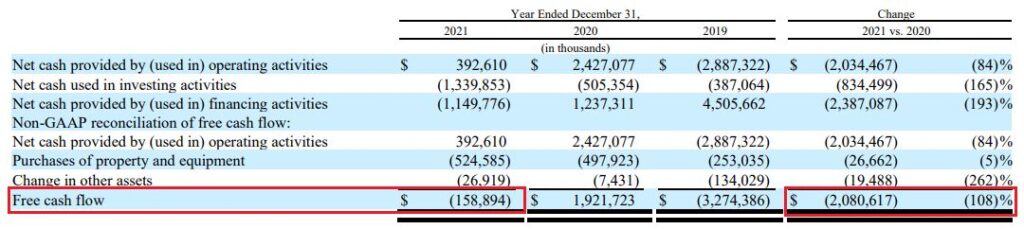

So far, the numbers look good for Netflix in terms of revenue generation and profit. However, when we investigate further into the cash flow, we noticed that the cash flow has been in the red since 2014 to 2019. In 2020, there was a sharp increase in their cash flow but then the cash flow drops back in 2021.

Operating cash flow is referring to the cash that is generated from day-to-day business operations.

Free cash flow is the cash that the company retains after deduct capital expenditure (CapEx) from the operating cash flow.

This is an abnormal situation because when the net income increased, the cash flow for the company should also increased. This cash flow trend of Netflix is one of the red flags that we should further investigate.

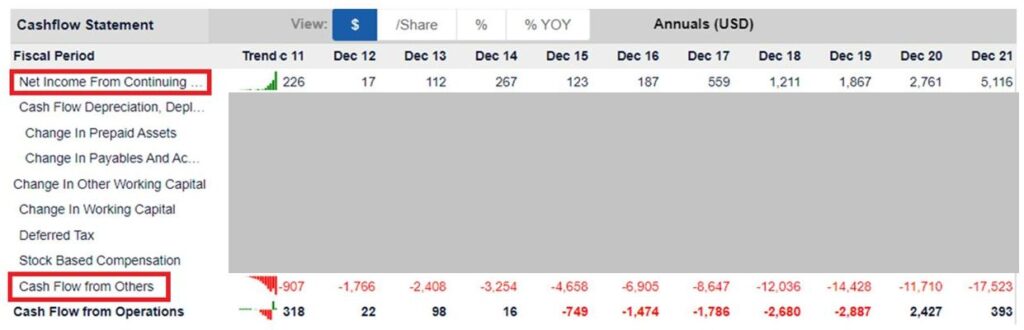

There are two main components that is affecting the operating cash flow – net income (cash inflow) & cash outflow.

From the diagram above, we noticed that the net income has been increasing since 2012 to 2021, but the cash outflow has always been in the red since 2012. This is because Netflix need to spend cash to acquire contents for streaming. Interestingly, the Cash Flow from Operations has been in the red from 2015 to 2019 as Netflix has started to produce own original contents.

In one of their documents, they explained that the original content productions cost more cash upfront to produce them.

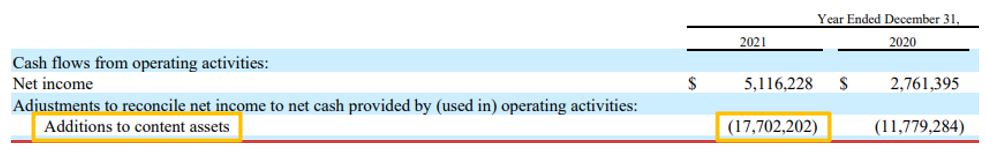

The sharp increase in operating cash flow in 2020 was because there was an increase in the net income and a decrease of cash outflow, which ends up a positive number for the Cash Flow from Operations in 2020 ($2.4 billion). However, even though the net income in 2021 has increased about 85.3% to $5.1 billion, they spent about 17.7 billion in content assets additions which was reflected in their cashflow statement below.

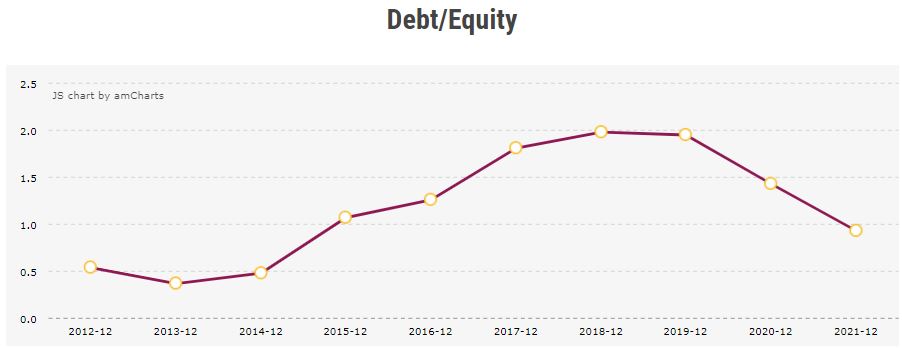

With the high cash outflow, we are concerned how the company can manage to finance the original content productions in the long run. We also look into the debt/equity ratio to check on the company’s total debt against shareholder’s equity.

According to Value Investing Methodology, if the Debt/Equity ratio is less than 0.5, this means that for every $100 of equity, the company can only have maximum of $50 of debt.

Currently, the debt/equity ratio for Netflix is close to 1.0, which is double from the recommended criteria of 0.5. This implies that the debt level for Netflix is high.

POTENTIAL RISKS & CONCERNS

From their annual report, even though the revenue and net income reached a new record high in 2021, we observed that there was also high debt and low cash flow in their financials.

From the list of industries, we noticed that the products and services are mostly considered ‘good to have’ or ‘luxury items’. Thus, the demand for these items in this sector depends on the economic condition and wealth of individuals.

The COVID situation has seriously hampered the content productions as less shows were available to broadcast. With lesser shows available, the members might consider exploring other entertainment channels to spend their free time and watch less Netflix shows, such as playing games or spend time on social media.

In addition, if the show that was produced does not meet up to the expected turn out or being positively received by audience, there will be less people watch the show and indirectly affected the subscription sign-ups for the show. As more than 99% of Netflix revenue was generated from membership fee subscription, a drop in the membership sign-up may also affect their revenue and income earnings.

Netflix also acquire licensing rights for their non-original contents. When the licensing rights expired or they are not able to renew the rights, the show will leave their platform. Again, with lesser shows on their channels, there will be lower incentive for people to subscribe Netflix to watch the streaming.

Other concerns includes subscribers sharing their passwords with their friends and families where one Netflix account can be used by different parties. This will directly affects the number of subscription members as the consumers can share the account and less likely to spend money for the subscription.

Netflix has been protecting all their technology and intellectual properties since 2003. As the patent only covers for 20 years, once the patent protection has lapsed, other streaming companies are able to duplicate their technology to grow their streaming business and compete against Netflix.

CONCLUSION

From the financial statement, even though Netflix is generating high revenue year-on-year since it launched IPO, nevertheless the worrying aspect of decreasing cash flow and high debt might cause one to wonder if the depletion of cash reserve in the company can weather through potential financial storm.

Netflix has also announced that they will be releasing Q1 2022 quarterly earnings on 19 Apr 2022. It will be best to wait for the earnings release to determine if the plunge is just a one-off thing and the company is still profitable with future long-term growth.

Bad news aside, Netflix has made news recently about the upcoming new release of Squid Game 2, where the first season was a major hit for the streaming company. Hopefully this news will turn the tide around for the company to regain its past glory.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.