In 2023, Nvidia’s stock surged by 38.5% to $423.02 from $305.38 in a few months, showcasing its AI-driven success. This rise underscores its dominance in AI tech, bolstered by aggressive investments in startups.

As the brains behind the chips that power ChatGPT and numerous other cutting-edge AI technologies, Nvidia is now aggressively investing in other AI startups, further solidifying its position as a key player in the AI industry.

Should investors seize this moment?

In this blog, we’ll delve into Nvidia’s qualitative analysis, latest AI ventures, and financial performance. The path to understanding Nvidia’s rapid ascent begins here.

For a more immersive understanding, we’ve dedicated a segment to Nvidia on our YouTube channel. Don’t miss the chance to glean even more insights by watching the video below.

QUALITATIVE ANALYSIS OF NVIDIA

Nvidia, a US-based tech company, specializes in GPU design for visuals and accelerated computing. They also offer AI-driven solutions for data centers.

NVIDIA GPU

Despite their innovation, they’re fabless — meaning Nvidia focuses on designing chips instead of producing chips. To learn more about the semiconductor ecosystem, click on the link to find out!

Founded in 1993 by 3 computer scientists including current CEO Jensen Huang, the company’s HQ resides in Santa Clara, California. They entered the stock market in 1999 via an IPO with the ticker symbol NVDA on NASDAQ.

PRODUCTS & SOLUTIONS

Nvidia’s GPUs find versatile application across a spectrum of computing platforms:

Data Centers – Nvidia’s GPUs play a pivotal role in data centers. The GPUs accelerate complex computations with parallel processing capabilities which power artificial intelligence and machine learning workloads. This allows data centers to process vast amounts of information efficiently.

Gaming – In the gaming realm, Nvidia’s GPUs are instrumental in delivering immersive experiences and lifelike graphics. Gamers benefit from the enhanced visual quality and seamless gameplay that Nvidia GPUs offer.

Professional Visualization – In the realm of professional visualization, Nvidia GPUs drive cutting-edge graphics solutions for design, animation, and visualization. Architects, engineers, and creative professionals rely on these GPUs to bring their visions to life with stunning clarity.

Automotive – Nvidia’s GPUs are integrated into advanced driver assistance systems (ADAS) and autonomous driving technologies where they process data from sensors and cameras. This aids in tasks like object recognition and decision-making, contributing to safer and more efficient driving experiences.

Nvidia’s GPUs serve as a cornerstone in diverse sectors, exemplifying the company’s commitment to innovation and technology that transcends boundaries.

NVIDIA'S FUTURE PLAN WITH AI

Amidst the ascent of generative AI, Nvidia has emerged as a prominent driving force, notably supplying the chips empowering systems like ChatGPT.

ACCELERATED COMPUTING

Nvidia’s CEO, Jensen Huang, has unveiled a vision centered around accelerated computing for the forthcoming computing era.

Accelerated computing involves turbocharging computation using specialized hardware, such as GPU, particularly in situations where tasks demand substantial computational power and parallelism, like the training of deep neural networks in AI.

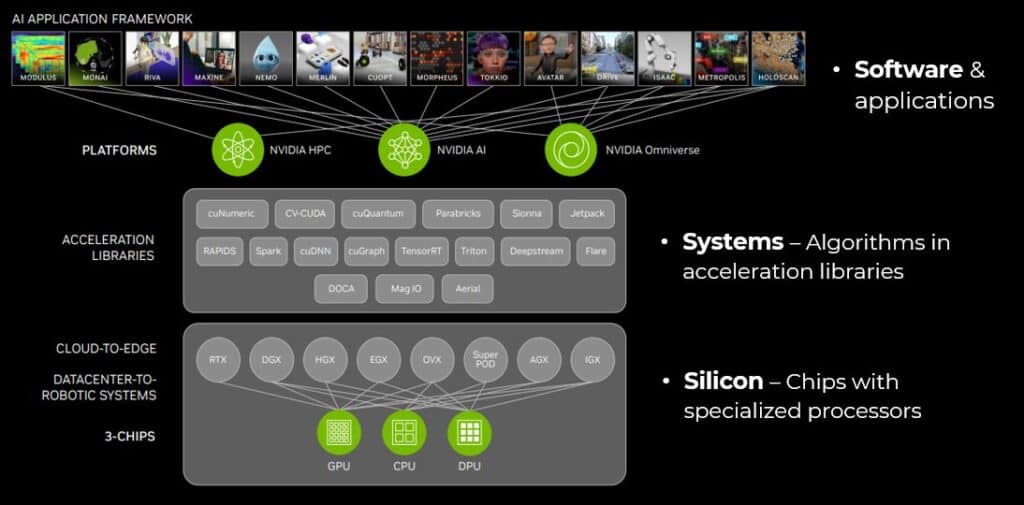

Accelerated Computing Framework – Full-stack Approach

This strategy targets the enhancement of compute-intensive aspects within applications through a comprehensive full-stack approach, with a combination of Hardware (silicon chips), Systems (acceleration libraries) and Software.

This full-stack approach aims to usher in a new phase of computational prowess.

NVIDIA AI & NVIDIA OMNIVERSE

In an era where data centers are becoming the new computing hub, Nvidia steps forward with a suite of cloud services to address these demands, including Nvidia AI and Nvidia Omniverse.

Nvidia’s AI initiatives harness cutting-edge technologies to drive advancements across various industries with AI-driven solutions. By harnessing potent GPUs and innovative software, Nvidia AI is reshaping domains such as healthcare, finance and autonomous driving.

- In healthcare, AI’s image analysis prowess expedites diagnoses while predictive models enhance treatment planning.

- In finance, AI’s data analytics aids in risk assessment and fraud detection.

- Autonomous driving is transformed through AI’s ability to interpret surroundings and make real-time decisions, revolutionizing road safety.

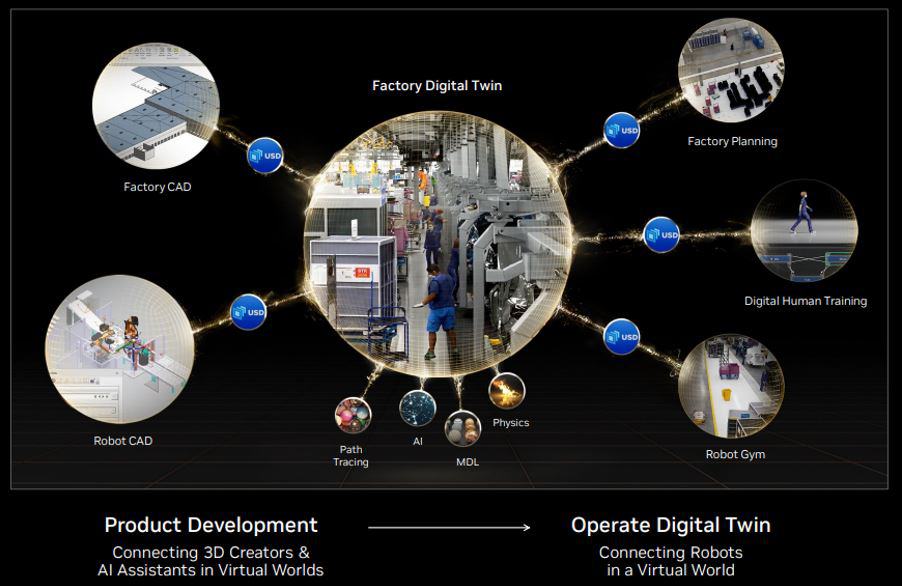

NVIDIA Omniverse emerges as a breakthrough platform where virtual reality (VR) and simulation converge. It facilitates cooperative 3D simulation and design across diverse sectors, spanning from gaming to architecture.

Nvidia Omniverse

Participants can digitize their workflows and simulate intricate 3D environments in real time within the virtual realm. This platform’s real-time capabilities facilitate unprecedented levels of creativity and collaboration among professionals.

INVESTMENTS INTO AI STARTUPS

NVIDIA also invested in AI startups, such as OmniML and Inflection AI.

Nvidia acquiring OmniML highlights their commitment to enhancing Edge AI capabilities. They plan to integrate OmniML‘s tech to improve Edge AI performance, particularly with the Omnimizer tool that optimizes on-device AI tasks, saving time and cost.

The collaboration shapes the Edge AI landscape, accelerating AI’s potential in various applications. This acquisition signifies Nvidia’s strategy, transforming Edge AI through advanced tech integration.

Nvidia’s investment in Inflection AI highlights a shift towards innovative AI solutions focusing on human interactions.

While Nvidia is known for advanced AI systems like ChatGPT, their partnership with Inflection AI underscores a focus on creating a friendly and empathetic AI experience, akin to conversing with a compassionate friend.

Inflection AI‘s approach aligns with Nvidia’s dedication to leading AI advancements by prioritizing human-like engagement and empathy.

Now that we’ve gained insights into Nvidia’s future strategies, let’s delve into their financial performance and numbers!

QUANTITATIVE ANALYSIS OF NVIDIA

REVENUE GENERATION

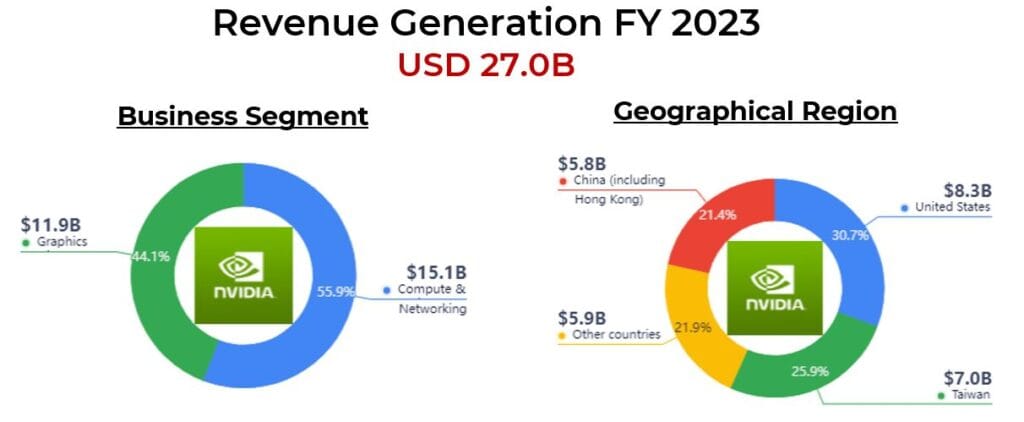

In the fiscal year 2023, Nvidia achieved a substantial total revenue of USD 27 billion, with 56% attributed to the Compute & Networking segment. The Graphics segment accounted for the remaining 44% of revenue.

Graphic Source: GuruFocus

- Graphics Segment: responsible for designing and delivering cutting-edge graphics processing units (GPUs) to deliver stunning graphics, real-time rendering, and immersive gameplay.

- Compute & Networking Segment: focuses on utilizing Nvidia GPUs for computational tasks beyond graphics, such as accelerating complex computations through parallel processing to drive progress in AI, machine learning, and scientific research. This segment is also involved in networking solutions to support fast data transfer in modern communication networks.

Nvidia further segmented its revenue based on geographical regions: the United States, Taiwan, Other countries, and China (including Hong Kong). Notably, each of these regions made nearly equal contributions to the revenue, as depicted by the pie chart for FY 2023.

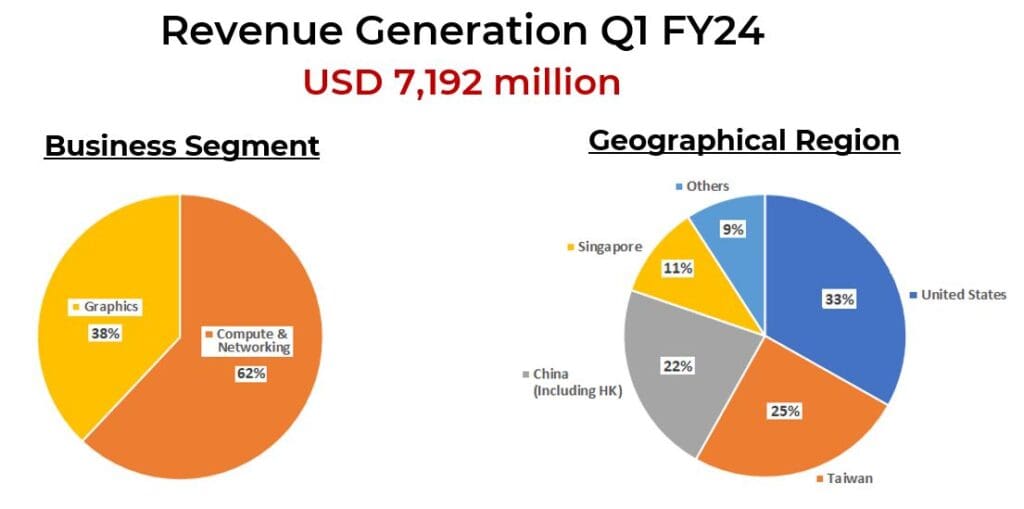

Data Source: Q1 FY24 Quarterly Report

In their most recent quarterly report (Q1 FY 2024), the Compute & Networking segment took the lead, generating 62% of the revenue, while the Graphics segment accounted for 38% of the total revenue. This highlights the dynamic shifts in revenue distribution across these two pivotal business segments.

In terms of geographical contributions, the United States remained the largest revenue generator at 33%, followed by Taiwan at 25%. China accounted for 22% of the revenue, while Singapore and Other regions contributed 11% and 9%, respectively.

FINANCIAL STATEMENT ANALYSIS

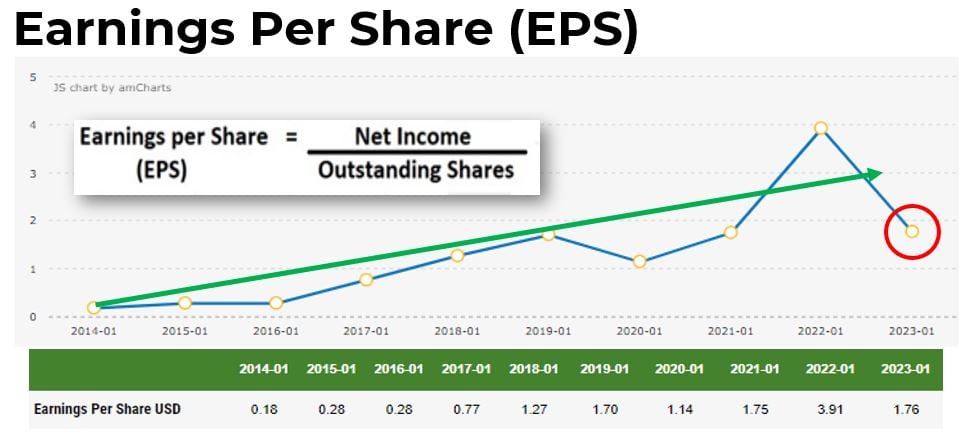

From 2014 onward, Nvidia experienced a consistent upward trajectory in its EPS. However, a stark deviation was witnessed in 2023 where the EPS dropped to 1.76, which raised concerns.

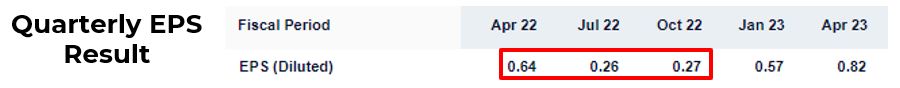

The notable decline in EPS during that year can be attributed, in part, to a slump in PC sales observed in late 2022, as evident from the quarterly EPS results.

This transition serves as a segue into our next exploration: uncovering potential risks lurking beneath Nvidia’s recent AI-driven hype. Despite the buzz, delving into these potential challenges is essential for a comprehensive understanding of the company’s standing.

POTENTIAL RISKS

While Nvidia’s AI-driven GPU future appears promising, prudent investors must also consider potential risks before committing to the company.

NVIDIA operates as a chip design firm, not a manufacturer, focusing on advanced AI chip designs. Manufacturing is outsourced to semiconductor fabs, currently collaborating with TSMC.

The question looms: Can present semiconductor tech keep pace with cutting-edge AI chip designs and demands?

We’ve delved into additional potential risks associated with Nvidia, evaluating its appeal as a promising tech stock investment. Visit our YouTube channel for valuable insights and make informed decision-making!

CONCLUSION

In conclusion, Nvidia stands as a pioneering force in the realm of technology, spearheading innovations that have not only reshaped industries but also transformed the way we interact with artificial intelligence.

Their GPU technology has not only powered cutting-edge AI applications like ChatGPT but also demonstrated its versatility across gaming, data centers, professional visualization, and automotive sectors.

From their remarkable rise in stock prices, underpinned by exceptional performance in the midst of the AI boom, to their strategic investments in AI startups like OmniML and Inflection AI, Nvidia has consistently showcased their commitment to pushing the boundaries of AI capabilities.

However, amid their success, Nvidia remains conscious of challenges such as cyclical shifts in the semiconductor industry, export restrictions, and the intricacies of maintaining consistent EPS growth.

Nevertheless, as Nvidia navigates the ever-changing technological terrain, it’s important to remain vigilant and attentive to the potential impact of future AI developments that could shape the realm of innovation significantly.

Are you in search of growth and undervalued companies? Dive into our US Case Study Subscription to:

- Discover companies meticulously researched from thousands in the US market.

- Bypass the tedious research process; we evaluate and pinpoint the intrinsic value using advanced tools.

- Harness advanced options strategies for a new stream of passive income.

Click on the banner below to find out more!

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.