We shared some details about how value investing got started and introduced its intellectual patriarch, Benjamin Graham.

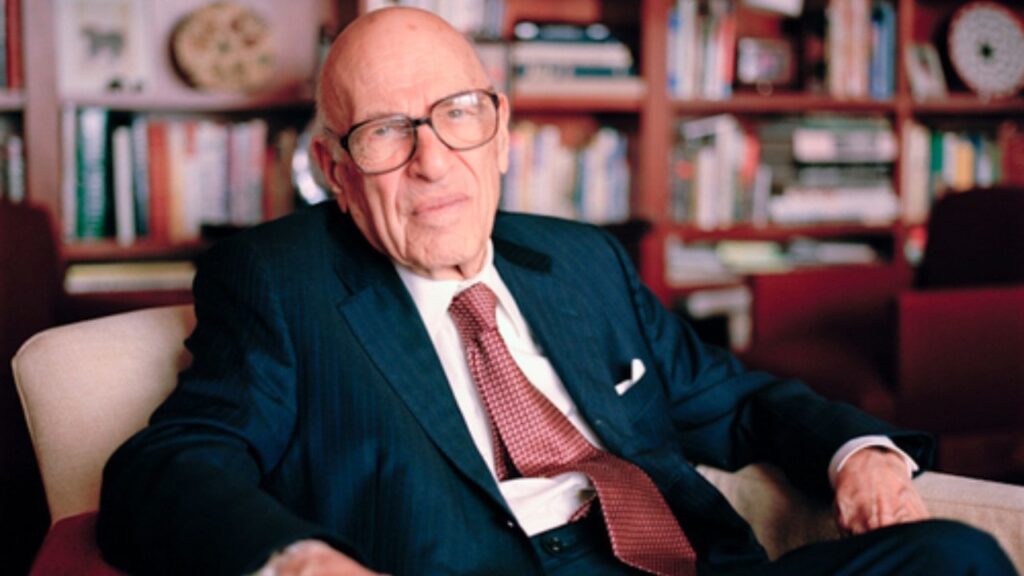

Benjamin Graham

Graham taught an investing course at Columbia Business School, which Warren Buffett attended. After Buffett’s graduation from Columbia, he eventually ended up working for Graham at his investment firm, the Graham-Newman Corporation (GNC).

People familiar with the term value investing in modern times might associate it with Warren Buffett and the analysis of a business’s ability to generate above-average and sustainable profit margins and cash flows to determine intrinsic value with a focus on the Income and Cash Flow statement. Buffett wants to find compounders – companies that can grow intrinsic value over time.

Warren Buffett

But, when Buffett started work with GNC, he analysed stocks differently. In GNC, analysis of a business’s intrinsic value relied heavily on the balance sheet. Graham did not think too hard about what differentiated a ‘good’ business from a ‘bad’ business. To Graham, so long as the stock was statistically cheap enough, it will usually be considered a candidate for investment in a widely diversified portfolio of stocks numbering in the hundreds.

Graham’s methods worked and his investment firm was very successful, but Buffett’s thoughts about investing had started to diverge a little. Buffett left Graham’s firm in 1956 and started his own investment partnerships.

He started out using Graham’s methods and was very successful but eventually, Buffett would start investing in the way that people would most closely associate him with in modern times – investing in great businesses that can earn great returns on capital over the long term. But, that would be a development that would take the introduction of a certain Charlie Munger and Philip Fisher, two people who would really reshape the way Buffett thought about investing.

But before we introduce Charlie Munger and Philip Fisher, let’s go back to 1954 when Buffett started work in GNC. In GNC, Buffett met Walter Schloss, who would quit Graham’s firm in 1955 to set up his own investing partnership. While Buffett will always be the ultimate poster child for value investing, Schloss is nonetheless a very important figure in value-lore, for he was the one-true torch bearer for Graham.

Walter Schloss

Schloss was about 10 years older than Buffett when they first met as colleagues in GNC. Buffett was the golden boy at the firm, favoured by Graham and the other important partners in GNC, while Schloss was treated as a normal employee. But, Schloss took Graham’s lessons to heart. When he set up his own investing partnership in 1955, he used what he had learnt from Graham in his investing activities and never wavered all the way till his retirement in 2001.

For 46 years, Schloss walked the talk by investing the “Ben Graham way”, focusing on the balance sheet and trying to buy companies that were selling below their working capital. His earliest investors have to thank their lucky stars, for Schloss grew every dollar entrusted to him into $662 by the time he retired, more than thirty times the returns from the overall stock market.

While the whole world was watching Buffett invest in companies like Coke, See’s Candies and American Express, Schloss was happy buying stocks that were selling for less than all their net assets. As communication technology improved over the years, information flowed at a faster rate and Schloss found that Graham’s famous Net-Net investing opportunities were beginning to dry up.

So, Schloss modified it a little by investing in companies that were selling below their total net worth. Even as the internet-era arrived, Schloss still managed to profit handsomely by applying Graham’s investing methods.

Investing in great businesses with unusual and sustainable profitability was what Buffett taught the world. But, Schloss was a testament that Benjamin Graham’s methods of investing with a strong focus on the balance sheet of unloved companies whose intrinsic business values were likely not to grow, could still work in the modern era. That was how Schloss carried Graham’s torch into our times.

Schloss’s story is interesting, but we’re sure you’re still wondering about Buffett’s investing transformation. So, stay tuned next week as we find out how Buffett fused Graham’s lessons with the ideas of two other very important people in investing-lore, Charlie Munger and Philip Fisher, into the value investing philosophy we know so well today.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.