With the rage of Artificial Intelligence & ChatGPT taking the world by storm, many semiconductor companies such as Intel, TSMC, and Samsung are racing to release the latest advanced chip technology to ride on the AI wave.

However, American chip giant – Intel had canceled one of their planned 2023/2024 products due to unforeseen circumstances. This has pushed back the release date of their latest GPU chip project – Falcon Shores to 2025.

Will Intel be able to catch on to the AI wave on time or be left out of the AI race?

In this blog article, we will deep dive into Intel to find out if Intel still has a bright future in the AI race. And also to find out if now is a good time to buy the dip into Intel despite the recent bleak news!

We have also done coverage about Intel on our YouTube Channel! Click on the video to watch!

NEW CEO - PAT GELSINGER'S PLAN

In Feb 2022, when Intel’s new CEO – Pat Gelsinger came onboard to the company, he had great visions and plans to turn the company around to become the technology leader of the semiconductor industry.

Intel CEO – Pat Gelsinger

His revival plans include:

- Set up a new division – Intel Foundry Services (IFS)

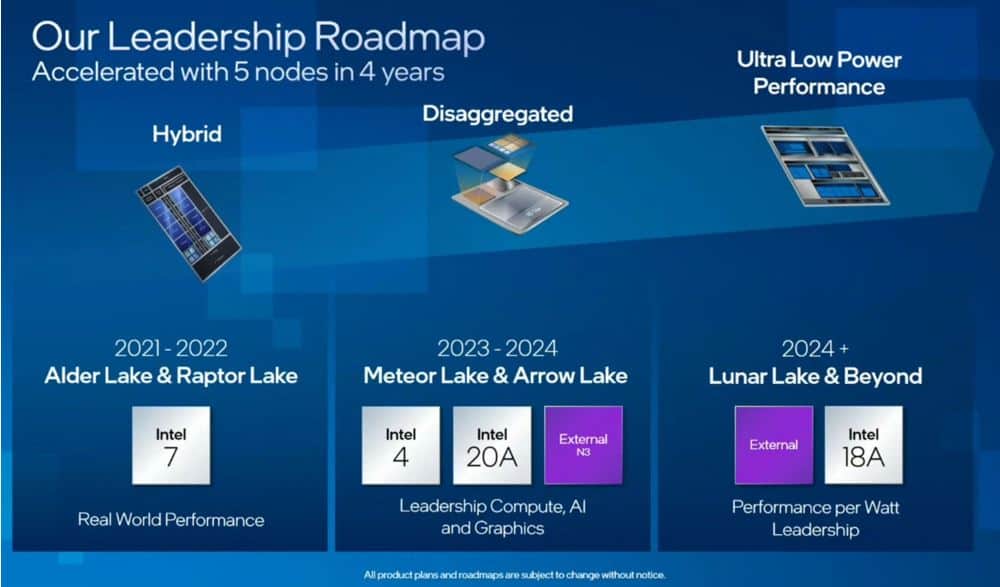

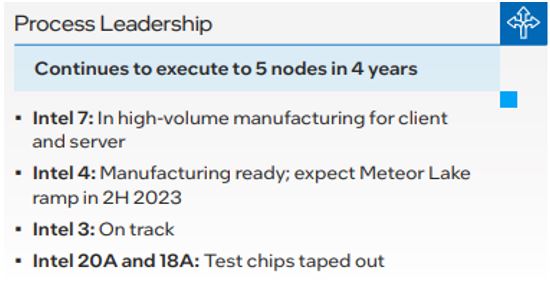

2. Deliver 5 nodes in 4 years.

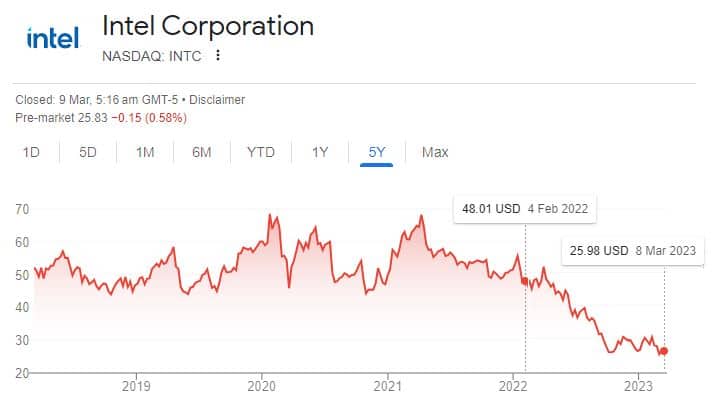

However, the company’s share price plunged from USD 48.01 to USD 25.98 a year later after Gelsinger had became CEO.

Source: Google Finance

Why is Intel’s stock down for the past 1 year?

Let’s find out more in the next section.

LATEST UPDATE ON INTEL

In FY 2022, Intel’s revenue took a nosedive of about 32% year-over-year decline. This was due to a drop in PC sales worldwide as many consumers had bought new PCs during the COVID pandemic. As a result, PC demand has dropped to the lowest level in recent years and directly affected the sales of various chip companies, such as Intel & AMD.

Next, Intel has also announced a change in their production roadmap for their supercomputer chip products (GPU). One of the GPU product lines were to be discontinued and they delay the release of the next GPU products to 2025. We will explore more on this in the following section.

Moreover, the announcement of reducing their dividend payout has also been reflected badly on Intel as most people bought into Intel for their dividend payout.

The rationale for the deduction of their dividend payout is to conserve cash. The company planned to use their retained earnings to fuel the company’s future growth and reclaim their past glory as the industry leader.

With all these bad news announcing across news channels, can Intel recover from these bad news?

To determine if Intel is still a good stock in the midst of turning its ship around, we will have to find out more about the company.

CIRCLE OF COMPETENCE - INTEL

Intel is an American multinational corporation that designs and manufactures semiconductor chips. It is also one of the largest semiconductor chip manufacturers in the world.

As such, Intel is categorized under the Integrated Device Manufacturer (IDM) in the semiconductor ecosystem.

Semiconductor Ecosystem

Intel produces various hardware products such as processors, memory & storage, chipsets and graphic cards.

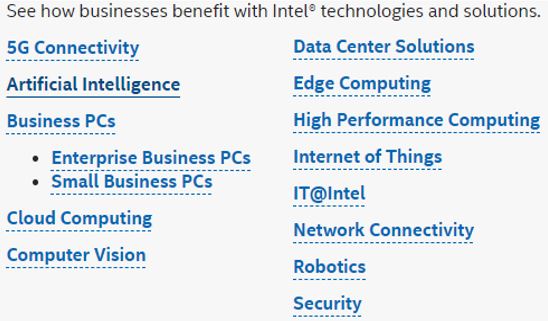

In addition, they also offer software solutions in various technologies as per shown in the diagram below:

Source: Intel Website

Intel has a total of 9 manufacturing sites worldwide, where most of the wafer manufacturing sites (purple colour) are in the US, Ireland and Israel.

After the chips have been manufactured, the chips will be sent to assembly and test facilities to be tested before being packaged into final products. In the map below, the assembly and test facilities (blue colour) can be found in the Asian region and Costa Rica.

Intel’s Global Manufacturing Sites

INTEL'S COMPETITIVE ADVANTAGES

As the semiconductor industry is a niche and competitive industry, Intel faces stiff competition with other chip manufacturers (such as TSMC & Samsung) and chip designers (such as AMD & NVIDIA). Intel has to compete with them in the technology to manufacture the chips, known as process nodes and the chip applications.

To fend off the competition and remain as the technology leader in the semiconductor industry, Intel will have to widen their economic moat. This is a term coined by Warren Buffett that a company with huge competitive advantages can prevent their competitors from taking away their market share.

One of their advantages is that Intel has a strong partnership with major PC manufacturers where their chips are widely used in their products. This allows Intel to form a wide distribution network for their chips. 3 of Intel’s largest customers that accounted for 42% of their revenue in 2022 are Dell (19%), Lenovo (12%) and HP (11%).

In addition, the brand that Intel established decades ago gives a strong impression of quality and reliability in the consumers’ mind, which is a strong brand recognition.

However, due to the rise of other semiconductor companies, Intel might be lagging the race as the chip technology leader.

For example, the smallest process node technology that Intel can manufacture is at 10nm. Intel’s competitor, TSMC and Samsung are now producing chips with node technology as small as 3nm. The smaller the process node technology, the more energy efficient and powerful the chip is.

To catch up on the race of producing the most powerful chip, Intel has announced their plan to release 5 nodes technology in 4 years. Whether Intel can reclaim their throne as the technology leader, we will have to monitor their development progress of the chips.

INTEL'S UPDATED FUTURE PLAN

When Intel announced the update of the production roadmap for their supercomputer chip, Graphics Processing Unit (GPU), their share price took a hit and tumbled from USD 28.89 to USD 25.53, approximately 11.6% drop.

This reason for canceling the chip release in 2024 and delaying the high-performance computer chip release to 2025 was because the company wanted to focus on producing high quality chips. They want to avoid releasing the chip just for the sake of meeting the deadline.

Nevertheless, in their latest annual report, they announced that their process node technology is still on track.

Intel’s Process Node Progress

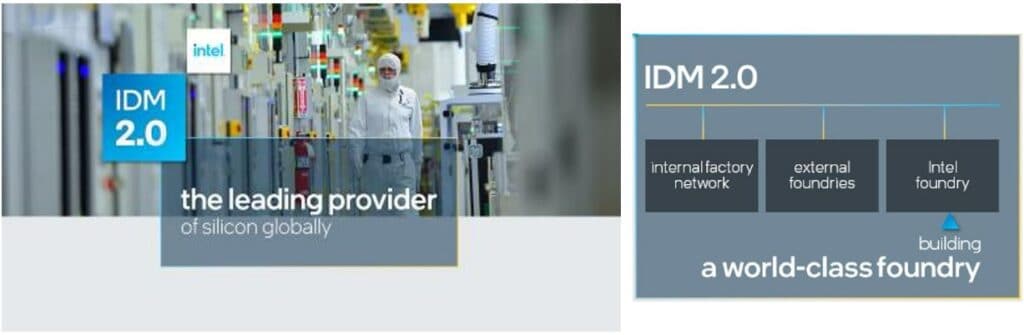

For their IDM 2.0 strategy, Intel intends to become the major provider of US semiconductor chips, while driving sustained technology & product leadership in the US.

As such, there are 3 focus area in the IDM 2.0 strategy:

- Expand internal manufacturing capacity (domestic chip manufacturing)

- Expanded use of 3rd party foundries capacity

- Offer manufacturing services to fabless companies, such as AMD & NVIDIA

In the next section, we will also look at their numbers to determine if Intel is doing well financially.

INTEL'S FINANCIAL ANALYSIS

Revenue

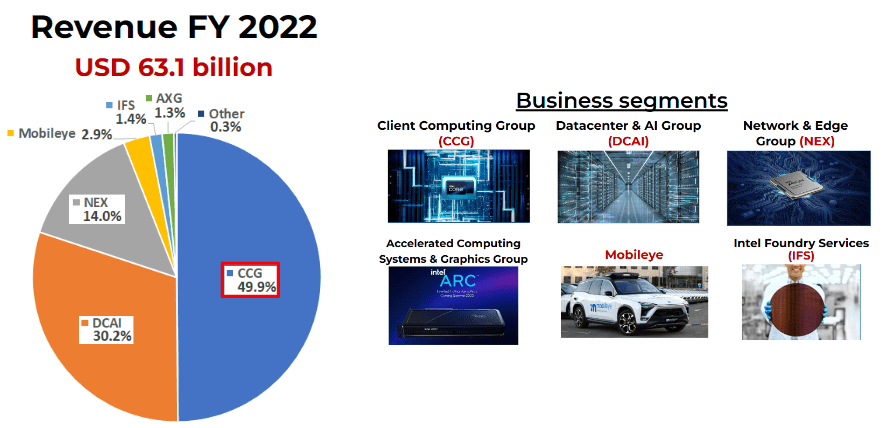

First, we will look into Intel’s revenue in FY 2022 where they generated a total of USD 63.1 billion.

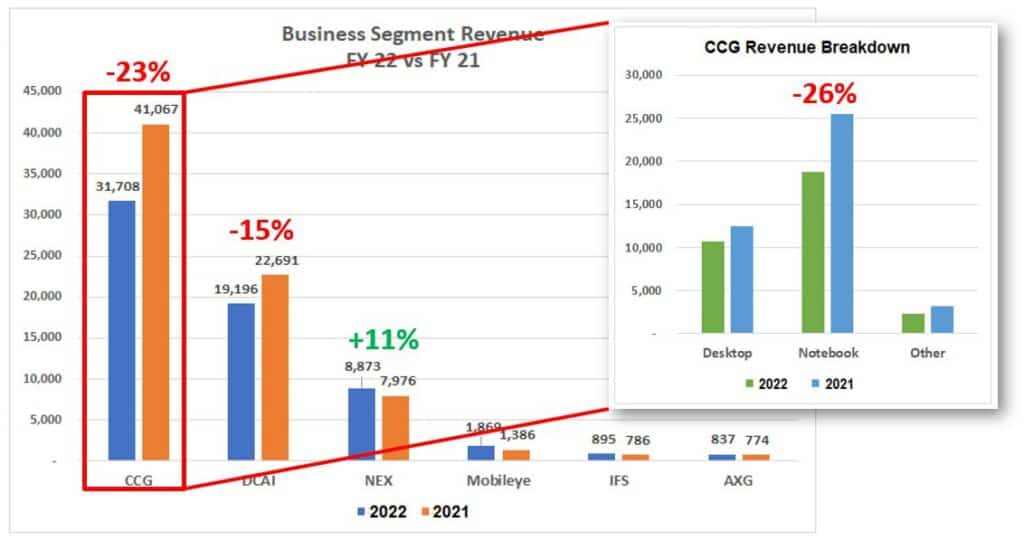

The majority of the revenue comes from CCG (49.9%), followed by DCAI (30.2%) and NEX (14.0%). The rest of the business segments each contributed 2.9% (Mobileye), 1.4% (IFS) and 1.3% (AXS).

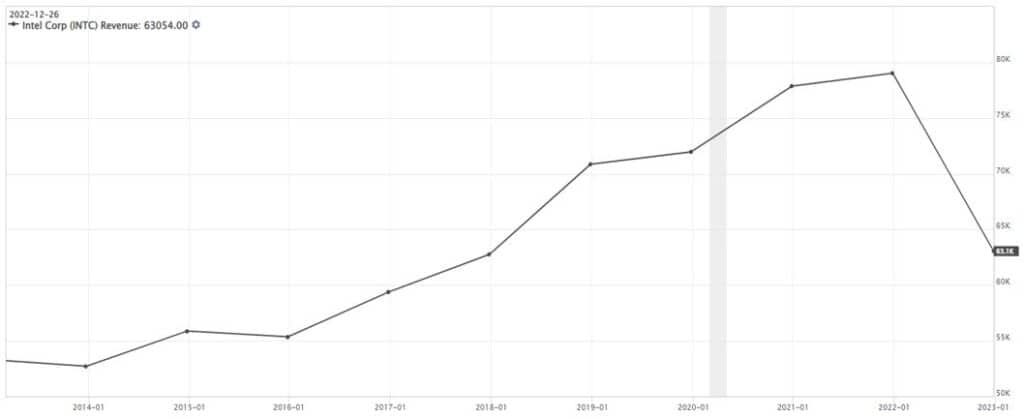

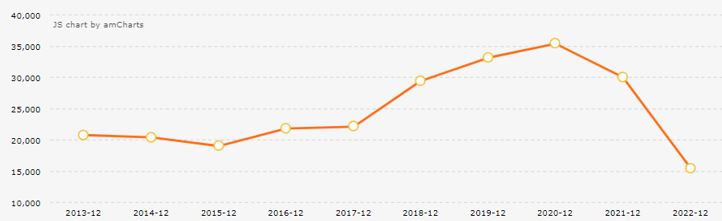

However, when we look into their past 10-year revenues, we were alarmed to see a sharp drop in their revenue in 2022.

Intel’s 10-year Revenue (2013-2022)

Further investigation led us to find out that the plunge in revenue was due to a drop in PC sales which severely affected their major contributing business segment, CCG.

Business Segment Revenue Breakdown

As such, if the PC sales are to recover in the next few quarters, Intel’s revenue should be able to recover.

Profitability – Earnings Per Share (EPS)

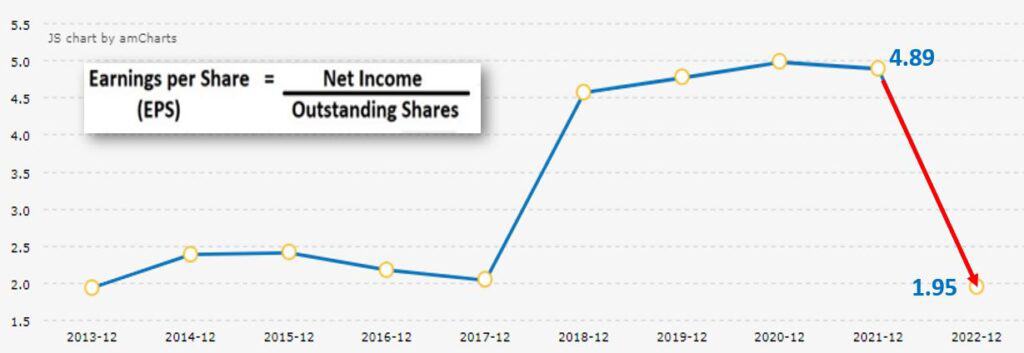

As their revenue dropped, this also affected their earnings per share (EPS) in 2022. Their EPS dropped from 4.89 in 2021 to 1.95 in 2022, which is a severe plunge of 60%.

Earning Per Share (EPS)

Cash Flow

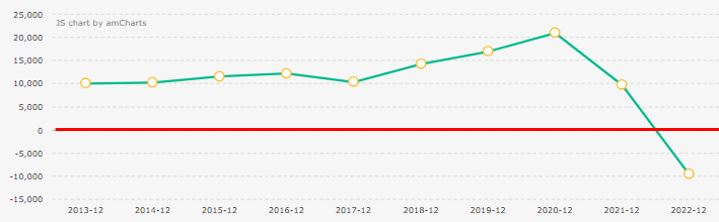

To add salt to the wound, their cash flow situation was also quite bleak for the past year.

Their operating cash flow, which is the cash flow generated from normal business activities such as selling semiconductor chips, had dropped since 2021

Operating Cash Flow

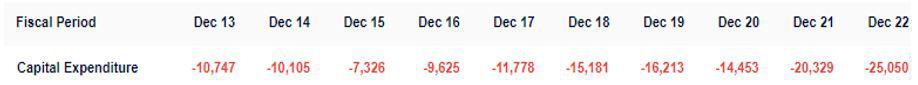

As the company is massively expanding their manufacturing capacity, they incurred high capital expenditure, known as CapEx. CapEx is the expenses used by the company to purchase assets that will last more than 12 months.

Intel’s Capital Expenditure (CapEx)

Due to the drop in operating cash flow and high expenses in their capital expenditure, we observed that the free cash flow has dropped below $0 and become negative.

Free Cash Flow

This may have caused worry among the investors about the company’s future prospects and financial health, which might led to share price plunge back in February 2023.

Long Term Debt

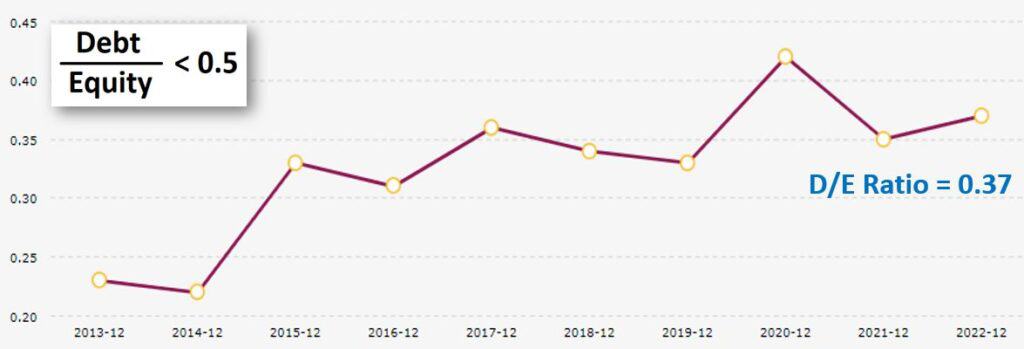

Hence, this led us to investigate the company’s debt situation where we will be looking into their debt-to-equity ratio.

Based on Value Investing Methodology, we want to see that the ratio is below 0.5, which means that for every $100 of equity that the company has, it cannot borrow more than $50 of debt.

Debt-to-Equity Ratio

Even though Intel’s debt-to-equity ratio is below 0.5, with the latest ratio in 2022 at 0.37, we observed a gentle increasing trend since 2015.

Although the financial metrics do not paint a rosy picture about Intel’s financial situation, we will have to take note that currently Intel is in a transition to improve the company’s productivity and technology prowess.

Thus, we will also need to consider Intel’s future growth as these metrics are just a quick glance of Intel’s financial situation, additional analysis is required for us to truly determine if Intel is still a good company to invest in.

CONCLUSION

To conclude, due to the share price plunge in early 2023, people have been speculating that Intel might have been past their prime time as the semiconductor technology leader and many had considered the semiconductor industry to be a sunset industry.

Nevertheless, with the exciting technologies such Artificial Intelligence, 5G and ChatGPT, these advanced technologies will require powerful semiconductor chips to work. Hence, semiconductor companies will still need to upgrade their process node technology to cater to the needs of these advanced technologies.

As Value Investors, this might be the ripe time for us to find great companies that are selling at a discount price to add into our portfolio.

Should you always want to learn a systematic way of analyzing a company to invest in, click on our banner above “MasterClass Registration” to find out more!

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.