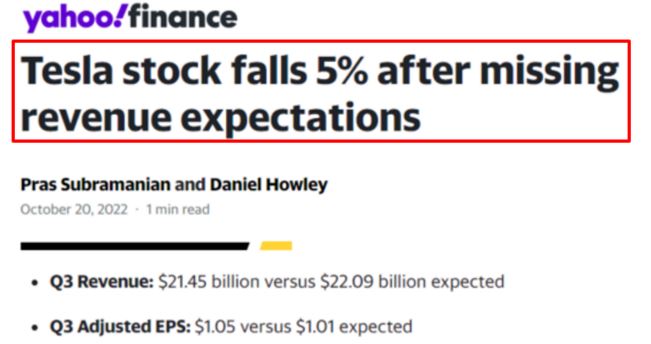

Tesla’s share price sank about 5% after missing Wall Street analysts’ expectations on their Q3 revenue but slightly beat on earnings.

In addition, Tesla slashing car prices in China has also triggered concern among investors that the sluggish sales in China market may exacerbate the bleak situation.

Various news channels and social media has been grabbing public’s attention, predicting the next price rally or plunge of Tesla’s shares based on the recent financial reports & Twitter’s acquisition drama. With the news fluctuating between rising or dropping in share price, investors are in dilemma to decide if now is a good time to invest in Tesla.

In this updated article on Tesla, we will find out more about the latest development of Tesla’s operation and their most recent financial numbers in 3rd quarter (Q3) of 2022.

We have also deep dive on Tesla and the electric vehicle (EV) industry. Click the links below to read more!

TESLA’S BACKGROUND

Tesla Inc. is an American multinational company that manufactures electric automotive, clean energy generation and storage products. The headquarter is now based in Austin, Texas where they shifted from Palo Alto, California in Dec 2021.

It was founded in 2003 by Martin Eberhard and Marc Tappening as Tesla Motors. In the subsequent year (2004), both founders brought in Elon Musk to invest in the company for about $6.5 million. In 2008, Musk replaced Eberhard to become the CEO of Tesla.

Tesla set up their first automotive manufacturing facility in Fremont, California in 2010 and became a public company in the same year, with ticker symbol TSLA on NASDAQ.

MANUFACTURING FACILITY LOCATION

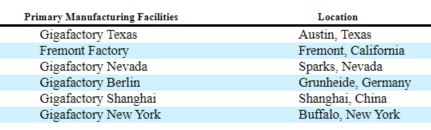

Currently, Tesla has 6 manufacturing facilities to produce electric automotives, energy generation & storage products in the following locations:

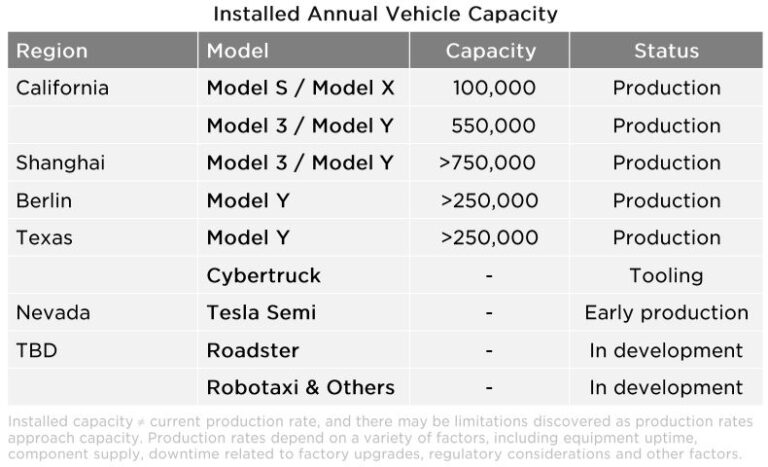

In their latest quarterly report (Q3 2022), they have updated investors on the vehicle production capacity in each manufacturing sites:

TESLA’S LATEST PRODUCTS & SERVICES (OCT 2022)

Tesla operates as two reportable business segments:

AUTOMOTIVE

Tesla is currently manufacturing 4 models of EVs –

- Model S

- Model 3

- Model X

- Model Y

Tesla’s current automotive lineup

Read more on Tesla’s car models in-depth analysis and explanation!

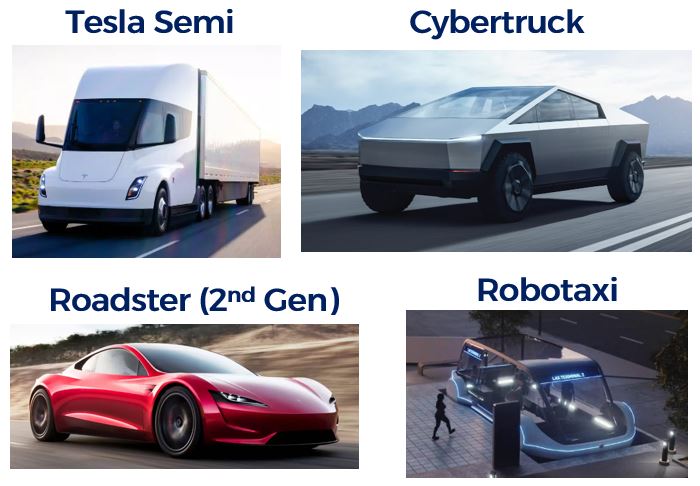

In the latest Q3 2022 report, Tesla has updated on their future vehicles’ production and development progress:

Tesla’s future vehicles

- Tesla Semi – In early production stage at Gigafactory Nevada. Expected to deliver first truck to Pepsi in December 2022.

- Cybertruck – In tooling stage at Gigafactory Texas.

- Roadster (2nd Generation) & Robotaxi – In development stage.

Tesla also offered other types of services to their customers, such as non-warranty after-sales vehicle services, sales of used vehicles and vehicle insurance.

Tesla vehicle insurance policy

ENERGY GENERATION & STORAGE

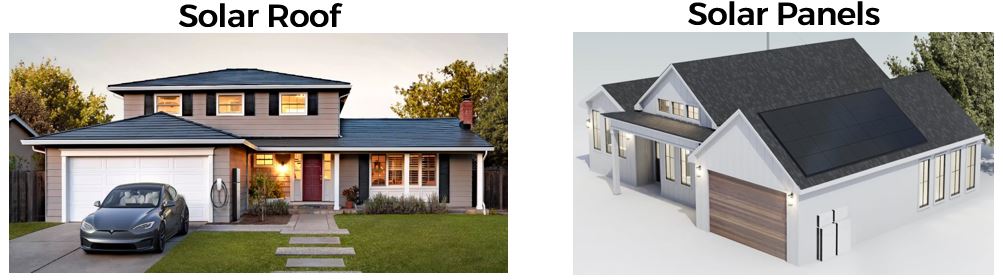

For energy generation products, Tesla is offering two types of products where the customers can generate energy from solar power.

Tesla’s energy generation products

- Solar roof – replace the whole roof with solar panels made from glass solar tiles that produce energy and steel tiles that add longevity & corrosion resistance.

- Solar panels – install solar panels on existing roof to harness solar energy to power home and electric cars.

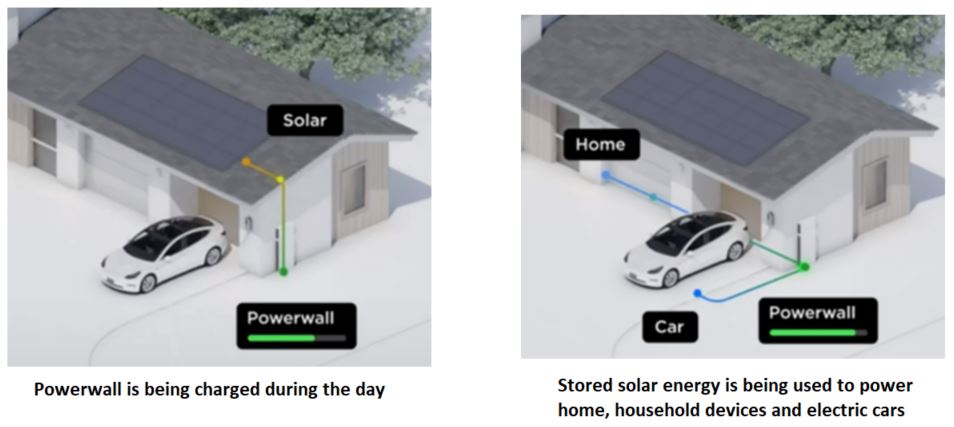

To store the harnessed solar energy for anytime usage, Tesla also offered Powerwall to be installed at homes as backup storage.

Powerwall

The diagram below shows how the Powerwall stores the harnessed solar energy during the day and being used to power electronic devices or EVs at home anytime.

Tesla also offered energy storage products for large scale energy storage at the grid, known as Megapack. Each unit of the Megapack can store over 3MWh of energy, which is equivalent to powering up about 3,600 homes for an hour.

Rows of Megapack

REVENUE GENERATION

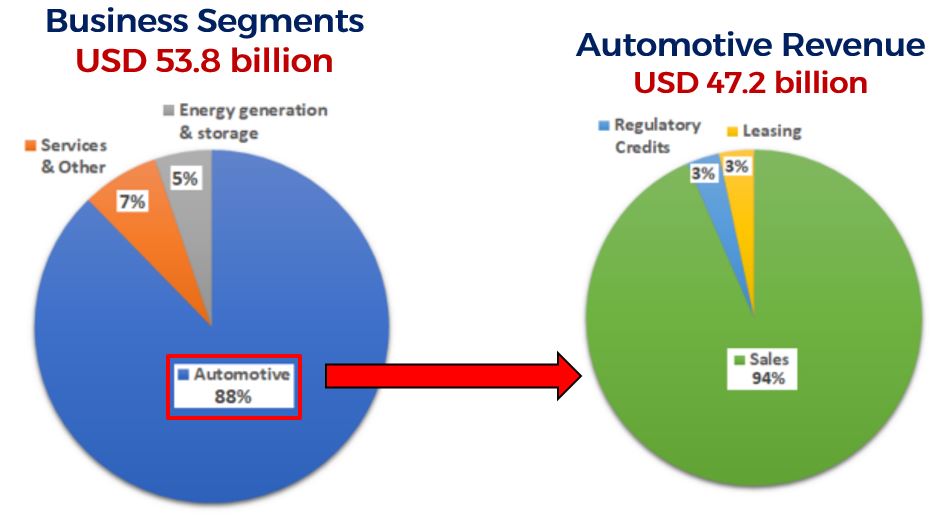

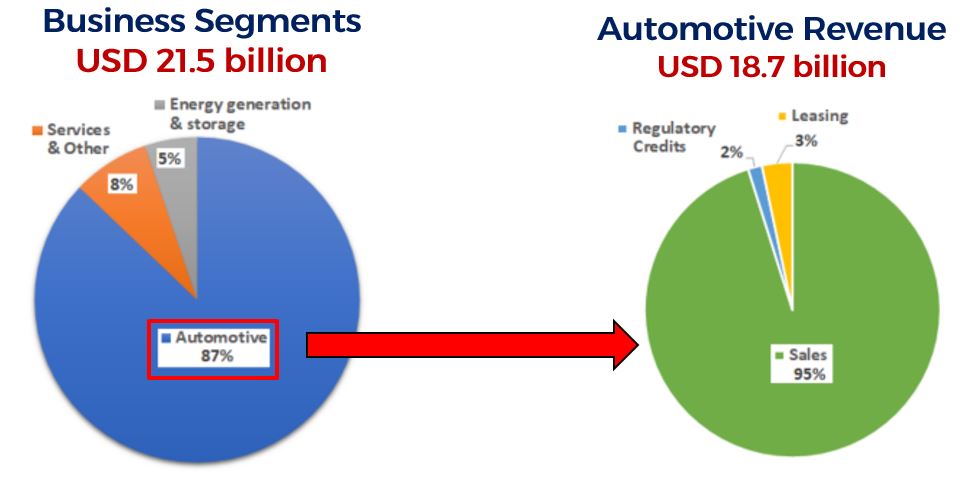

In 2021, Tesla has generated a total of USD 53.8 billion, with 88% of the revenue derived from Automotive segment, followed by Services & Other (7%) and Energy Generation & Storage segment (5%).

When we further breakdown the Automotive revenue, we found that 94% of the revenue came from automotive Sales. Revenue from Regulatory Credits sales and automotive Leasing each contributed 3% in 2021.

Tesla 2021 Annual Report

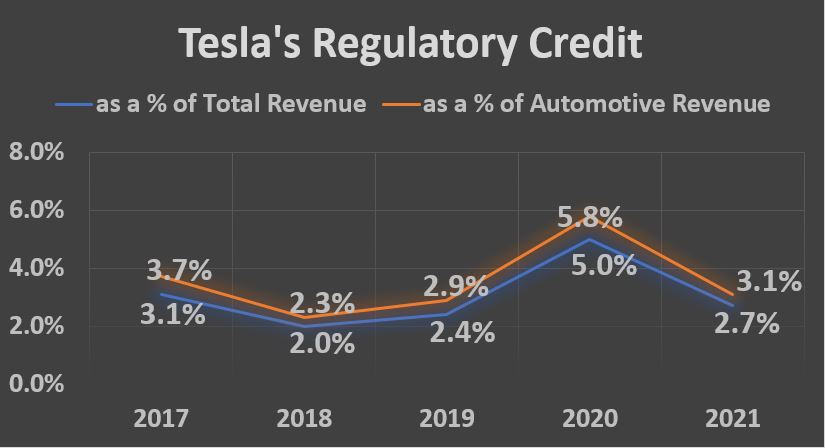

Regulatory credit is an incentive issued by governments to automakers who manufacture zero carbon emission vehicles. As Tesla only manufactures zero-emission electric vehicles, they are awarded the credit for free. In turn, Tesla can sell the credits to traditional automakers who can’t meet the government-mandated zero-emission vehicles sales target.

Regulatory credit selling

One of the well-known investors, Michael Burry has raised concern in Tesla selling regulatory credit to traditional automakers. He took a short position to bet against Tesla as he observed that Tesla is relying on selling the credits to boost their profit.

When we compare the regulatory credit as a percentage against the total revenue and automotive revenue, Tesla’s regulatory credit sales is currently below 5% in 2021.

Tesla’s annual reports

Even though Tesla may be perceived as selling regulatory credit to boost their bottom line (aka profit), most of the revenue generated in 2021 still comes from automotive sales as per shown in the 2021 revenue pie chart above.

Tesla 2021 Annual Report

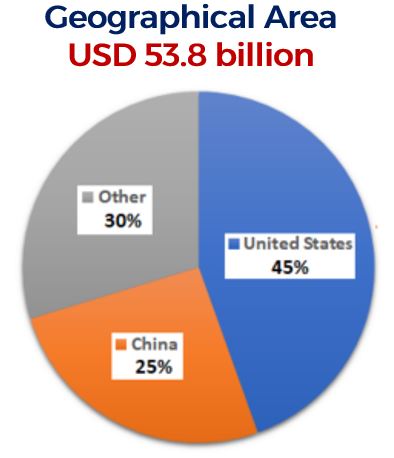

For geographical area, most of the revenue in 2021 came from the United States (45%), then followed by China (25%) and other countries (30%).

When Tesla announced to cut down the car pricing in China, the share price slipped as much as 7% when the news was released. As China is Tesla’s second largest market for their EV sales, a drop in the car price may be perceived by the investors that it may also lead to a drop in their future revenue.

In their latest Q3 2022 financial report, a total of USD 21.5 billion was generated, with 87% of the revenue came from Automotive, 8% from Services & Other and 5% from Energy Generation & Storage.

Tesla Q3 2022 Quarterly Report

From the latest quarter report, most of the automotive revenue came from automotive Sales. Automotive Leasing still generated about 3% of the revenue and we found that the Regulatory Credits sales dropped to 2% for Q3 2022.

TESLA FINANCIALS

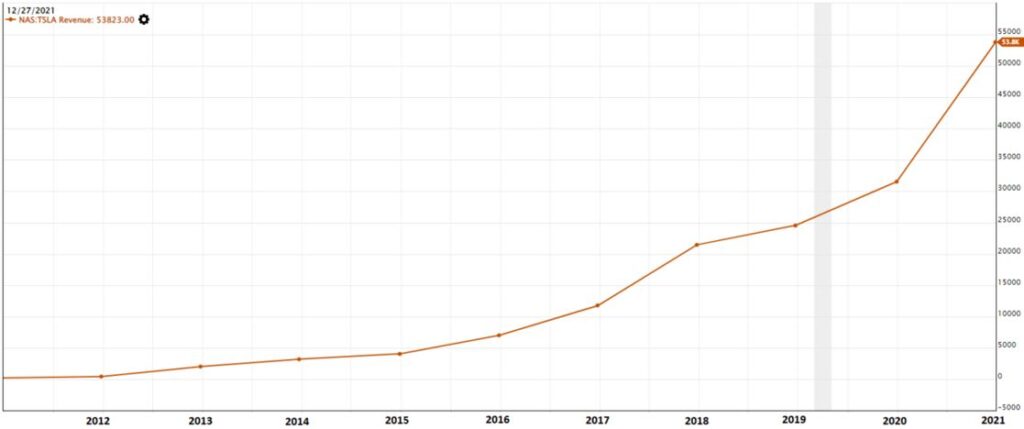

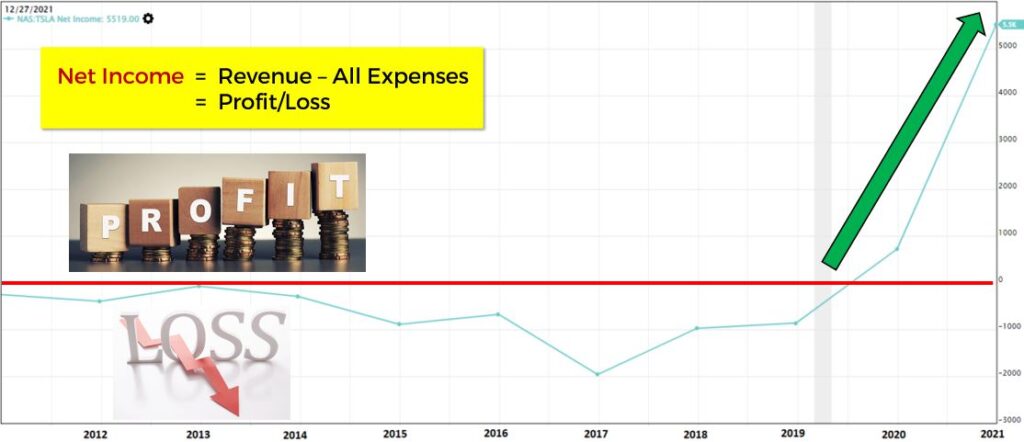

In this segment, we will deep dive into Tesla’s latest financials (2012-2021) to determine if the fundamentals are still good and profitable for us as investors to invest our money in this company long-term.

Tesla’s Revenue is still on an upward trend for the past 10 years and a sharp increment was observed in 2021. Based on Value Investing Philosophy, this is a good sign that the company can generate sales from their business operations.

For their Net Income, even though Tesla was having losses from 2012 to 2019, they are starting to make profit in 2020. In 2021, their net income also spiked up from USD 721 million to USD 5.52 billion, about 665% increment!

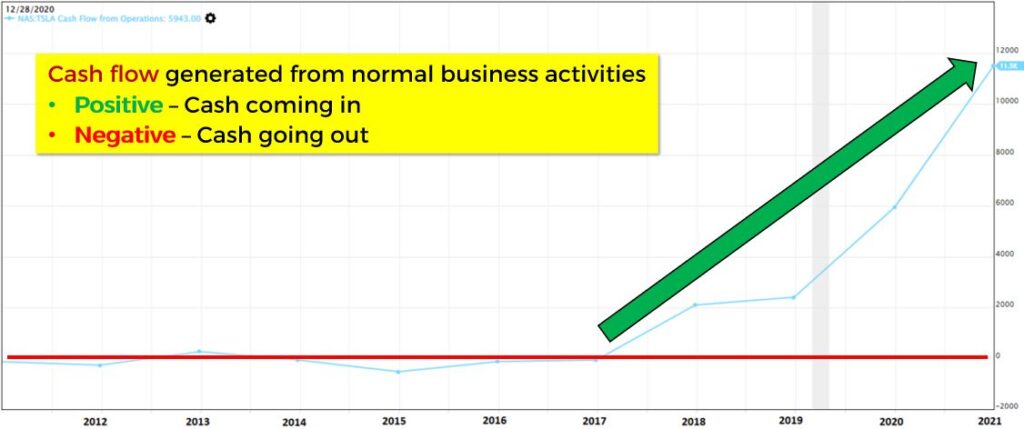

For their Operating Cash Flow, which is the cash flow generated from their day-to-day business activities, we observed that since 2018, the company were generating inflow of cash (positive cash flow) from their business operations.

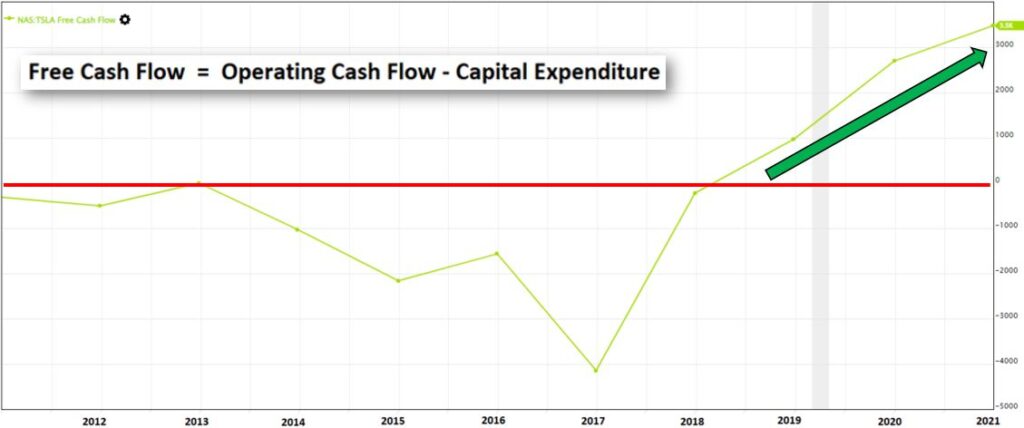

Free Cash Flow is referring to the cash available for the company to use after deducting the Capital Expenditure (CapEx) from their Operating Cash Flow. CapEx is the expenses used to purchase assets that will last for more than 12 months.

Between 2012 to 2018, the company’s free cash flow is at negative value, which means that the company do not have any free cash available during that period. Nevertheless, Tesla can generate positive free cash flow starting 2019 and the upward trend continued in 2020 and 2021.

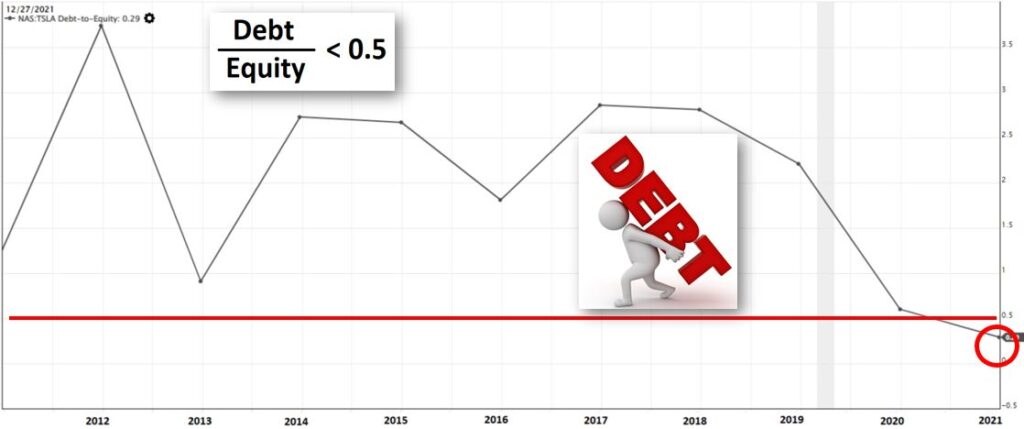

During 2012-2019, we observed that Tesla is not profitable or at a loss from their Net Income data. As such, we looked at the Debt/Equity (D/E) ratio to determine if Tesla had taken on any debt to keep the business running.

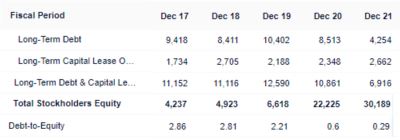

Based on Value Investing Methodology, a company’s D/E ratio should not be more than 0.5, which means that for every $100 of equity, a company cannot take more than $50 of debt. From 2012-2020, Tesla’s D/E ratio is more than 0.5, but the ratio managed to go down to 0.29 in 2021. To better understand how the D/E ratio managed to go below 0.5 in 2021, we investigated Tesla’s 2021 annual report.

Gurufocus

From the report, their Long-Term Debt has been decreasing since 2019 but the long-term Capital Lease Obligations were slowly increasing since 2015 and maintained around USD 2+ billion between 2018-2021. Capital lease obligations are instalment payments for Tesla’s long-term asset lease agreements, such as offices, manufacturing and warehouse facilities. When both long-term debt and capital lease obligations added up together, the total debt amount was decreasing since 2019.

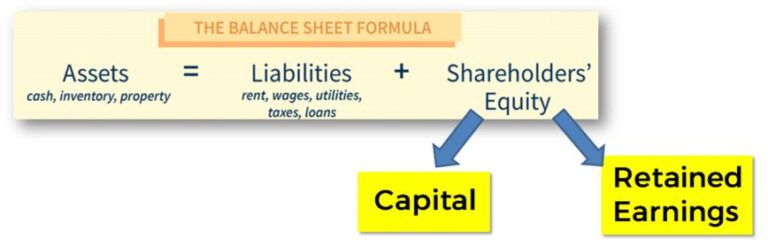

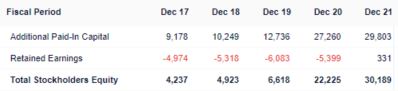

The other part of the D/E ratio equation is Equity, which we checked on Tesla’s Stockholders’ Equity or Shareholders’ Equity. Shareholders’ equity is mainly made up of Capital (where investors invest money into the business) and Retained Earnings (accumulation of income the company has earned from their business operations).

The shareholders’ equity has been increasing since 2017 as they are able to acquire more capital from investors or Tesla’s owners. However, the company was not able to accumulate earnings between 2017-2020. The retained earnings only became positive in 2021.

Gurufocus

As a result, the D/E ratio was decreasing from 2.86 (2017) to 0.29 (2021) due to decreasing debt and increasing equity for the past 5 years.

CONCLUSION

Although Tesla’s was profitable for the past 1-2 years based on their latest financials and has exciting future products lineup, will the company keep up with their financial performance in near future is anyone’s best guess, especially during these turmoil period of rising inflation and looming recession worldwide.

Should investors be interested to invest in Tesla, future due diligence and research into the company is a must to avoid losing their hard-earned money.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.