During the highly anticipated WWDC event, Apple unveiled their revolutionary product, the Apple Vision Pro goggles, but saw a slight dip in share price post-release. In contrast, Unity Software, a leading 3D development company, experienced a remarkable 17% increase in their share price.

What has led to the share price increment for Unity Software?

We will delve into the reasons behind the rise in Unity Software’s share price in this article. Considering the significant role of 3D in the AI field recently, Unity will also be assessed if it is a favorable 3D development company for investment.

Additionally, we have also investigated another 3D software development company, other than Unity Software, that could benefit from this trend and present a good investment opportunity.

Click on the video below to find out!

UNITY'S QUALITATITIVE ANALYSIS

Being the world’s leading platform for real-time 3D content creation, Unity Software empowers creators to develop, build, and monetize interactive content.

With a range of tools and services, the platform facilitates the creation of interactive 2D and 3D experiences, along with AR and VR engines. While extensively used in the gaming industry, Unity Software’s reach now extends to various other sectors.

Unity, originally founded in Denmark in 2004 as a game development company, later rebranded to offer game development tools to other companies. Their software proved valuable for game developers to create their own games.

The company’s current headquarters are now in San Francisco, USA. They launched their IPO in August 2020 with the ticker symbol U on NYSE.

Products & Software Solutions

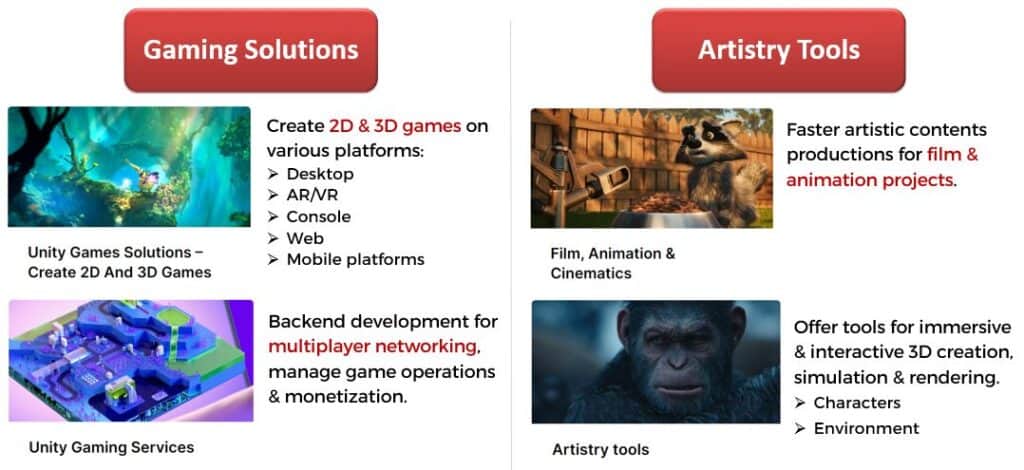

Unity’s products are classified into three main categories, catering to diverse content creators:

- Gaming Solutions

- Artistry Tools

- Industry Tools

UNITY'S FUTURE PLAN

In this section, we will delve into Unity’s strategic initiatives aimed at further expanding and strengthening the company’s growth.

Partnership With Apple

In the earlier part, we saw that Unity’s share price rose 17% when Apple launched their latest revolutionary products – Apple Vision Pro. This is because the company is partnering with Apple to create and develop 3D apps for the Vision Pro goggles.

Apple revealed its collaboration with Unity to develop gaming software apps for their new VR headset, while also fostering a third-party ecosystem of apps for the headset.

Upon the release of this positive news, investors are optimistic about Unity’s future performance, leading to an increase in the share price following the partnership announcement.

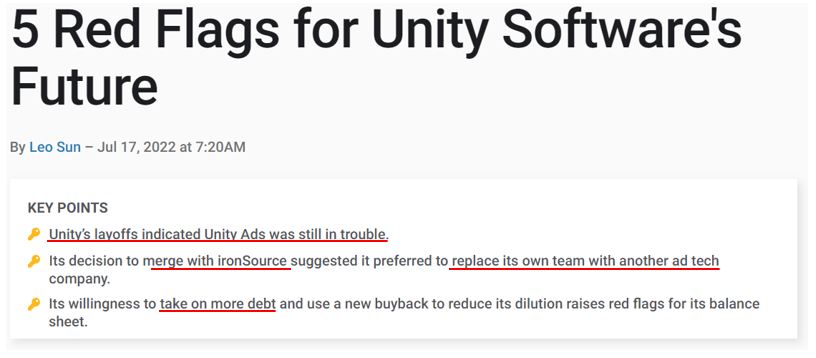

Acquisition on IronSource

Furthermore, Unity acquired IronSource, a global technology company specializing in mobile app monetization and marketing. This acquisition is expected to enhance Unity’s revenue generation for their created apps.

While acquiring a new company to bolster revenue growth is seen as a positive move, investors have expressed concern over recent news of Unity laying off 600 employees before the acquisition. The layoff of 600 employees accounted for 8% of Unity’s total workforce.

Source: Motley Fool

Among the 600 employees being laid off, about 200 of them belong in the AI & engineering department where they are involved in advertising algorithms.

The decision to lay off existing employees before the acquisition has left many questioning whether Unity is encountering challenges in converting sales from the apps they have created.

Unity’s future plan includes a partnership with Apple for VR gaming software and the acquisition of IronSource to boost revenue generation, highlighting the company’s dedication to expansion and innovation in real-time 3D content creation. These strategic moves position Unity to capitalize on new opportunities and solidify its position as a leader in the industry.

UNITY'S QUANTITATIVE ANALYSIS

Revenue Generation

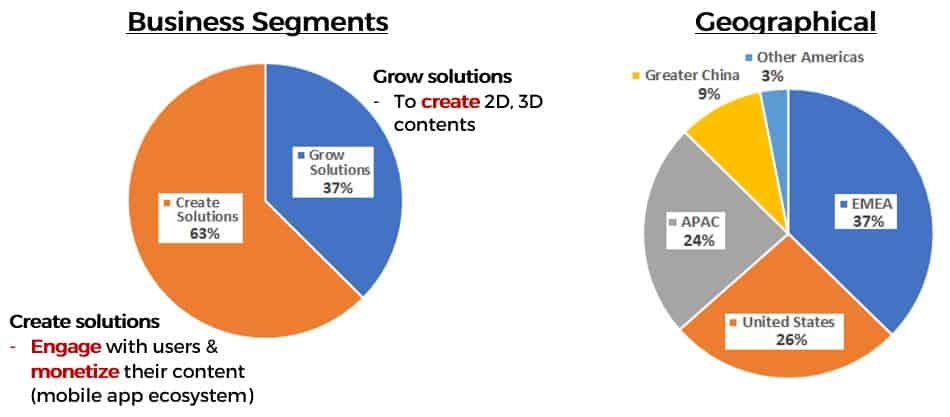

Unity’s revenue model centers on software licensing, subscription plans, and in-app purchases within the platform. They have categorized their business operating segments into two distinct categories:

- Grow Solutions: Offer tools for the creation of high definition, real-time 2D and 3D interactive contents.

- Create Solutions: Offer customers the ability to grow and engage their user base and monetize their content via mobile app ecosystem with analytical & optimization tools.

In their latest quarterly result for Q1 2023, they achieved a total revenue of USD 500 million.

In terms of geographical revenue, majority of the revenue (37%) was generated from EMEA, followed by the U.S. (26%), Asia-Pacific region (APAC; 24%), Greater of China (9%) and Other Americas (3%)

Financial Analysis

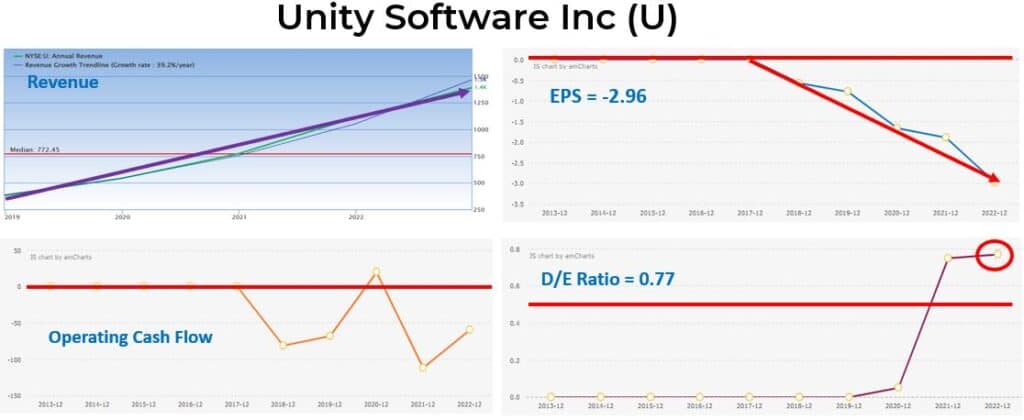

Let’s conduct a brief analysis of Unity’s financial statement to assess their performance and determine if further exploration of the company is warranted for a more in-depth evaluation.

We will examine 4 financial metrics:

- Revenue: How effectively the company generates sales for its products and services.

- Earnings Per Share (EPS): Indicates the earnings or net income that an investor can expect to receive for every share that they own.

- Operating Cash Flow: Measures the cash flow generated from the company’s business operations.

- Positive cash flow indicates the company is able to generate cash.

- Negative cash flow means the company is spending more cash than it generates to run its operations.

- Debt-to-Equity (D/E) Ratio: Evaluates the company’s long-term debt.

- According to the Value Investing Methodology, a ratio below 0.5 suggests that the company is effectively managing its debt level.

After a brief review of the 4 financial metrics, it is evident that Unity’s revenue has been growing annually. However, the other 3 metrics indicate financial challenges, with losses and limited cash flow, coupled with a debt level above 0.5.

Investors intrigued by Unity’s potential as app developers for Apple’s Vision Pro headset should conduct further investigations before making investment decisions.

We have covered one more 3D software development company on our Deep Dive video! Click on our YouTube channel to find out!

CONCLUSION

In conclusion, Unity’s leading position in real-time 3D content creation and its partnerships with Apple and IronSource indicate a commitment to expansion and innovation.

Although Unity offers exciting prospects in the ever-evolving world of 3D technologies, prudent analysis is vital to make informed investment choices. Investors should be cautious, considering the financial challenges Unity faces, including losses and limited cash flow.

As with any investment decision, thorough research and consideration of financial metrics, revenue models, and growth strategies are essential.

If you have always wanted to learn how to invest and grow your money by evaluating other potential companies, join us in our upcoming Masterclass where you will learn from Cayden on how to:

- Generate 3 Sources of Passive Income even if you know Nothing about investing.

- Invest with minimal capital.

- Create a Cash Dispensing Machine to replace your existing salary.

Click on the banner below to find out more!

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.