Value Investing was not a popular investing methodology in Singapore many years back and it’s only about 3 – 4 years ago when it becomes a topic people talk about. If you want to know more about what is value investing and how to do value investing in Singapore, you can read some of our part articles at the following links:

Through our flagship value investing course, called Value Investing Programme (VIP) which is conducted across 11 cities in Asia, we have trained thousands of people who ranges from someone who has zero experience in investing to experienced investors who have lost tons of money. So is Value Investing suitable for you?

First, we need to appreciate that there are many schools of value investing. Using martial arts as an analogy, there are many schools of martial arts. It can be Karate, Tae Kwon Do, Wing Chun, etc. Even though there are many different forms of martial arts, they can be broadly classified into Martial Arts. Same thing for Value Investing. There are different styles of Value Investing, and I am sure there will be at least one style that will fit your needs.

1) VALUE INVESTING INCOME INVESTOR

This group tends to be very busy and do not have much time to do analytical work. They may also be more senior (More than 50 years old) and prefer to have a stable income generating machine without worrying too much about movement of stock prices. It’s like an investor owning a property and he just wants to collect the rental regularly every month without much worry. Then one way of using value investing is to invest in REITS (Real Estate Investment Trusts). Just dividends alone, the return can range from 5% – 9%. What I like about investing in REITS as compared to traditional hard properties are as follows:

(i) ROI – ROI from investing in REITS (5% – 9%/year) in Singapore is definitely much higher than that of investing in properties in Singapore (Around 3%/year)

(ii) Income not taxable – Income collected from REITs either from capital appreciation or dividends are not taxable whereas rental collected from properties in Singapore are taxable

(iii) Low capital – To invest in REITS, your start up capital can be as low as a few hundred dollars but for investing in properties, you will need hundreds of thousands of dollars. If you do not have enough cash, you will still have to take a huge loan from bank which will in turn incur interests. In addition, you will also have to wait for the property to be fully constructed which will take years, and take more months to rent out by paying commissions to real estate agents. There is a lot more risk and uncertainty in investing in properties versus using value investing to invest in REITS

(iv) High Liquidity – Investing in REITs is highly liquid because REITs are examples of stocks which can be bought or sold via your broker with just a click away. But for properties, you have pay the real estate agents commission to help you sell away the property which may take weeks to months

(v) No worry about Tenants – Investing in REITs has lesser worry about managing your tenants as compared to investing in a property. I have friends who constantly worry that their tenant will spoil or dirty their new house when the house is rented out.

Overall, through our value investing course, Value Investing Programme (VIP) in Singapore, you can learn the basics of how you can get started to invest in REITS.

2) VALUE INVESTING GROWTH INVESTOR

This group of investors is typically young to middle-aged and has sufficient time to conduct analysis to search for fast growth stocks. A fast growth stock has an earnings growth rate of 20% per year or more. Fast growth companies tend to be small-cap and pay little or no dividend because they need more money to grow.

However, small companies tend to have higher risks than much bigger companies that are growing slowly and steadily, such as McDonald’s.

This style of investing is predominantly Warren Buffett’s style of value investing. In an interview, he said that he likes to invest in two types of companies: the first type being companies that have a high rate of returns on tangible assets that grow, and the second type being companies that have a high rate of returns but do not grow.

As long as it’s a great company purchased at a discount, investors can still do well. If you want to know more about investing in Fast Growth companies, you can register for our Free Investing Course in Singapore by clicking HERE!

3) VALUE INVESTING DEEP VALUE INVESTOR

This kind of investors love diversification. They cannot stand putting all their money in a concentrated portfolio. They have this belief that the more diversified their portfolio is, the safer they are. Then, value investing using the Benjamin Graham and Walter Schloss style might be of interest to you. Predominantly, such styles of value investing will involve some of the following:

(i) Buying stocks below their Working Capital – It means taking the current assets of the balance and deduct its total liabilities. Whatever that is left, divide it by the total outstanding shares, so that you know how much the stock is worth. This number is known as Working Capital or sometimes known as Net-Net. But such stocks are difficult to find these days and even if you have found some, you need to be mentally prepared that such companies are usually have some challenges. This is why the stock is cheap and we need to have wide diversification to protect the downside risk.

4) VALUE INVESTING AUTO-PILOT INVESTOR

This is the simplest, laziest way and low risk method to make money in using Value Investing in Singapore stocks or US stocks. The trick is simply to invest in a low cost index fund, also known as ETFs (Exchange Traded Funds).

Every few months, we will conduct a value investing course known as Auto-Pilot Investing Workshop where we teach people how to set up a simple auto-pilot system to invest in a basket of stocks.

However, do note that not all ETFs are created equal. My favourite ETFs are a few selected types of S&P 500 ETFs such as VOO (Vanguard 500 Index Fund), RSP (Guggenheim S&P 500 Equal Weight ETF) and MOAT (VanEck Vectors Morningstar Wide Moat ETF).

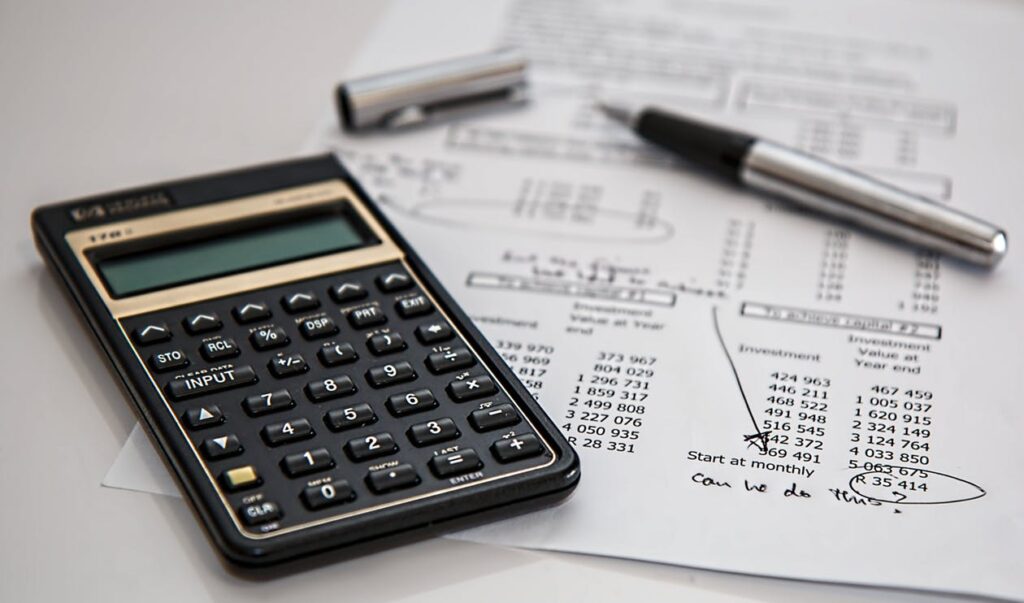

Based on Berkshire Hathaway’s latest letter to its shareholders, S&P 500 has given an average annual return of 9.7% since 1965 which means that if you have invested $10,000 in 1965, you would have about $1.3 million today. That’s a lot of money for doing little.

There are more styles of using value investing in Singapore or any other parts of the world but the 4 styles can form a basic foundation of what types of value investing are there and which types suit you best.

Disclosure

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.