In this blog, we will deep dive into Tyson Foods, a company in the consumer staples industry that is widely considered as recession-proof and to explore investment potential during the recession.

With the economy showing signs of recovery after Covid-19 pandemic episode, people are jubilantly looking forward to the good old days prior to the pandemic. Nevertheless, financial experts and market leaders have been starting to sound the warning bell of inflation and possibly, a recession.

The forecasted global downturn was due to a few incidents that triggered all the doom and gloom news: Russia’s invasion of Ukraine, China’ crippling lockdown to impose zero-tolerance for Covid-19, and major banks worldwide are imposing tighter monetary policy to fight against inflation. All these incidents have further deteriorated the global economic environment which had yet recovered from the battered experience of the pandemic.

As investors, we are still wondering if there is a good company that is recession-proof for us to invest in these peril times and earn extra source of income.

In this article, we will explore a company that produce daily essentials that everyone needs – FOOD.

TYSON FOODS COMPANY BACKGROUND

Tyson Foods, Inc (NYSE: TSN) is one of the world’s largest food companies and largest US marketers of protein products. The company produced and marketed approximately 20% of beef, pork, and chicken within the US in 2021.

Tyson Foods offered a broad portfolio of products and various well-known brands. The protein products were sold to retail grocers, foodservice distributors, national fast-food and restaurant chains.

Tyson Foods was established by John W. Tyson in 1935 where he first started off in buying and selling chickens in the Midwest. As food demand surged during World War II, Tyson Foods started to raise chickens to meet the demands and the company expanded significantly after the war.

Tyson Foods Founder – John W. Tyson

In 2001, Tyson foods acquired IBP, Inc., a meat packing company from South Dakota, US and started to offer beef & pork products. Tyson Foods further expanded their product portfolio – prepared foods by acquiring Hillshire Brands (2014) and AdvancePierre Foods (2017).

Prepared Foods product range

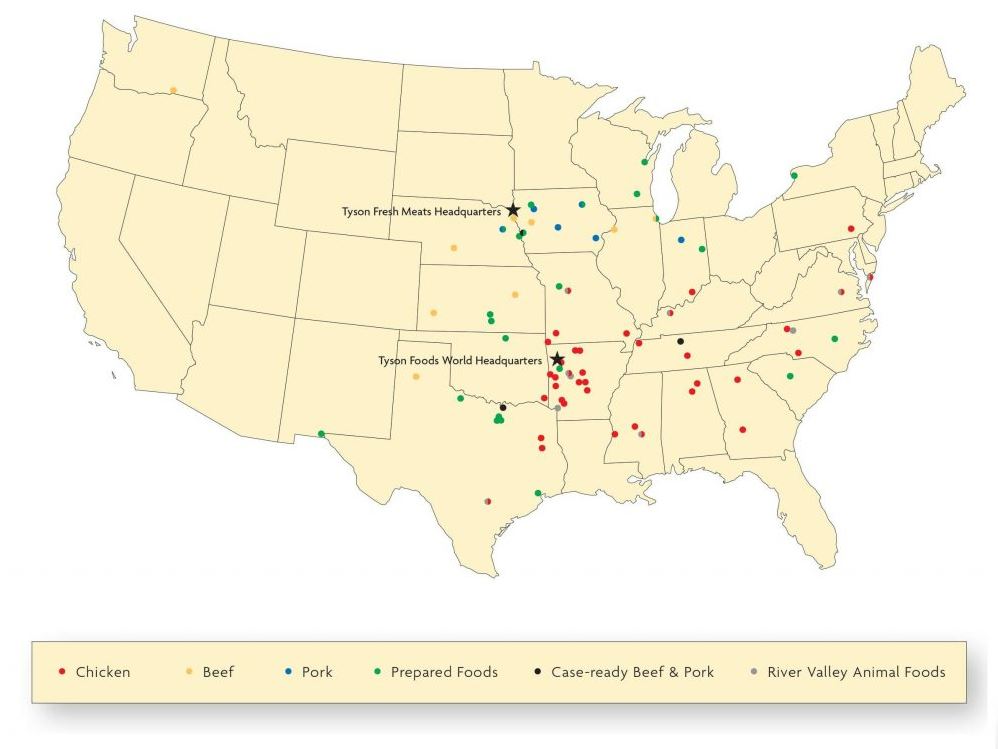

The company’s headquarters is based in Springdale, Arkansas, US. It currently owns 123 food processing plants, slaughter plants and meat packing facilities. The plant locations are mostly located in the Midwest and South of the US (16 in Arkansas, 11 in Texas and 9 in Iowa). Tyson do not own breeding farms of the livestock – cattle, hogs & chicken, but cooperate and source the livestock from 11,000+ independent farms.

Tyson also has international production operations in the following countries: Australia, China, India, Malaysia, Mexico, South Korea, Thailand, and the Netherlands to supply local protein source besides exporting US protein products to other 140 international markets.

WHAT PRODUCTS DO TYSON FOODS MANUFACTURED?

Tyson Foods offered four main protein products – Beef, Pork, Chicken & Prepared Foods.

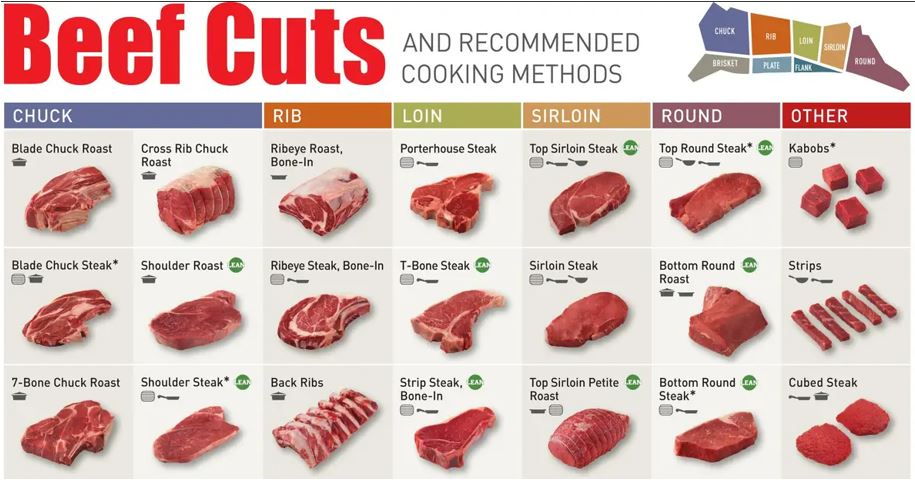

1. PRIMAL MEAT CUTS

First cut of the beef and pork carcasses into 8 or more parts.

2. SUB-PRIMAL MEAT CUTS

Primal meat cuts that are further divided into smaller pieces.

3. CASE READY PRODUCTS

Meat products that are being processed and packaged.

For chicken products, Tyson Foods produced their own chicken feeds (corn & soybean) and work closely with farmers to raise chickens that meet their standards. The chickens are then processed into:

1. FRESH PRODUCTS

2. FROZEN PRODUCTS

3. VALUE-ADDED CHICKEN PRODUCTS

Processed chicken into nuggets, breaded chicken strips, stuffed chicken breasts, etc.

Tyson Foods also manufactures frozen & refrigerated products and markets under Prepared Foods segments. The range of products include:

- Sausages, hot dogs, and corn dogs

- Breakfast sausages

- Bacons

- Turkey / ham

- Pepperoni

- Ready-to-eat sandwiches & sandwich components (i.e. lunch meat)

- Flour & tortilla products

- Breadsticks & pizza dough

HOW DOES TYSON FOODS DISTRIBUTE THEIR PRODUCTS?

The protein products are being marketed and distributed via four different channels to their customers.

HOW DOES TYSON FOODS GENERATE REVENUE?

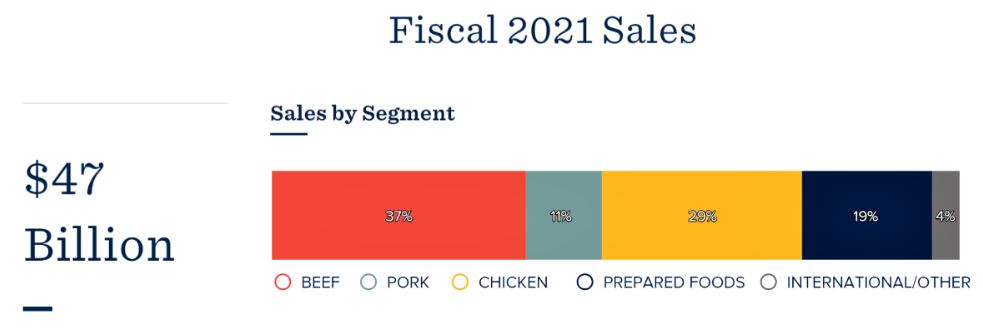

In FY 2021, Tyson Foods has generated a total of $47.0 billion in revenue.

Tyson Foods Website

Within US domestic sales, Beef contributed the largest portion of sales (37%), followed by Chicken (29%), Prepared Foods (19%), and Pork (11%). International sales made up of 4% of the total revenue in 2021. International/Other refers to local sales in foreign countries, such as Australia, China, Malaysia, Mexico, South Korea, Thailand, and the Netherlands that has production sites.

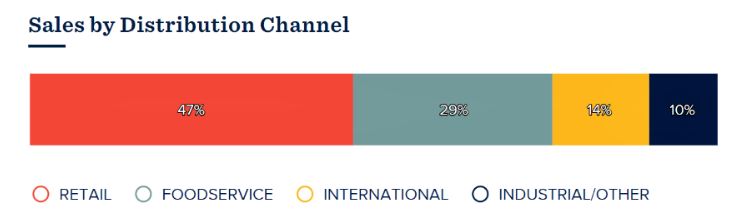

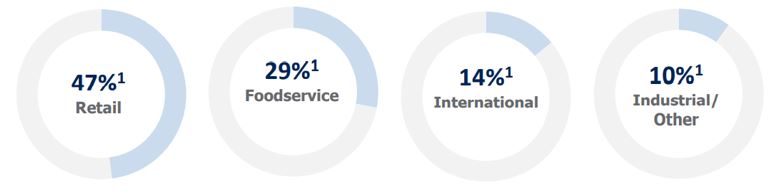

The breakdown of sales by distribution channel was reported in four channels as shown in the chart below.

Tyson Foods Website

Retail sales contributed the biggest portion in 2021, approximately 47%. Next is Foodservice (29%), International (14%) and Industrial/Other (10%). International distribution channel is inclusive of both export sales to international markets and local production sales.

After going through the background and the revenue generations of Tyson Foods, the company has been expanding and growing their product portfolios. But do we really know if Tyson Foods is a good and valuable company to invest in during the recession?

PLANS FOR FUTURE GROWTH

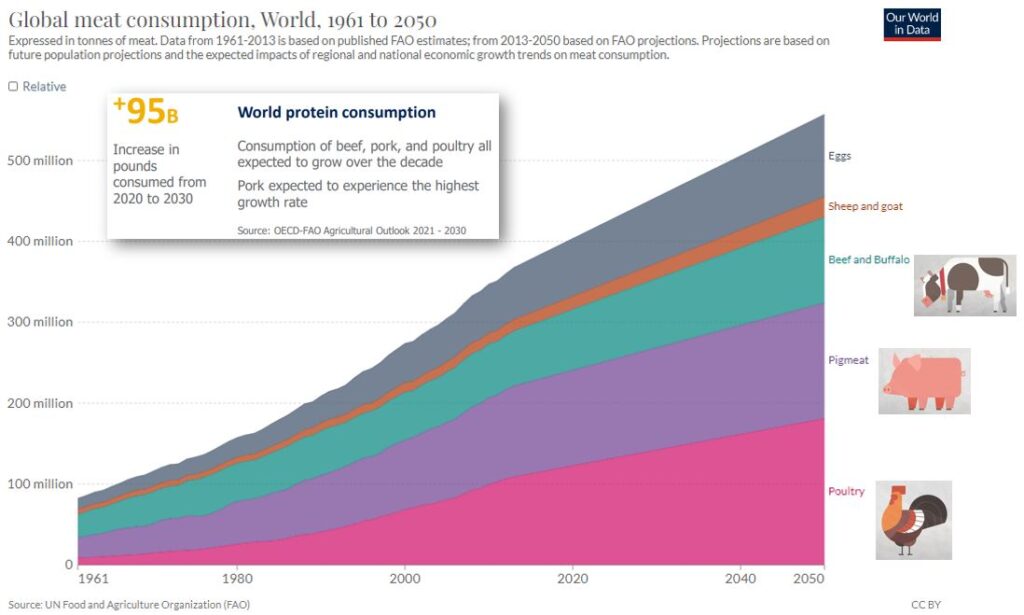

UN Food and Agriculture Organization (FAO) published an estimated projection of global meat consumption from 1961 to 2050, indicating that the consumption of protein products is expected to grow, especially for poultry and pork.

As a result of this projection, Tyson Foods has made future plans and strategize to strengthen their position as global protein leader. One of the strategies is to expand the current facilities and they expect to open 12 new plants worldwide in the next 2 years.

Other than meat products, there has been a trend of increasing demand for plant-based proteins as consumers are prioritizing on health, wellness and buying products that align with specific diets (flexitarian, vegan), and lifestyles.

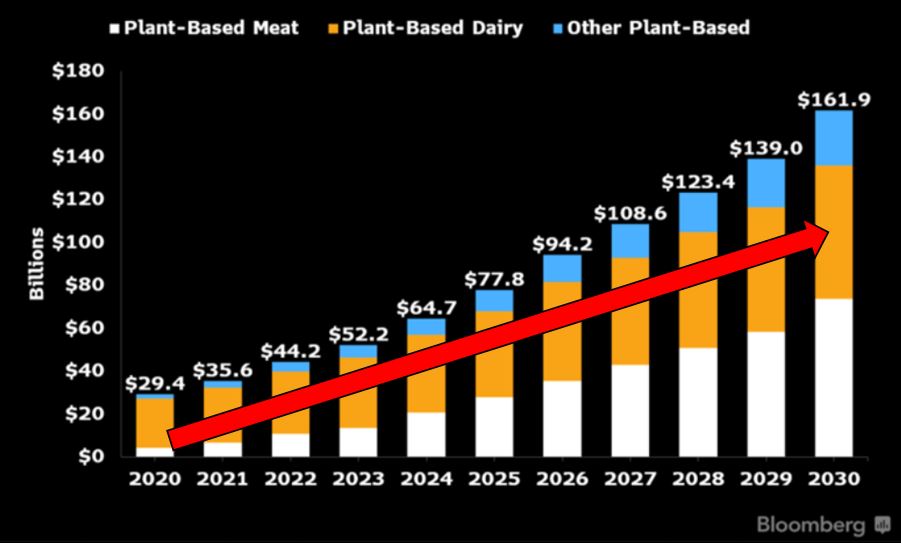

Bloomberg has also reported that the sales of plant-based protein market is projected to increase from $29.4 billion (2020) to $161.9 billion (2030), approximately 451% increment for the decade.

To cater for the growing demand for plant-based protein, Tyson Foods has launched their own brand – Raised & Rooted, plant-based protein made from pea protein isolate and golden flaxseed.

To drive further operational and functional excellence, Tyson Foods has launched initiatives to increase their productivity savings and expand the operation margins by introducing digital solutions and automation into their operations.

They are utilizing new digital solutions such as artificial intelligence and predictive analytics to increase efficiency in operations, supply chain planning, logistics and warehousing. They also modernize and automate key production systems and manual plant operations by leveraging on automatic and robotics technologies.

WHO ARE TYSON FOODS’ COMPETITORS?

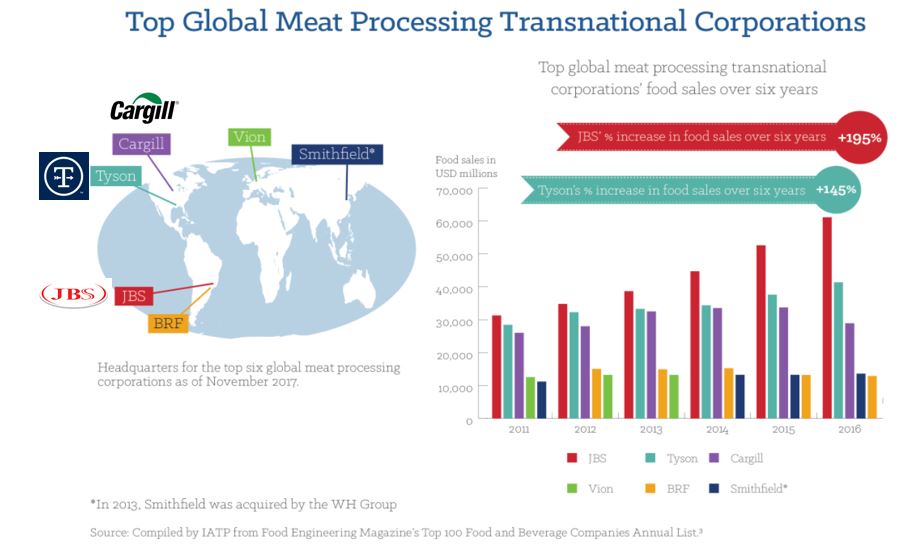

Besides Tyson Foods, there are other meat processing companies that produce and market protein products to the consumers. The diagram below shows the top global meat processing transnational companies in 2017.

From 2011 to 2016, JBS S.A. has been the top seller of meat processing company and the sales have soared about 195%. Tyson Foods ranked second during that period and the sales have also been increasing about 145%.

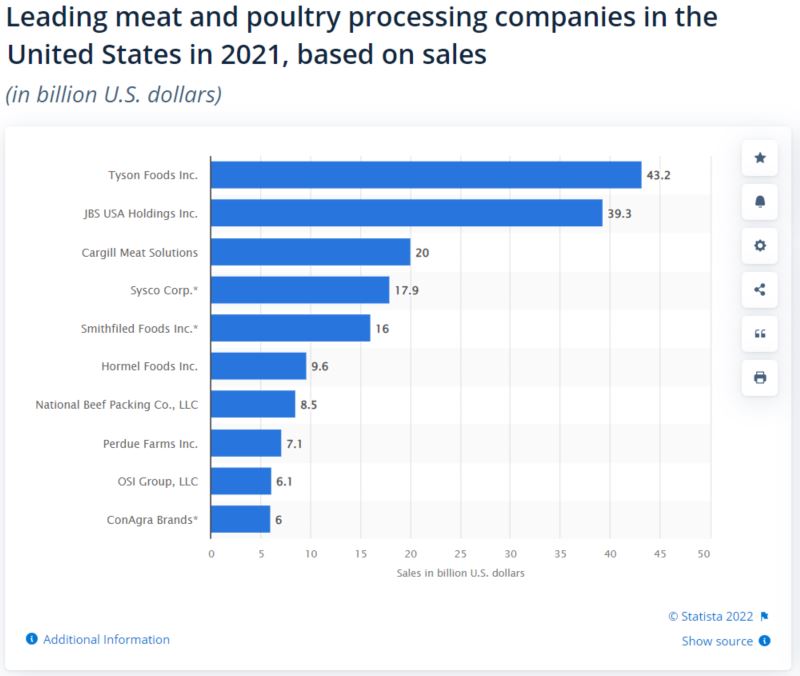

In the latest figure of food sales within the US for the meat processing companies, Tyson Foods came in first place which recorded about USD 43.2 billion as reported by Statista. Second place was hold by JBS USA Holdings (USD 39.3 billion) and Cargill Meat Solutions took the third place (USD 20 billion).

WHAT ECONOMIC MOAT DO TYSON FOODS HAS?

To maintain their global protein leader position, Tyson Foods has a few economic moats to strengthen their competitive advantages.

The first moat is that they have a wide distribution network that can deliver products to various customers both locally in the US and 140 international markets as shown in the diagram below:

Distribution channels (Sales in 2021)

Moreover, they also have a broad product portfolio, with brands that customer loved and trusted which caters to different customers’ palates, diets and preferences.

The company also applied patents for their processes of meat packing and products to maintain and reinforce their competitive advantages against their competitors.

With the growing population and demand for protein products, Tyson Foods has made strategic plans to expand the company and strengthen their position as the global protein leader!

Nevertheless, it is also important for us to understand the company’s financial statements to better analyze the company and determine if it is a good company to invest our money. But alas, the financial terms and jargons might be too difficult and scary for a non-financial background person to understand and make an informed decision on the company’s financial situation.

FINANCIALS EVALUATION

We will now investigate into Tyson Foods’ financial number to determine if the company is a good and profitable company. We would like to know if the company is generating income (profitability) and have any underlying issue with their cash flow or in high debt to fund the company’s growth.

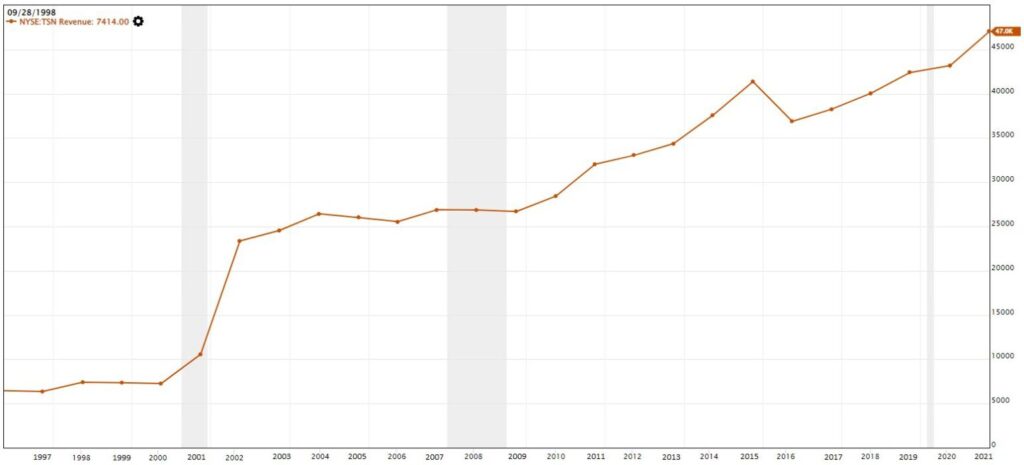

The total revenue generated by Tyson Foods has been increasing year over year. In addition, there was no sign of the revenue being severely affected during the 2001 dot.com bubble burst and 2008-2009 financial crisis. This implies that even though the economic environment had been rocky during that period, food is an essential daily expenses as people still need food to eat.

The sharp increase of total revenue in 2002 and 2015 were due to acquisition of IBP and Hillshire that further expanded the company’s product portfolio and strengthened the company’s position as the global leader in protein products.

Now we will look into the profit that Tyson Foods had generated throughout the years – Net income. Net income is defined as the profit or loss that a company generated after deducting all expenses from their total revenue.

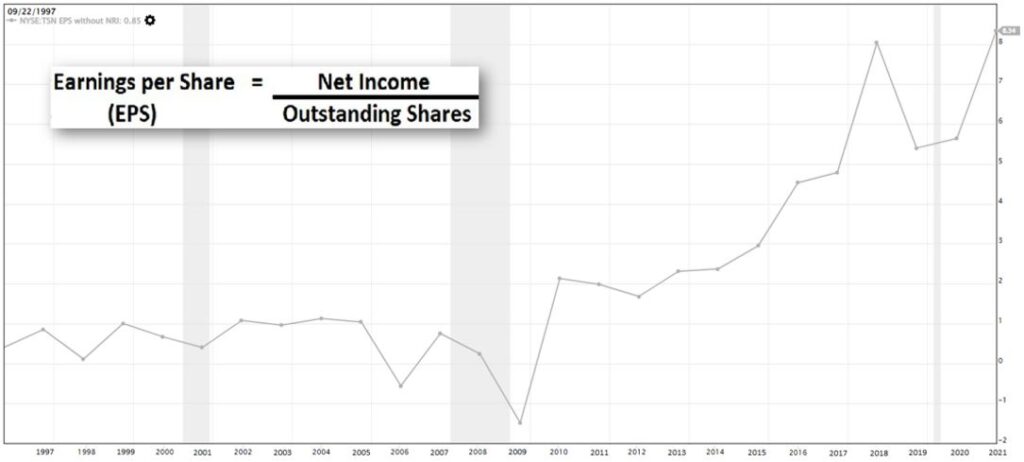

From the chart, we noticed that there were two years (2006 & 2009) where Tyson Foods had experienced losses. Further investigation revealed that in 2006, there was avian influenza in Asia and mad cow disease which disrupted the US domestic sales and international export sales, causing the net income to be in the red zone. In 2009, high grain cost for chicken feeds and the disruption in the global financial market had led the company to put in non-cash goodwill impairment for the beef segment which caused a drastic drop in net income for Tyson Foods that year.

In 2018, the sudden spike in net income was because of tax rebate for that year. The sharp increase in profit for 2021 was due to increment in sales volume as more people are cooking at home during the pandemic and average sales prices.

Despite the unstable years during the 2000-2010 period, the company had increased in profit and the overall net income is in upward trend after 2011. The company’s net income also came back stronger after the financial turmoil years of 2001 and 2008-2009.

Next, we analyze on the Earnings Per Share (EPS), which is defined as how much profit can the company generate for every share that the investor has purchased. For example, if the EPS is $8, this means that for every share that was being purchased, the company can generate $8 of profit.

From the mathematical definition shown in the chart, the EPS trend followed closely with net income trend. Thus, when the overall trend of net income is increasing, the trend of EPS also follows closely.

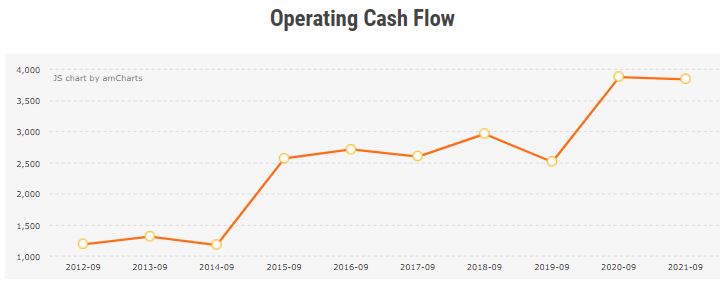

As there were two years of losses (2006 & 2009) reported by Tyson Foods, we are concerned that if the losses will affect the company’s cash flow situation even though the company has displayed a year-on-year increment in revenue.

Operating cash flow is the cash flow that is generated from normal business activities. We observed from the chart that the overall trend of the operating cash flow is in upward trend, with two years of explosive growth in 2015 and 2020.

Investigation into the annual report showed that there was decrease on raw material costs and accounts receivable balances (payments from customers who are on credit) for both years, which lead to an increase in their operating cash flow. This indicate that the cash flow in the company is healthy, and the company is able to generate money from their business operations.

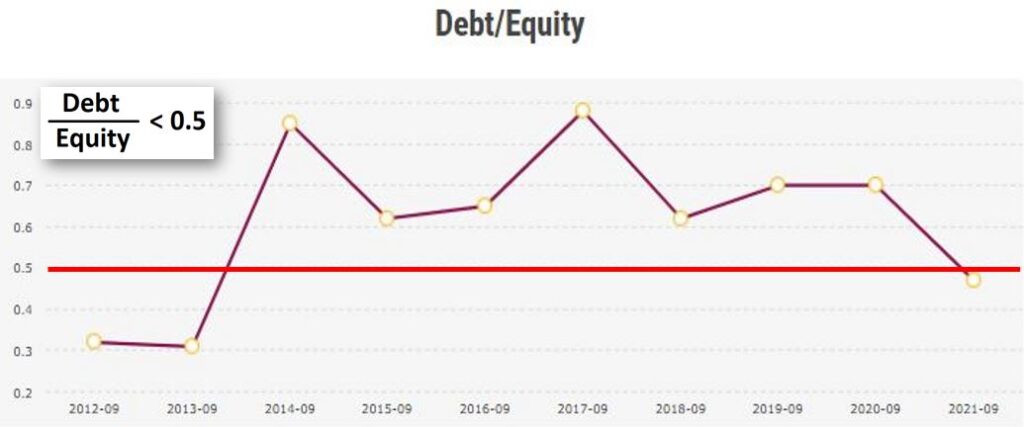

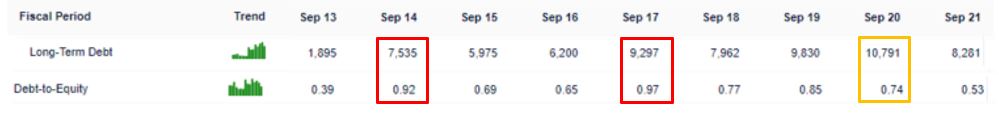

To determine if the company is in high debt or have a big hole in the pocket which cause them to lose money, we will check on the debt-to-equity ratio. According to Value Investing Methodology, the debt-to-equity ratio should be below 0.5. This means that for every $100 of equity, the company cannot take more than $50 of debt.

From the chart, other than 2012 & 2013’s Debt/Equity ratio is below 0.5, most of the years (2014-2020) had been above 0.5. Although this might be an alarming signal that the company could be in high debt, we further investigated into their balance sheet.

In the balance sheet, we observed that in 2014 and 2017, there were sudden high increment in their long-term debt. This was because Tyson Foods acquired Hillshire (2014) and AdvancePierre (2017). They used debt to finance the acquisition.

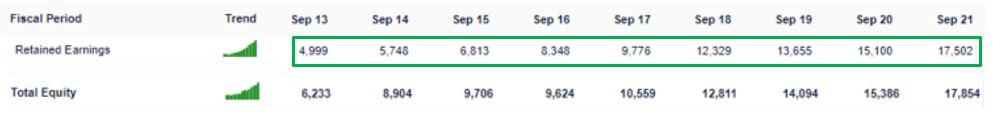

However, in 2020, there was a higher increase in long-term debt but the debt/equity ratio was decreased to 0.74. Why did the ratio decrease when the long-term debt in 2020 increased?

Based on the definition of the balance sheet formula, there is Shareholder’s Equity, which is usually made up of the Capital of the business and Retained Earnings.

- Capital referred to the money that the business owner invested into the company.

- Retained Earnings is the cumulative profits that has left over after paying all expenses of the business and dividends to shareholders.

From 2013 onwards, the reported retained earnings has been increasing year-on-year which is a good sign that the company is generating profit and able to retained the earnings to further grow the company. Even though the debt level in Tyson Foods is high, as long as the company is able to generate profit and grow their retained earnings for the next few years, we may expect to see the debt/equity ratio to be below 0.5 in near future.

POTENTIAL RISKS IN THE COMPANY

As an investor, we look into any underlying risks or worrying aspects that the company might face which could potentially derail the investor’s investment in the company and lose money.

Recent months we have seen inflation creeping into our daily lives’ expenses and caused a rising cost pressure in both customers and producers. The inflationary cost pressure will induce rising prices in input costs of the company, such as raw materials, labour, and supply chain. Even though this may lead to increase in sales price, consumers may be price adverse and consider changing their diet, cutting down meat intake to reduce their household spending.

In addition, any animal diseases will lead to consumers to stop purchasing meat to consume as they are concerned of getting infected by the diseases. We have observed that the avian flu and mad cow disease in 2016 had caused dire losses for Tyson Foods as the sales were severely affected.

CONCLUSION

Economic moat refers to a company’s ability to maintain its competitive advantage over their competitors to protect the business market share and profits.To conclude, this deep dive into the company shows that even though the company may encounter hiccups in some years of financial turmoil or challenging market conditions, Tyson Foods is in one of the recession proof industries – food supply, which is a daily essential for the common public. As a result, the company is able to come back stronger in the subsequent years which was being shown in their financials.

All in all, if we were to invest in the company for long term and never sell in short term for quick appreciation gains, as Warren Buffett famously quote, “Our favourite holding period is forever.”, we will be able to realize long term capital gains from the company.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.