Since a couple of weeks ago, we have been shocked with the emergence of Wuhan virus infections with the increasing number of death toll to be at least 250 people on top of 6000 suspected cases worldwide. Numerous countries have placed restrictions in allowing China related citizen from entering respective country. As a result, biopharma companies such as Inovio Pharmaceutical (NASDAQ: INO) has been put under pressure for speeding up their effort in their deoxyribonucleic acid (DNA) based immunotherapies and vaccines.

In brief, Inovio Pharmaceutical serves as clinical-stage pharmaceutical company, mainly targeting cancers and infectious diseases by activating immune responses via T cells. Apart from the life threatening diseases, they also have CELLECTRA electroporation delivery technology to facilitate the therapy thereby increasing their efficiencies. With the recent havoc regarding the Wuhan virus, Coalition for Epidemic Preparedness Innovations (CEPI), a public-private non-profit based in Norway, has granted $9 million to Inovio for their vaccine development.

It is expected that the financial aid to support Inovio’s effort in conducting phase 1 testing of INO-4800 vaccine at preclinical and clinical level. This vaccine is specific against the Wuhan virus. It is important to note that this is not the first time CEPI granted such financial assistance to Inovio. Previously, a total of $56 million was injected to facilitate development of vaccine against another type of Coronavirus, causing Middle East Respiratory Syndrome (MERS) as well as Lassa fever.

Currently, Inovio is planning to initiate Phase 2 trial for INO-4700 vaccine targeting Middle East regions which has high prevalence of MERS-linked Coronavirus (MERS-CoV) cases. Their Phase 1 study which was successfully completed in September 2018 showed positive outcome whereby approximately 90% of trial patients responded with broad-based T cell activities. The antibody level was also increased in 95% of participants and its presence remained for about 60 weeks, indicating robust response.

Almost 90 percent of the participants depicted broad-based T cell responses, whereas, 95 percent showed an increase in the levels of antibody responses after the use of this MERS-CoV vaccine. Furthermore, sustainability in the robust antibody responses was also observed for almost 60 weeks after vaccination.

INVESTMENT SUMMARY

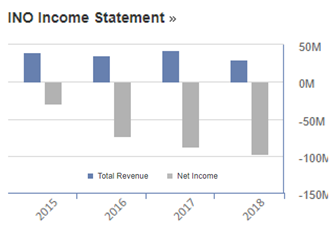

Looking at the financials of Inovio, the income over the years was not convincing for investors. For example, as shown in figure below, the net income in 2015 is $-29.19M and it went downwards by 3 times to $-96.67M. Their total revenue in 2015 was $40.57M and in 2018 it was reported as $30.48M, thereby indicating that the change in their revenue was not as drastic as net income.

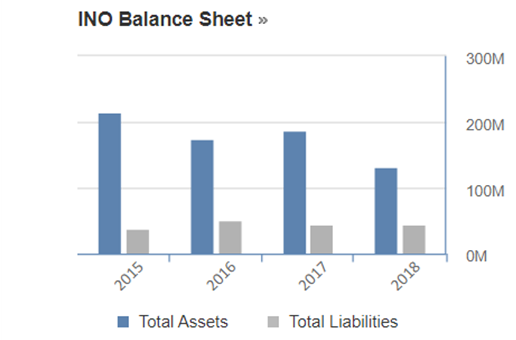

Looking at their balance statement, a similar profile was also observed. Total asset was reported at $213.84M in 2015 which showed reduction of 39% to $131.11M in 2018. Despite having reduced assets, their liabilities over the years were rather consistent. In 2015, their liability was reported to be $38.15M and it went marginally upward by 16% to $44.18M in 2018.

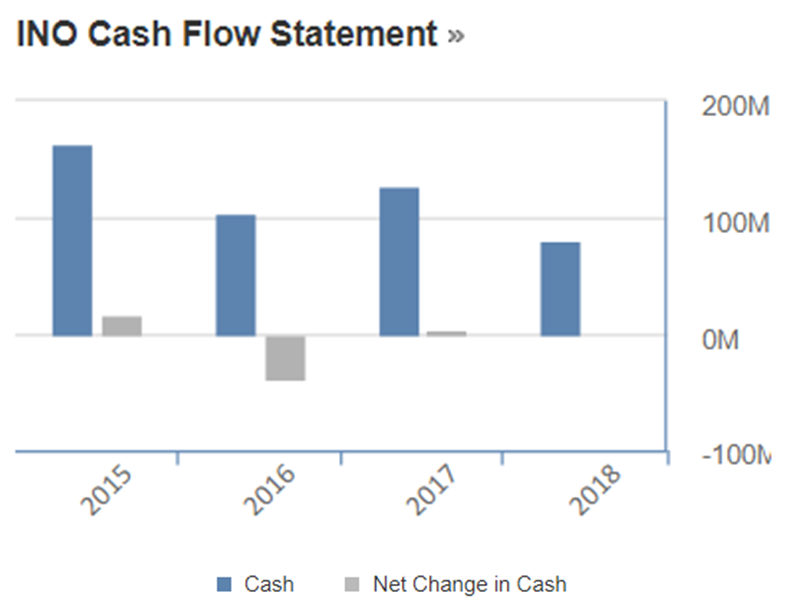

From their cash flow statement, again a series of inconsistency was observed. For instance, cash from operating activities in 2015 was reported to be $-12.44M and the expenses got increased thereby making the cash amount to $-73.55M in 2018. Cash from investing activities however showed an increment from $-54.82M in 2015 to $42.42M in 2018. Further reading on their 2018 10K report revealed that some of their investments were matured and therefore contributed to significant increment in cash flow as compared to previous years.

However, their cash from financing activities did not show similar trend as their cash flow from investment whereby from $84.35M in 2015, it got reduced to $31.04M in 2018. This is possibly due to lack of investors coming forward to buy Inovio’s shares. As a result, when we look at their net change in cash upon incorporating all these three important financial component, it was shown to be $17.09M in 2015 which then reduced to $-0.09 in 2018.

Despite the inconsistent financial records, the stock price seem to go upwards upon the news of financial aid. If we look at the share price in the past one month, it was observed that the price was increased from $3.09 per share to $4.52 per share, which is an increment of 46%. However the price fluctuations in future is very volatile and requires thorough analysis.

RISK

In the 2018 10K report, the company was being very conservative in highlighting risk factors associated to Inovio. The following lists the key risk factors which require further consideration:

Related to business and industry:

- The company has been incurring losses since its inception, and there is high chance for the company never become profitable.

- The source of revenue is rather limited to their ability to develop vaccine, immunotherapies, and electroporation equipment.

- The company may not eventually develop successful product which can be approved for sale.

- Presence of debt and liabilities could hamper cash flow, possibly affecting business, financial conditions and results of operation.

- Dependence on key personnel who may leave for better opportunity thereby delaying the company’s progress.

- High cost of clinical trials which is lengthy with varying degree of uncertainty. The outcomes of earlier studies and trials may not be predictive of future trial results.

Related to Intellectual Property:

- High cost and difficulty in generating and protecting proprietary technologies.

- Infringement of intellectual property rights may cost the company huge sum of money which will hamper their business.

Related to Common Stock:

- The volatility of stock price which is unpredictable and could decline in value.

- Presence of anti-takeover provisions, especially in Delaware could delay change of control thereby limiting market share price.

- Inability of Inovio to issue dividends may not be attractive to potential investors and the company does not foresee in issuing dividends in future as well.

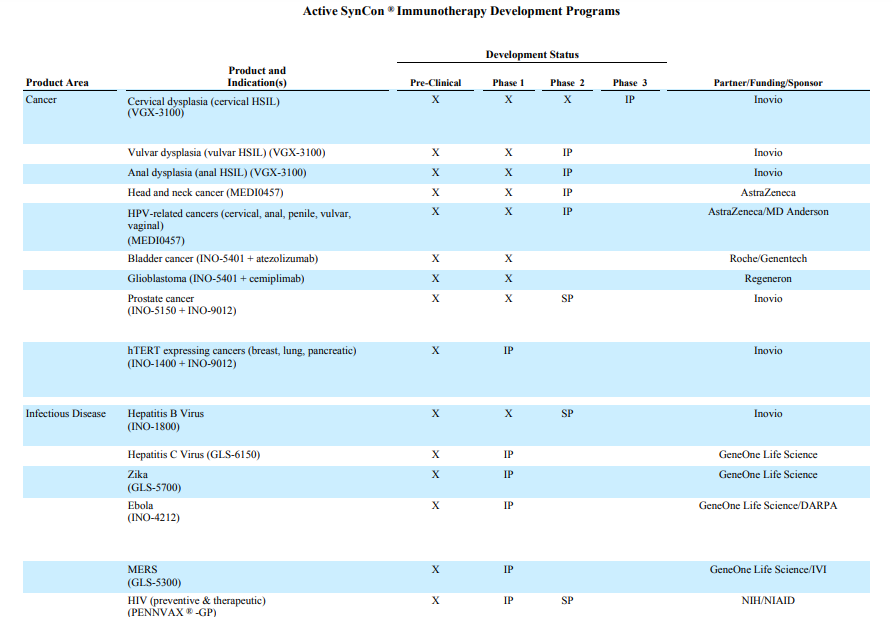

Despite having all these risks publicly mentioned in their 10K report, it is also important to note that Inovio has been playing its part diligently. The following Table, which was extracted from 10K report illustrates the current vaccines and immunotherapies programs under the purview of Inovio. The company has collaborations with big pharma like Astra Zeneca and with academic institution such MD Anderson, indicating their willingness to work with potential partners to push forward their development.

After going through all these information, it is believed that with the current trend witnessed in the company, more time is needed to evaluate the company for investment purposes. The fact that CEPI is willing to inject in extra funds should indicate that Inovio has potential but perhaps need a little more time to shine. Nevertheless, with the availability of Wuhan virus genetic codes, it is hoped that these companies can work together and materialize the vaccine very soon.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.