In the world of investment management, Bridgewater Associates stands tall as the world’s largest and most influential investment management firm with its commitment to data-driven decision-making.

Graphic source: Visual Capitalist

In this blog article, we will explore Bridgewater Associates’ success secret on how they maintain its stellar reputation for data-driven investing and risk management investing. In addition, we will also deep dive into one of their fund portfolios for insights on how to build our own risk-balanced portfolio!

We have also covered this topic on our YouTube Channel. Click on to watch!

We have also covered the difference between hedge fund, mutual fund & ETFs!

Click on to learn more about their differences!

BRIDGEWATER BACKGROUND

Founded in 1975 by Ray Dalio, Bridgewater Associates is one of the world’s largest and most influential investment management firms.

The firm manages assets worth hundreds of billions of dollars on behalf of institutional clients, including pension funds, endowments, and sovereign wealth funds. It is currently headquartered in Westport, Connecticut, Bridgewater.

At its core, Bridgewater is known for its systematic and research-intensive approach to investing, rooted in the field of global macroeconomic analysis.

Its philosophy revolves around the belief that understanding of the macroeconomic trends and market dynamics can unlock significant investment opportunities.

- Macroeconomic trends are the general patterns and changes in the economy that can have a broad impact on businesses, consumers, and the overall financial system. Examples such as economic growth, inflation, interest rates and unemployment.

- Market dynamic refers to the interactions and behaviors of buyers and sellers in a market, such as supply and demand and consumer behaviors.

Bridgewater’s success can be attributed to its unwavering commitment to data-driven decision-making. Their investment prowess has been exemplified through its flagship fund, the Pure Alpha Fund, which has delivered strong risk-adjusted returns over the years.

Besides the flagship fund, Bridgewater also has another fund portfolio that is more risk-balanced, which is their All-Weather Portfolio Fund.

BRIDGEWATER'S ALL-WEATHER FUND PORTFOLIO

The All-Weather Fund is a risk-balanced fund, designed to deliver consistent returns across various market environments. In theory, the fund is structured to generate returns in any economic environment, whether inflation, deflation or the stock market is going up or down.

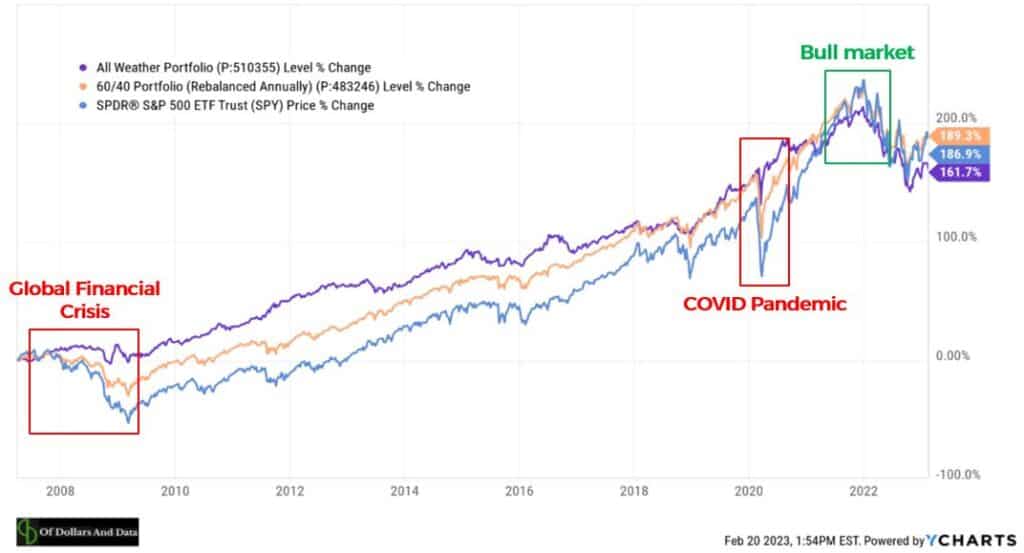

The graph shows the performance of the All-Weather Fund since 2007 to 2023:

From the graph, we observed that during the market downturn, the Global Financial Crisis & the COVID Pandemic periods, the All-Weather Portfolio (purple line) was not badly affected by these events as compared to the S&P 500 ETF (blue line).

However, during the bull market in 2021, even though the All-Weather fund did not rise as much as the S&P 500, it was still able to generate decent returns for its investors.

How did the fund manage to avoid a severe plunge during the market downturn while able to generate a decent return during the bull market?

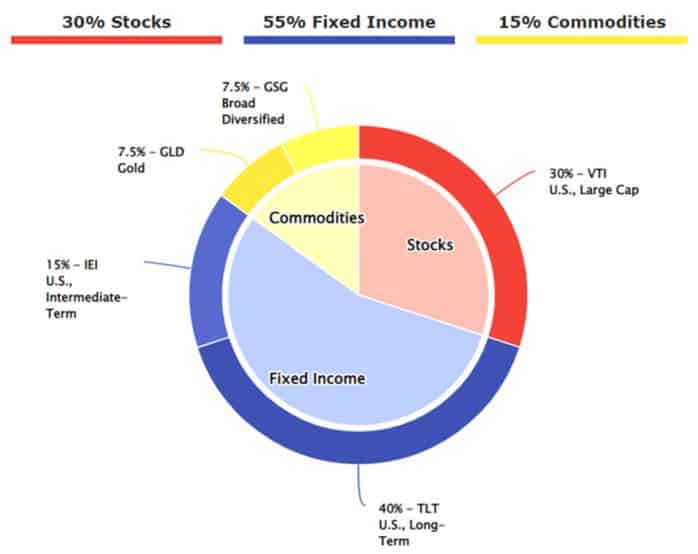

In the diagram below, the fund setup was structured to focus on diversification across asset classes, including equities, fixed income (also known as bonds), and commodities.

All Weather Fund Portfolio

This diversification helps to mitigate risk and provides exposure to different market factors.

HOW WILL THE FUND PERFORM DURING BULLISH OR BEARISH ENVIRONMENT?

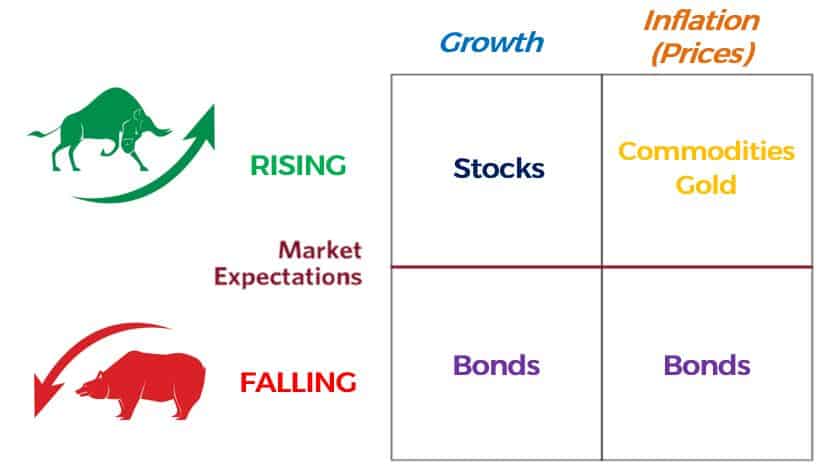

To better understand how the fund can distribute the risk evenly, the chart below shows how the fund will perform during a bull and bear market scenario:

In the first column – Growth:

- During periods of rising growth (bull market), stocks tend to do well. This is because during the bull market, it often coincides with strong economic growth. When economic is expanding, companies tend to have higher sales and profit. Thus, this will lead to higher stock prices.

- During periods of falling growth (bear market), bonds tend to do well. This is attributed to the fact that bonds provide predictable interest payments and guarantee the return of the initial investment upon maturity. Consequently, they are regarded as relatively less risky investments when compared to stocks, particularly government bonds like T-Bills & Singapore Government Securities (SGS) bonds.

In the second column – Prices:

- During periods of rising prices (inflation), commodities and gold tend to do well. One of the reason is because commodities have historically been viewed as a hedge against inflation. When prices rise due to inflation, value of commodities also increase due to increasing prices. Commodities are raw materials derived from agricultural, energy and metals.

- During periods of falling prices (deflation), bonds tend to do well. As prices of goods & services fall during deflation, the value of money increases, making fixed interest payments of bonds relatively more valuable. Bonds provide stability, fixed income, and the return of the principal at maturity, attracting investors seeking capital preservation. Hence, increased the demand for bonds.

With this setup, the All-Weather Fund can provide stable returns in all economic environments. In addition, it is also considered to be suitable for those who hate losses and want decent returns for their investments.

However, as the fund is slightly more heavily allocated for bonds (55%), it may not be suitable for those who want to have high growth returns for their investments.

As such, it is essential for investors to conduct thorough research, assess their individual investment goals, and risk tolerance before constructing their own portfolio.

CONCLUSION

All in all, investors can take cues from the All-Weather Fund’s setup to create their own portfolio by adopting a risk-balanced approach and diversifying across asset classes.

By considering their risk tolerance, investment goals, and time horizon, investors can create a well-rounded portfolio that seeks to deliver consistent returns across different market conditions, like the objectives of the All-Weather Fund.

If you have always wanted to learn how to invest and grow your money, join us in our upcoming Masterclass where you will learn from Cayden how to generate 3 sources of income even though you have no knowledge of investing!

Click on the banner below to find out more!

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.