Recently, you must have heard people around you mention cryptocurrencies, and how much future value they can create. Should you invest in it? Let’s us first understand what cryptocurrencies actually are.

A cryptocurrency is a digital or virtual currency that is secured by cryptography, which makes it nearly impossible for it to be counterfeited or spent twice.

Many cryptocurrencies are decentralized networks based on blockchain technology.

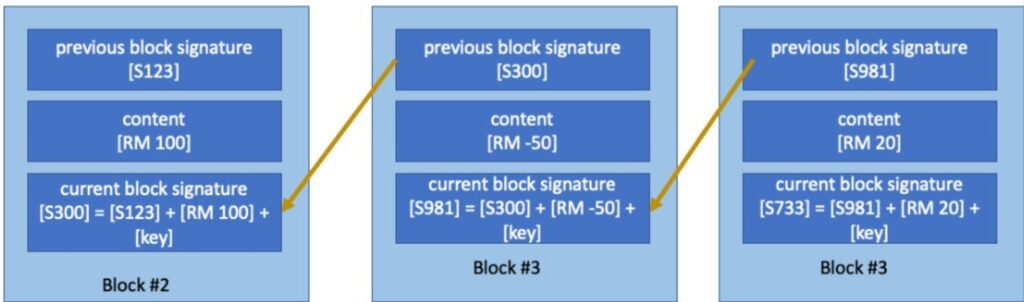

What is blockchain technology? In a simple term, it is a recording method. A fresh data came in will be filled in a new “block” until it is full, then it will be “chain” with the previous block together. Why it is highly secure because you need previous block + content + password to create new block and chain together as below.

And if you lost your password, it is PERMANENTLY LOST and NO-WAY to recover!

So, who was the founder of cryptocurrency? Many people will tell you that the founder is a person called Satoshi Nakamoto. However, the original story of these virtual coins actually begin with one person – the cryptographer David Chaum.

In 1983, the American developed a cryptographic system called eCash. Twelve years later, he developed another system, Digicash which was a more secured and encrypted system.

The term “cryptocurrency” was first coined in 1998.

That year, a computer engineer by the name of Dai Wei began to think about developing a new payment method that used a cryptographic system and whose main characteristic was decentralization.

Do you remember the global economic crisis that began more than a decade ago? In 2008, a funding crisis affected everyone and the cryptocurrency coins were no exception. The coins were losing their value at a phenomenal rate.

In 2009, a person named Satoshi Nakamoto, whose identity is still secret, created the first cryptocurrency – Bitcoin. As you now know, Satoshi was not the first person who came up with the cryptocurrency idea, but had the same intention behind creating Bitcoin – to create a new way of payment that could be used internationally, decentralized and without having any financial institution behind it.

In 2010, someone decided to sell their Bitcoin for the first time by swapping 10,000 of them for two pizzas. As Bitcoin increased in popularity and the idea of decentralized and encrypted currencies caught on, the crypto trend boomed.

Do you know how much you would have now if you invested $1000 in Bitcoin in 2009? At its all-time high, $1000 Bitcoins would have been worth more than $50 million USD, not accounting for compounding, and assuming you bought and held the asset the entire time.

Source data: https://www.coindesk.com/price/bitcoin

WHY IS CRYPTO SUCH A HOT INVESTMENT?

In 2017, a gradual increase in the places where cryptocurrencies could be spent, also known as marketplaces, resulted in more money flowing into the cryptocurrency ecosystem, contributing to its ever-increasing growth in popularity. During this period the market cap of all cryptocurrencies rose from $11bn to its current height of over $1 trillion today.

The technology behind cryptocurrencies – blockchain – has sparked a revolution in the fintech industry. Most recently, the price of cryptocurrencies has been trending upwards, driven by high-profile supporters. Examples of such supporters are:

- The Bank of New York Mellon, who have committed to provide custody service for digital assets, citing growing client demand.

- Mastercard, who have also said they would begin to offer support for cryptocurrencies on its network this year, and

- Elon Musk, who announced that Tesla bought $1.5billion of Bitcoin, and that Tesla would soon start to accept the cryptocurrency as payment.

ALL of these positive news has made the cryptocurrencies extremely bullish!

WHY DID ELON MUSK BUY CRYPTO?

The Telsa CEO explained that the inability to receive a decent return on his company’s cash was the key reason behind the decision to buy $1.5billion of Bitcoin.

Real interest rate is negative when the rate of inflation exceeds the nominal interest rate. However, crypto, currently not pegged to the real interest rate, is attractive enough that Mr. Musk believed that it would be able to give better returns than having the asset in cold-hard cash!

RISK OF INVESTING IN CRYPTOCURRENCIES

All investments have risk, and managing said risk is a personal decision depending on one’s own risk appetite.

The risks of investing in cryptocurrencies are:

- Manipulation – as a digital currency, cryptocurrencies are susceptible to technical glitches, human error or hacking. They can also be affected by discontinuation.

- High volatility – Cryptocurrencies can potentially give great returns, but alternatively could just as easily go bust as there is no centralized supports and is mainly driven by market sentiments!

- Lack of regulation framework – means there is high degree of uncertainty. Crypto regulations are complex, disorganized and haphazard. One area of particular concern for investors is the tax treatment. The good news is that regulators are catching up. Switzerland is one of the first countries to begin building a robust regulatory framework, while Britain & Singapore have been exploring their blockchain and crypto regulatory requirement, aiming to provide platforms that enable companies to experiment under relaxed regulation and licensing requirements.

- Market adoption – The rate of cryptocurrency as a currency for transactions currently remains low, and a lack of standardized regulation means that many countries do not freely accept cryptocurrencies yet.

- Security, custody & consumer rights – storing cryptocurrencies and other crypto assets can be risky business. Horror stories include situations whereby investors cannot recover assets that get lost or stolen, as well as investors who find that mistaken transactions cannot be reversed!

Cryptocurrencies has been described as everything from the future of money to an outright scam. Regardless, cryptocurrencies look like they are here to stay. Will cryptocurrencies successfully replace government-controlled, centrally supported national currencies with a distributed and decentralized alternative? It is a possibility; the situation is improving, but it’s far from ideal.

As Peter Lynch once said – “Never invest in any idea you can’t illustrate with a crayon!”

Disclosure

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.