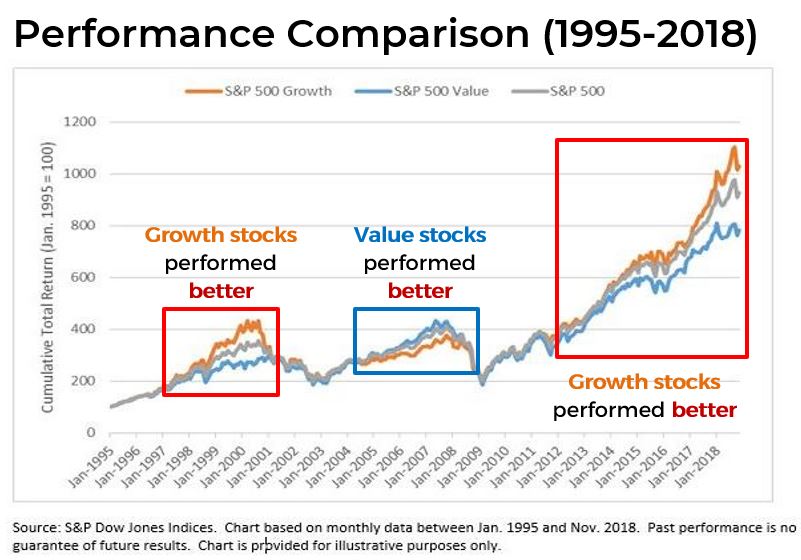

Over the years, there has been a heated debate of superiority between Growth Investing vs Value Investing as the best investing method. In a five year period, Growth Stocks ETF have generated a cumulative return of 170%, compared to Value Stocks ETF (75%)!

Nevertheless, the performance period between these two investing methods has been in a cyclical manner, where a certain period, Value Investing has performed superior to Growth Investing and vice versa.

From the chart above, Growth Stocks have been performing exceptionally well for the past two decades based on the historical performance.

In this blog, we will learn more about:

- What is Growth investing and Value Investing

- The characteristics and potential risks of Growth Stocks vs Value Stocks

- Which Investing Strategy should you use for your investment goals

Moreover, we will also be exploring some of the stocks suggestions by online financial sites – Kiplinger and determine if these stocks suggestions are potential stocks to invest in based on our value investing methodology.

Watch on our YouTube Live below!

Without further ado, let’s jump right in!

GROWTH INVESTING & GROWTH STOCKS

Growth Investing is an investing method where investors buy the stocks of companies that are growing fast due to their future potential & will appreciate in price over time in the future.

The S&P 500 sectors in which the growth companies commonly found are in the Technology sector, Consumer Discretionary sector, and Communication Services sector.

CHARACTERISTICS & POTENTIAL RISKS OF GROWTH INVESTING

For Growth Investing investors, they are looking for companies that have the potential to outperform the overall market due to their future potentials.

The main characteristics for growth stocks is that the companies will grow faster in revenues or sales as they are offering products or services that are expected to sell well in the market by investors.

Hence, these companies are perceived as having a bright future to be the future industry leader or the “Next Big Thing” because their products or services have a competitive edge (Economic Moat) against their competitors.

As a result of this, the stock prices of these companies can rise sharply within a short period of time as investors are rushing in to buy the shares, fearing missing out a potential great deal. (Remember Tesla?)

This will push the share price higher and higher, which caused an euphoria in the investing community that the company is going to be the “Next Big Thing”! The investors who purchased the stocks at a later time may end up overpaying or buying overvalued stocks, in hope to gain unsupported proof of supercharged returns.

However, if any bad news that these growth companies are no longer performing as expected or another competitor is taking away the market share, the share prices may encounter a drastic plunge (How about SEA Ltd or Netflix?).

This is because even though these highly anticipated companies are able to generate high revenues year-on-year, the expenses to grow the company may even be higher! If the expenses are higher than the sales generated, the companies may end up losing money, which makes these companies have higher potential volatility.

Those with a big risk appetite and able to stomach huge volatility may consider investing in these types of companies, as the saying goes “the bigger the risk, the bigger the rewards”!

VALUE INVESTING & VALUE STOCKS

Value Investing is another form of investing method where investors buy stocks that are undervalued (cheap) by the marketplace but usually have strong financials. Companies with strong financials are usually found in the Financials sector, Industrials sector and Consumer Staples sector of the S&P 500.

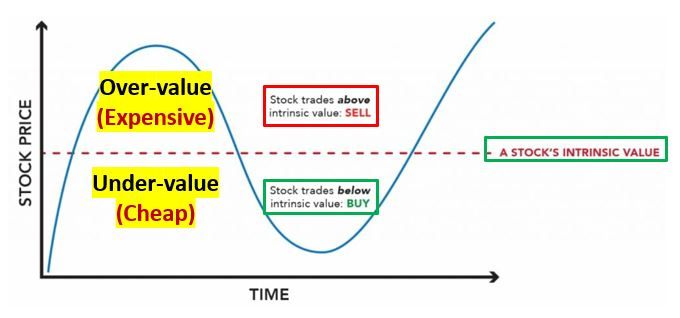

But how do one determine if the share price is undervalued or cheap?

From the diagram above, value investors will determine if a company is undervalued by finding out the intrinsic value (true worth) of the company based on their financial statements.

- If the current share price is below the stock’s intrinsic value, the company is considered to be undervalued or cheap.

- Value Investors will come in to buy the shares after performing due diligence on the company’s background.

- If the current share price is above the stock’s intrinsic value, the company is considered to be overvalued or expensive.

- Value Investors may consider to sell the shares if they deemed the company is no longer valuable in the long term.

Most of us would like to generate an additional source of income as rising inflation and high living costs has been tough on our wallets. One of the ways that we can grow our money is by investing.

However, when people talk about investing, the first thought comes to mind is losing money or it is very hard to invest and grow our money. Not to mention that how do we determine if a company is a good opportunity to invest in?

In Value Investing Academy, we have prepared a Free MasterClass session to debunk these myths about investing where you will learn 3 ways to generate passive incomes even if you don’t know anything about investing and how to start investing with minimal capital!

Moreover, you will also learn how to create a cash dispensing machine to replace your existing salary from this MasterClass session! Click on the banner below to find out more!

CHARACTERISTICS AND POTENTIAL RISKS OF VALUE INVESTING

For Value Investing investors, they will identify and invest in companies whose stock prices are lower than the intrinsic value, known as undervalued stocks.

How do they identify such undervalued stocks?

When a company’s share price is trading below its intrinsic value, most of the time was due to the company may have suffered a temporary corporate scandal, economic or political event hampering the overall industry or during a recession!

Although the company’s share price has suffered a beating and is currently undervalued, if the financials are still strong, value investors may still invest in the company. This is because when the stock rebounds after the bad incident has subsided, it may generate higher returns for the investors!

Compared to growth investing, value investing is a much slower but steadier investment approach. The companies found to be value stocks are usually the larger and more established companies, such as Coca-Cola, Visa and IBM. For these types of companies, there might not be much potential for growth as they are well-established and market leaders of their respective industry. So investors may have to patiently wait for some time to see their portfolio to generate substantial returns in the long run.

To invest in value stocks, due diligence is a must for investors before investing their money. This is because there is potential for the share price to drop further and take a very long time for the share price to rebound, especially if the company is not financially strong.

WHICH INVESTMENT STRATEGY TO USE?

Now that we know the characteristics and potential risks between these two investing methods, one might be asking – “So, which investing method should I be using to achieve my financial goals?” Should I purchase more growth stocks vs value stocks?

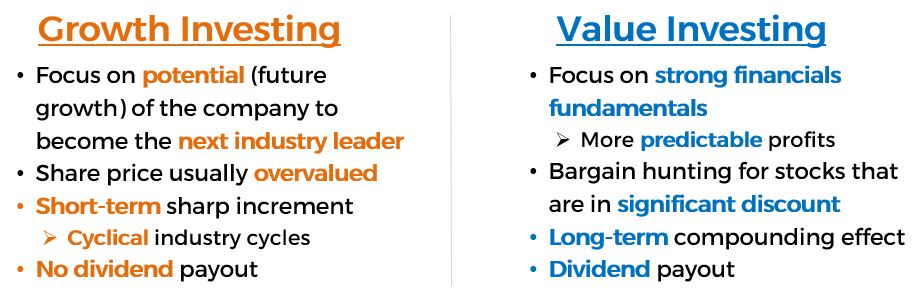

Here, we have did a quick comparison on these two investing methods:

From the comparisons, it will be easier for us to determine which investing method that is best suited for our investment goals when we ask ourselves these 3 questions:

- Why do you want to invest? (or What do you want to gain from investing?)

- How long do you intend to invest? (Investor’s time horizon)

- How much risk can you take on when investing? (Risk appetite)

It’s only when we know the answers to these 3 questions, then we will be able to choose the investing strategy that best suited our personality and risk appetite!

We have also done 3-part articles on exploring the investing strategies of famous value investors, such as Warren Buffett, Charlie Munger and Michael Burry. Click on the links below to learn more on their investing strategies!

RECOMMENDED STOCKS BY KIPLINGER

As investors, we love to search and look for great companies to invest in. For this article, we have explored one of the famous financial sites – Kiplinger on their stock suggestions, three each on Growth Stocks and Value Stocks!

3 GROWTH STOCKS

Darling Ingredients (DAR)

- US multinational company that develops and manufactures sustainable ingredients from edible by-products & food waste for their customers in Pharma, Food, Pet Food, Fuel & Fertilizer Industries.

VICI Properties (VICI)

- US real estate investment trust that specializes in properties in Gaming, Hospitality, Entertainment and Leisure.

MasTec Inc (MTZ)

- US multinational infrastructure engineering & construction company that installs:

- Wireless, wireline & satellite communications

- Oil & Gas pipeline Infrastructure

- Conventional & renewable power generation

3 VALUE STOCKS

Target Corp. (TGT)

- US big box department store chain that sells products in:

- Beauty & household essentials

- Food & Beverage

- Home furnishings & decor

- Hardlines

- Apparel & accessories

- US multinational consumer goods corporation that offers 65 brands of consumer care products in:

- Health care & Oral care

- Fabric & Home care

- Beauty (skin & personal care, hair care)

- Grooming (shaving blades)

- Baby, Feminine & Family care

- US biopharmaceutical & research-based pharmaceutical manufacturer. Produces drugs for:

- Immune system (Immunology)

- Blood cancer (Hematologic oncology)

- Aesthetics & women’s health

- Neuroscience (e.g. migraine, Parkinson’s & schizophrenia)

- Eye care

CONCLUSION

To conclude it all, the debate between Growth Investing and Value Investing will never come to an end. Both investing styles have different performance periods where they outshine each other which makes it very hard to determine the right time to invest.

Nonetheless, both investing styles will be able to generate good long-term returns if one invests in good quality companies. Like the world’s most successful value investors, Warren Buffett, he is not only applying value investing methodology to hunt for cheap companies, but also invest in companies that have future potential growth in the long term!

So why not learn from Warren Buffett to choose the best of both worlds when investing?

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.