DBS bank is a bank that need no introduction to any Singaporeans. It is the bank that set up the Singapore Government and most Singaporeans has a bank account with it.

Established on 16/7/1968 by the Government of Singapore, the bank’s main purpose is to provide loans and financial assistance to Singapore industries.

Since this bank was set up by the Singapore Government and a lot of Singaporeans has a lot of faith in it. But does it mean it is a good company to invest in it?

\\\In this blog post, we will discuss whether DBS is:In this blog post, we will discuss whether DBS is:

- Profitable?

- Safe?

- Able to grow?

IS DBS BANK PROFITABLE?

Banks’ revenue comes from two sources, Net Interest Income and Non-Interest Income.

REVENUE: NET INTEREST INCOME AND NON-INTEREST INCOME

Based on the 10 years trend, their revenue has been increasing and rising!

Net Interest Income is compounding at 8%.

Non-Interest Income is compounding at 7.8%.

That’s a good sign.

NOTE: WHAT ARE NET INTEREST INCOME AND NON-INTEREST INCOME?

Net interest income is measuring the difference between the revenue generated from a bank’s interest-bearing assets and expenses associated with paying on its interest-bearing liabilities.

Now, usually Bank’s interest-bearing assets are Loans lend out to their clients, earning the interest rates.

Bank’s interest-bearing liabilities usually come from our deposits and in some case; bank does borrow money from other banks, which is debt or borrowings.

As for the Non-interest Income, basically the income comes for their services they provide. For example their credit card services, fees from telegraphic transfer etc.

NET INCOME

Next we should look at their Net income.

Now, we know that bank is profitable. Their Net Income is compounding at 10.7% for the past 9 years.

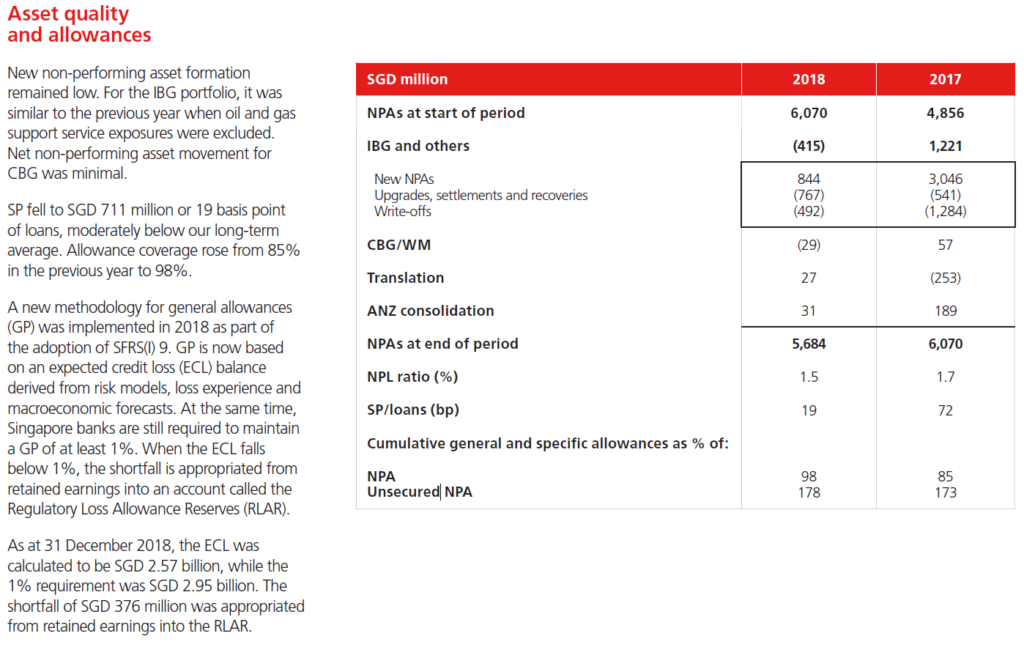

IS DBS BANK SAFE?

WHAT IS NON-PERFORMING ASSETS (NPAS)?

WHAT DOES THIS MEANS?

CAN DBS BANK GROW?

WHAT IS REVENUE RESERVE?

OTHER FACTORS TO CONSIDER

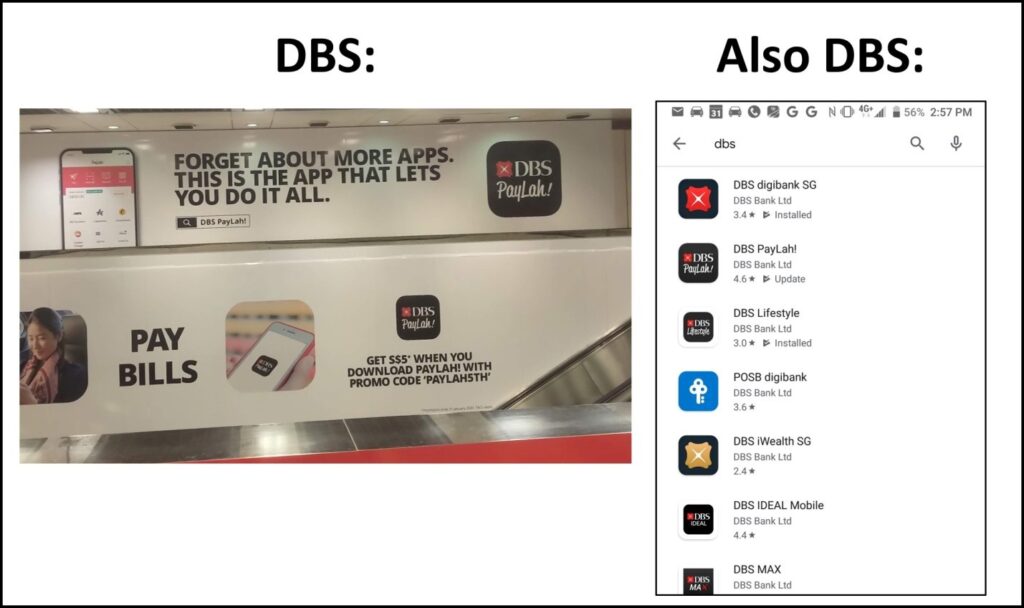

DIGITALLY

IS DBS BANK WORTH IT?

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.