Hi Investors,

REITs are among the extremely popular investment choice for Singaporeans because

- Of exposure to property and as well as offering good returns

- You can enjoy tax transparency if they pay out at least 90% of their profits as dividends

- They can be bought or sold on the Singapore Exchange(SGX) like a stock

- As investors you can choose to analyze individual REITs or invest in a basket of REITs using an ETF

WHAT IS A REIT

(REAL ESTATE INVESTMENT TRUST)

It is a company (listed as a Unit Trust) that owns and operates properties and receive rental income from its tenants. As a unit holder, you are actually buying a share in the underlying property of the REIT. REIT units could be traded in the stock market like any other stocks making it easier for investors to easily buy or sell units. This makes it a more liquid investment compared to physical property.

The investor benefit through regular dividend payments and can also enjoy share price appreciation similar to any stock. Most REITs yield around 5% to 9%.

Now let us look at different types of REITs.

(NOTE: DIFFERENT COUNTRIES COULD HAVE MORE ON WHAT IS LISTED HERE, TO MAKE THING SIMPLE WE LOOK AT THE SINGAPORE REITS MARKET).

TYPES OF REITS

(SIMPLIFIED VERSION)

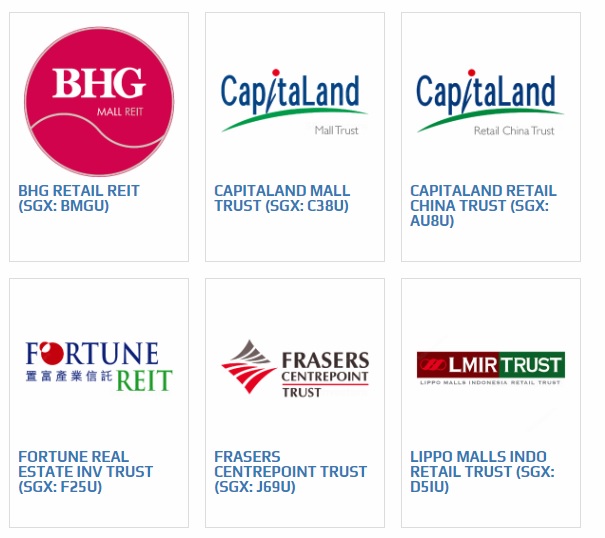

RETAIL

Shopping mall as their underlying assets

- Easier to research as you simply visit the malls and observe how well the businesses are doing in terms of location, the tenant mix, the types of shoppers, and any kind of AEI (*Asset Enhancement Initiatives: see glossary below) signaling that the management continues to upgrade the establishment.

- As a starting REITs investor, you can focus on analyzing this particular REIT. *Scuttlebutt your way in if I may say.

- Examples: Capitalmall Trust, Fraser Centrepoint Trust

HOSPITALITY

Hotels as their underlying assets.

- Maybe considered the riskiest, because it is susceptible to a lot of variables from unpredictable ravages such as earthquakes, terrorist attacks, disease pandemic to name a few. It may be wise to consider and factor in all these additional risk before investing.

- Economically sensitive and sudden fluctuations in visitor arrivals may impact hotel profitability.

- Examples: Ascendas Hospitality Trust, Ascott Residence Trust

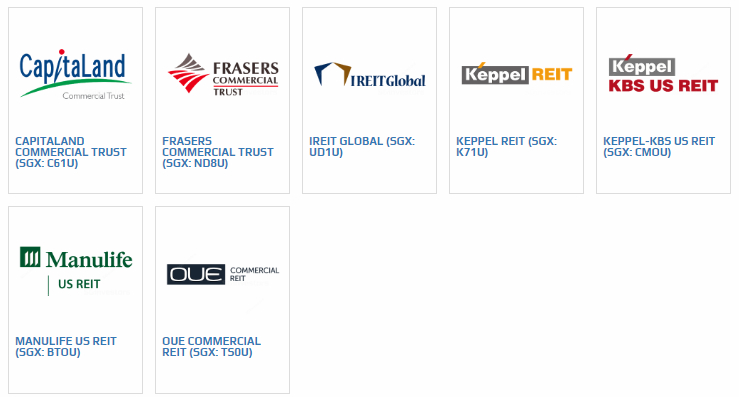

OFFICE

Office space as their underlying assets

- A.ka. commercial REITs

- Strongly link to the economy because when the economy is doing very well, business tend to rent more office space. Watch out for office vacancy.

- Examples: MappleTree Commercial Trust, Capitaland Commercial Trust

HEALTHCARE

Hospitals and nursing homes as their underlying assets

- Favored by Risk adverse investors due to its defensive nature

- Because of its risk adverse characteristics it is expensive and generate low yields

- Examples: First REIT, Parkway REIT

INDUSTRIAL

Factories, warehouses, business parks and industrial buildings as their main asset

- Usually with higher yields because of low maintenance cost but despite this kind of attractiveness it is difficult to conduct due diligence as the investor has no direct access to the factories or the properties unlike retail REITs

- Quite popular due to high yields. A word of caution: Yield alone is not the sole yardstick in measuring a REIT’s profitability.

- Examples: Ascendas Real Estate, ESR-REIT

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.