Ark Invest’s CEO, Cathie Wood made big bets on Teladoc Health Inc. (NYSE: TDOC) for about $20 million worth of shares in 2021 and garnered attentions from the investment world. But why did she invested millions of dollars into this telemedicine company? Various news channels had made coverage to unearth the reasons for this bulk purchase and set off a frenzy purchase of the company during Covid-19 pandemic. The frenziness had pushed TDOC share price to an all time high of almost USD300 in February 2021.

However, the stock tumbled more than 40% in late April 2022 when the company reported missed their earnings in their first 2022 quarter. This triggered flood of headlines of many newswires that reported this plunge and started to doubt whether Cathie Wood had made an informed investment in Teladoc.

Despite the plunge, Cathie Wood is still bullish on Teladoc, believing in the company to be the future information backbone of the US healthcare industry.

In addition to that, she also listed out four reasons why she is still bullish on the company despite the plunge as reported by an article from Markets Insider:

1. The Pandemic Changed Things

“A lot of people were introduced to telemedicine during the coronavirus crisis. They got their first taste. And to the extent they can help it, meaning they don’t absolutely have to see a doctor for checkup reasons that need to be done personally, we are not going back to the old way of doing things.”

2. The Cross-selling Opportunity

“Now, if you look at the revenue of Teladoc, it is up fourfold from 2019. And perhaps more important, the average revenue per user has gone from roughly $1, to $2.60. And our analyst, Simon Barnett, says that if they did a lot more cross-selling and just theorectically, every person took all of their services, that ARPU could go all the way to $68. Now, of course it won’t, but it is going a lot higher.”

3. They Have A Real Business

“They just guided to the December quarter 43% growth, which was higher than consensus expectations. That revenue for 2021 now stands at $2 billion dollars. That’s a real company. A lot of sellers of our stocks… really don’t care what a company does. Many just have used valuation as a reason to sell our stocks. But they compare our strategy to a tech and telecom bubble strategy. None of the companies in the tech and telecom bubble that I remember got anywhere near $2 billion in sales.”

4. On Competition

“Many perople are basically dismissing Teladoc as, hey, United Healthcare could do that easily. Well, the fact is, and maybe they could – they are trying to do it in some way – but this is not their DNA. If you look at Teladoc’s price to sales right now, Teladoc’s price to sales is 5x. United Health, 13x to 14x. Teladoc’s growth rate revenues, they will tell you over the next three to five years, 25% to 30% plus, and United Health, maybe 10%. So there’s something very interesting about this picture.”

In this blog, we will explore in detail on what is Teladoc Health Inc. and is this really a good company to invest in as recommended by Cathie Wood.

INTRODUCTION

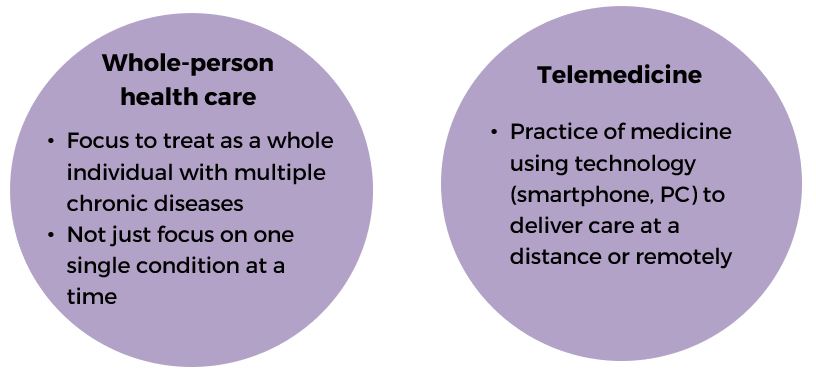

Teladoc Health (NYSE: TDOC) is the global leader in whole-person virtual healthcare and telemedicine company.

Teladoc was founded by Byron Brooks, MD & Michael Gorton in 2002 on a simple, and yet revolutionary idea at that time:

They envisioned that everyone has access to the best healthcare, anytime, anywhere in the world on their own terms. In addition to empowering all people to live their healthiest lives by transforming the healthcare experience.

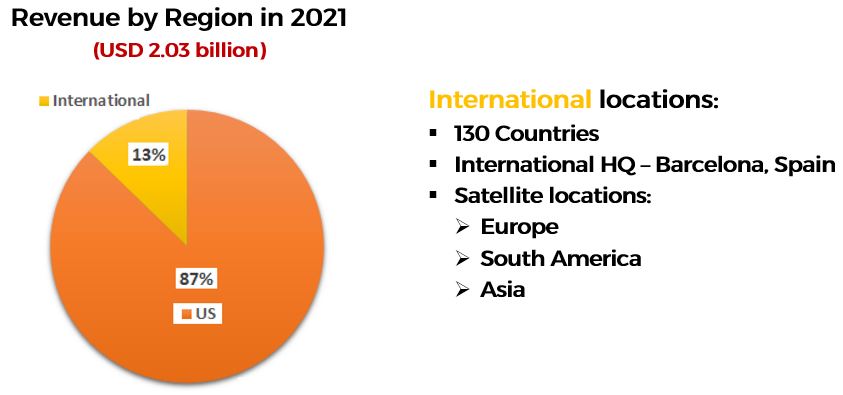

Teladoc has two headquarters: one is based in Purchase, New York, US and the international headquarters is based in Barcelona, Spain. Their telemedicine services are offered worldwide in 130 countries, with satellites across Europe, South America and Asia.

They also have in-house brands that provide a broad range of high-quality healthcare services and medical expertise:

As of 31 December 2021, the telemedicine platform has been providing healthcare access to over 53.6 million US paid members and 24.2 million visit fee-only individuals 24/7 and 365 days.

WHAT SERVICES DO TELADOC PROVIDES?

Teladoc offered a portfolio of healthcare services and solutions that covers hundreds of medical subspecialties that include:

- Non-urgent, episodic medical conditions such as flu, upper respiratory infection

- Chronic, complicated medical conditions such as diabetes, hypertension and mental health

To address these hundreds of medical conditions, they offered three main types of solutions for their clients and healthcare providers:

1. CONSUMERS

Teladoc Health

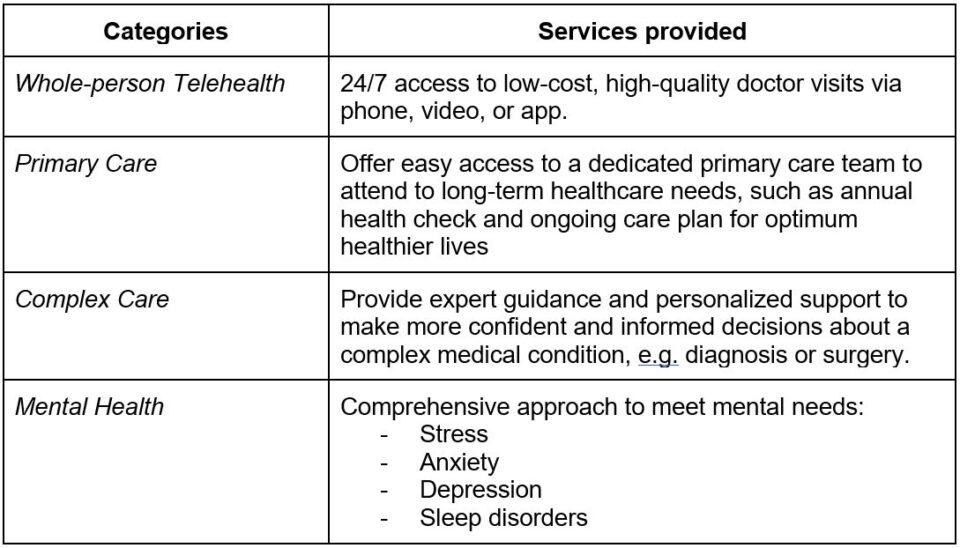

Virtual care services are structured in four main categories to deliver to Consumers:

2. CLINICIANS

Teladoc Health

For Clinicians, Teladoc provided software platforms, telehealth devices and virtual care solutions to enable clinicians to connect and support their patients virtually.

The software platform offered, SoloTM Platform enables healthcare providers to easily adapt to their clinical workflow, making it seamlessly integrate with their own existing technologies to provide optimized delivery care to patients.

Teladoc Health

In addition to that, Teladoc also develops telehealth devices to support remote point-of-care visits and clinical collaborations among clinicians via virtual meetings.

Teladoc Health

Various virtual care solutions are offered as a bundle of both telehealth devices and easily configurable software modules together to create a seamless virtual care experience for both clinicians and patients.

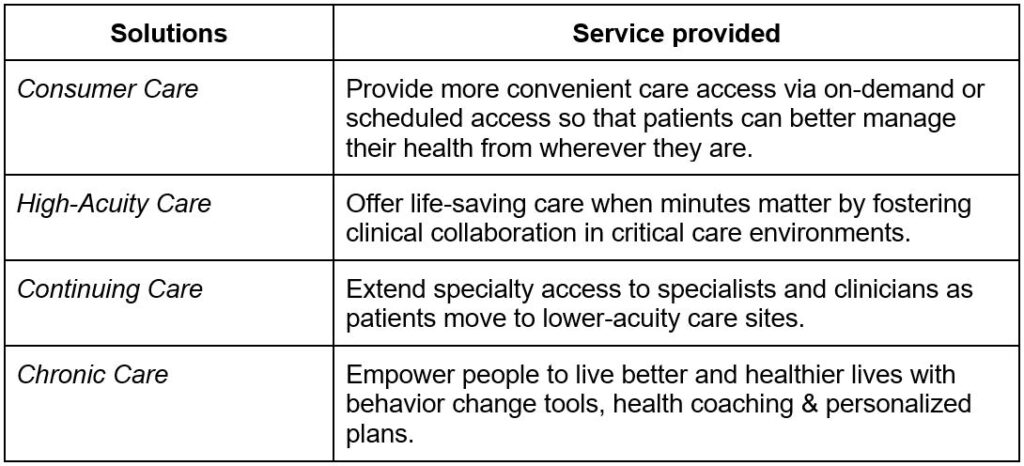

Four main solutions are provided with the aim to meet the need for every clinical workflow:

3. CHRONIC CONDITION

Teladoc Health

There are two main solutions offered for patients with chronic conditions:

Chronic Care Complete:

For patients with chronic conditions (e.g. diabetes & hypertension), this solution is structured to empower them to live healthier lives with smart connected devices to provide personalized health signals, expert coaches and physician-led care to enhance wellness and achieve lasting behavior change.

Teladoc Health

Specialty Care:

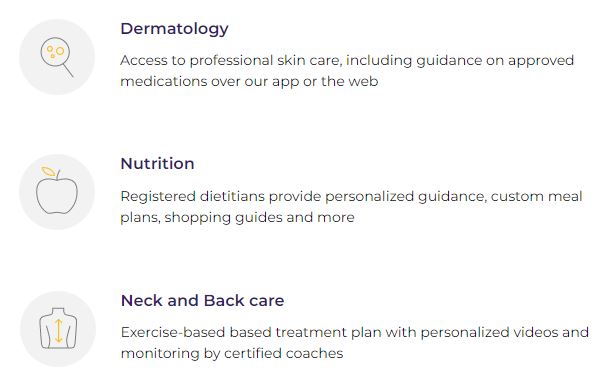

This solution focuses on patients who are diagnosed and want to have convenient access to personalized care from licensed physicians in dermatology, nutrition, neck and back care.

Teladoc Health

HOW DOES TELADOC GENERATE REVENUE?

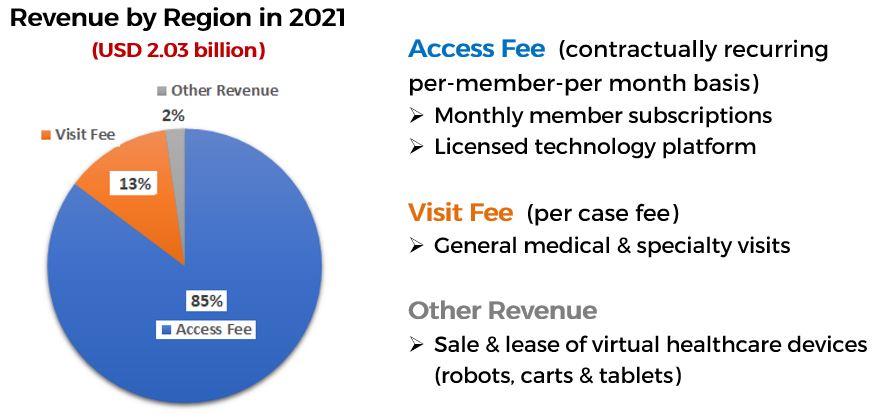

In 2021, Teladoc generated USD 2.03 billion of total revenue.

85% of the total revenue was generated from the Access Fee, which are the recurring monthly member subscriptions fees for patients to access the Teladoc platform to seek medical healthcare. In addition, the Access Fee also includes charges for clinicians who used Teladoc’s licensed platform to connect and provide medical care to their patients.

About 13% of the total revenue was generated from the Visit Fee where patients only paid per case visit for general medical & specialty visits. The remaining 2% was derived from Other Revenue, which is mainly from the sale & lease of virtual healthcare devices.

From a geographical perspective, about 87% of the total revenue was generated from the US region in 2021 and the remaining 13% came from the international region where Teladoc offered services in 130 countries.

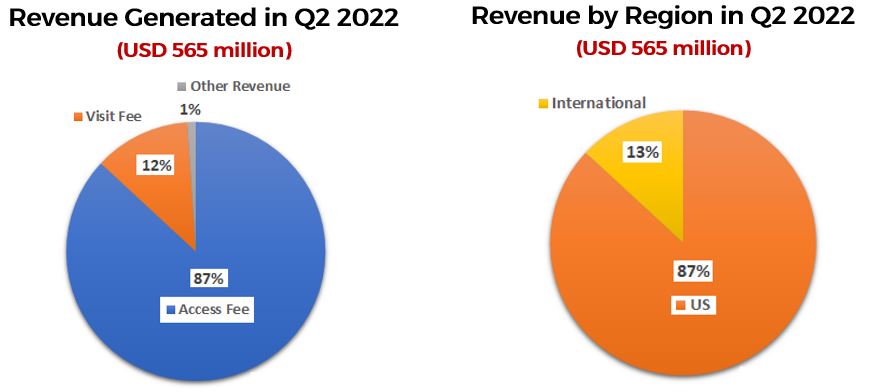

In their latest Q1 2022 report, the total revenue generated was USD 565 million, with Access Fee taking the lead (87%), followed by Visit Fee (12%) and Other Revenue (1%). The US region generated about 87% of the revenue in Q1 2022, and the international region generated approximately 13% of the revenue.

After going through the company background and revenue generations of Teladoc, it seems like this company offered a broad range of healthcare services and solutions to their clients . But do we really know if Teladoc Health Inc. is a good and valuable company to invest in with potential growth?

TELADOC’S FUTURE PLANS TO GROW THE COMPANY

Teladoc intends to make virtual care the first step in the healthcare journey and direct the patients to the right care with the right level of support. To achieve that vision, they provide integrated platforms, develop smart technologies, and use rich data exchange to enable collaborations among clinicians to connect and provide the best healthcare experience to their patients.

They also made focused investments and strategic acquisitions to expand their distribution capabilities and broadened their service offerings. The diagram below illustrates some of the important acquisitions throughout the years from 2015 to 2020.

Teladoc also expanded access and offered various touch points to provide easier and more convenient access to care for their clients, such as mobile apps to easily connect patients and clinicians.

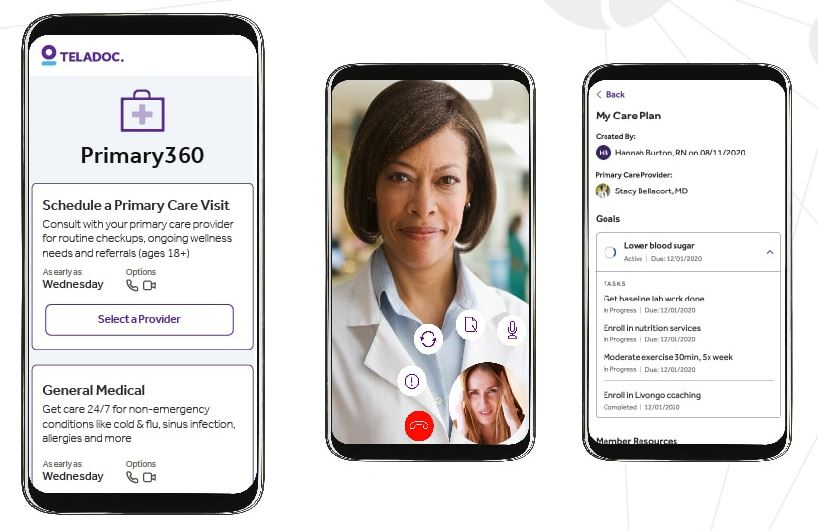

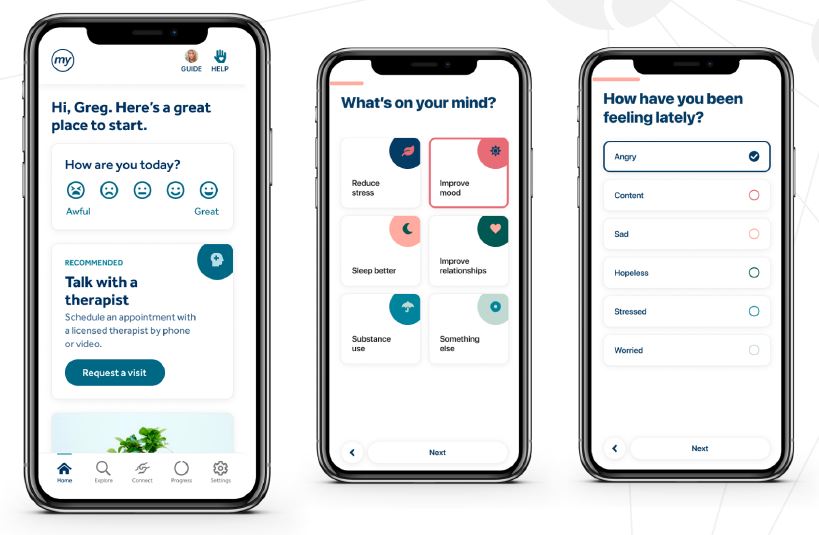

New plans were launched to expand clinical services offerings, such as Primary360 (virtual primary care with a dedicated team of physicians for personalized care plan) and myStrength Complete (a comprehensive virtual mental health program with easy access via app or PC to manage difficult emotions).

Primary360 – Teladoc Health

myStrength Complete – Teladoc Health

WHAT ECONOMIC MOAT DOES TELADOC HAS?

Economic moat refers to the company’s ability to maintain its competitive advantages over competitors to protect the business market share and profits.

Teladoc offers a wide range of virtual healthcare clinical services and whole person care model to address the myriad medical needs for their clients and support them to live healthier lives from any part of the world in 130 countries.

They also developed a highly scalable and secured API-Driven integrated technology platform to serve over 100 million members and with a response time of over 100,000 visits per day. For chronic care patients that rely on medical devices to obtain and provide personalized health signals to their own care team, Teladoc is also using cloud-based technology for connecting the patients’ data to their clinicians with smart-connected devices.

The company has a broad distribution channel that is able to reach directly to individual consumers via Direct-to-Consumer (D2C) basis and Business-to-Business (B2B) clients of almost every market. Some of their B2B clients consisted of employers of multinational companies (such as financial services companies), health plans & insurance, hospital & health systems.

WHO ARE TELADOC’S COMPETITORS?

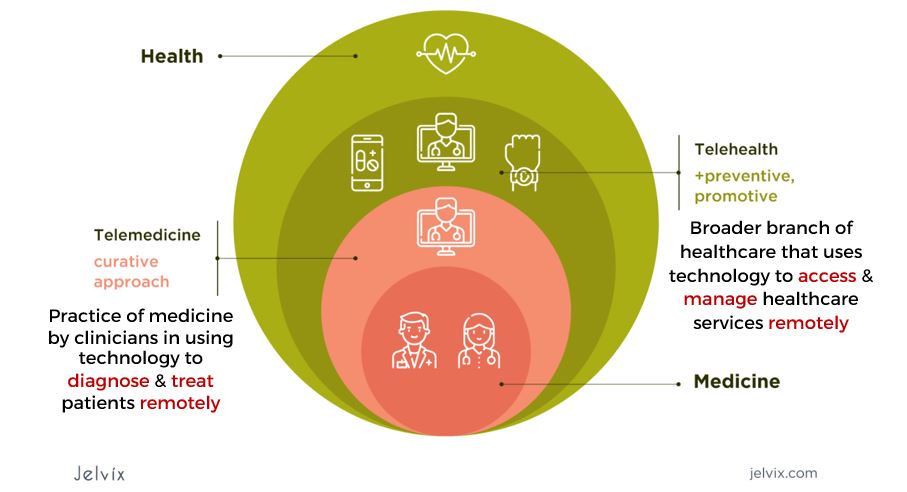

Before we look into the competitors of Teladoc, we will first understand and differentiate the terms between telehealth and telemedicine as both words sound similar but had very different meanings.

jelvix.com

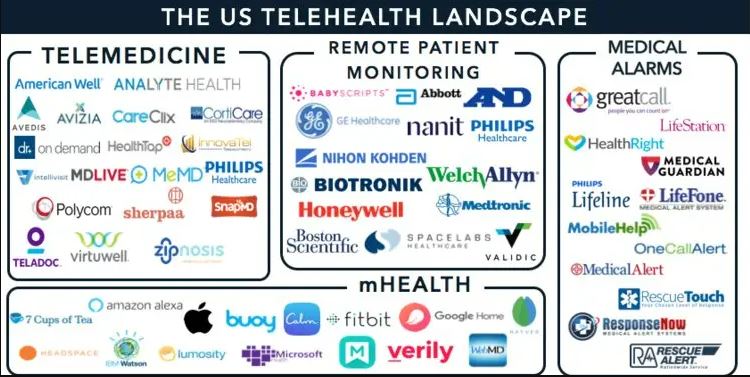

Within the telehealth landscape, Teladoc is found under the branch of telemedicine as shown in the diagram below.

Business Insider

Other than telemedicine, there are myriad companies that offer platforms and technologies for people to monitor and manage their health so that they can lead healthier lifestyles. Telemedicine is a niche field where people with health issues require medical support and analytical diagnosis from clinicians or doctors to treat them and recover from the illness.

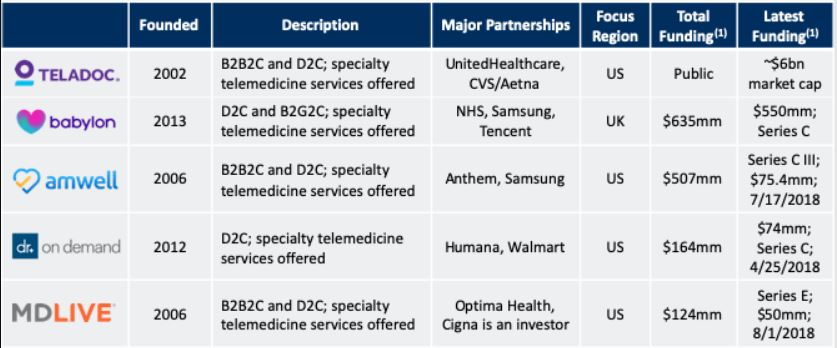

When we drilled down into the telemedicine industry, we noticed that Teladoc Health has a few competitors that offer similar telemedicine services and provide healthcare to similar distribution channels. As a result of this, Teladoc is in a stiff competition with other telemedicine companies as patients and doctors alike can choose to use different platform to seek or provide medical healthcare.

seekingalpha.com

FINANCIALS

For the financial section, we will look into the nitty gritty details to determine if Teladoc is a valuable and profitable company to invest in.

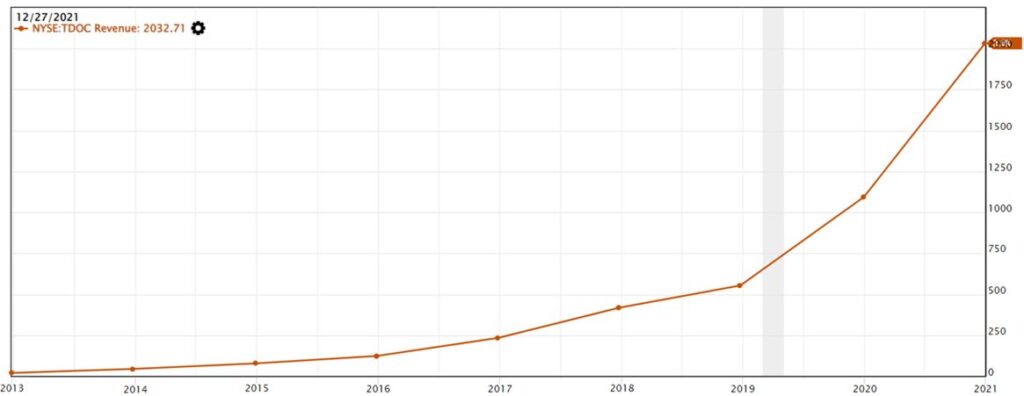

Since 2013, the total revenue generated by the company has been increasing year on year and we observed that there was an exponential growth for the last two years in 2020 & 2021. This is because during the Covid-19 pandemic, people are encouraged to visit doctors via video-conferencing compared to in-person visit to minimize the spread.

Up till now we learned that Teladoc has offered many new healthcare solutions and expanded touchpoints for people to access its platform to seek healthcare assistance. In addition, the revenue has been increasing, especially in 2020 and 2021, at the start of the COVID 19 pandemic.

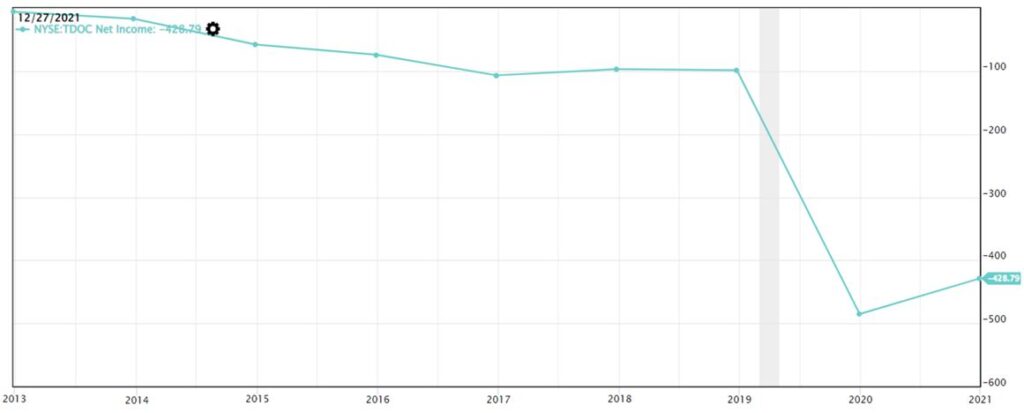

When we look at their net income, which is the profit or loss that the company made after deducting all expenses from their total revenue, the net income is in the red, which means the company is actually losing money.

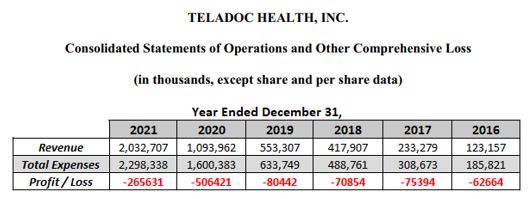

To find out what happened to their net income, we further investigated their income statement and discovered that even though the total revenue has been increasing, their total expenses has also been increasing year on year.

Teladoc Annual Report

There was a sharp drop in 2020 net income due to a sudden increase in their General & Admin expenses, thus pushing up the total expenses for that year and resulted a sharp drop in net income in 2020.

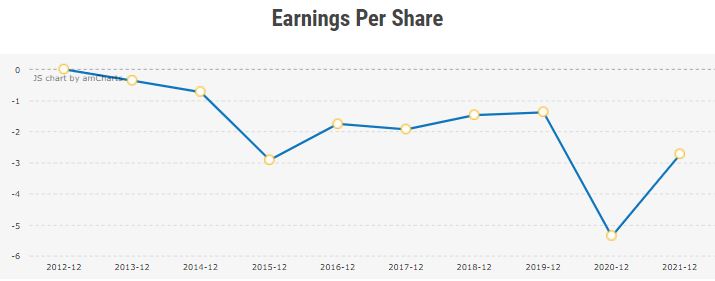

We also looked into Teladoc’s earnings per share (EPS) as this financial metric indicates how much profit the company can generate for every share that the investor has purchased.

Based on the mathematical formula above, if the EPS is $10, this means that for every share that was being purchased, the company can generate $10 of profit (net income). In the earnings per share (EPS) chart, we noticed that the similar trend pattern as net income was observed.

As both Net Income graph and EPS graphs are on a downward trend and in negative numbers, it implied that the company is not profitable at the moment.

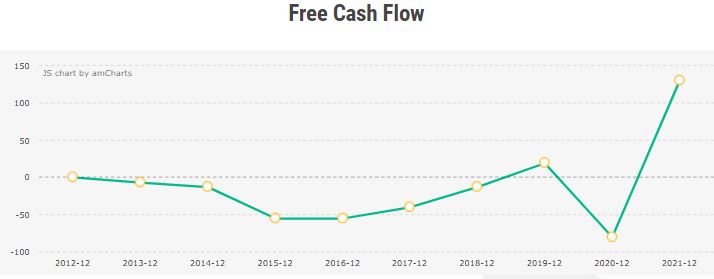

Next, we investigate the company’s Free Cash Flow (FCF). Free Cash Flow (FCF) refers to the cash left over after the company deducts the Capital Expenditure from the Operating Cash Flow.

Operating Cash Flow refers to the cash flow generated from normal business activities. Capital Expenditure (CapEx) is the expense used to purchase assets that will last more than twelve months.

From the graph, we noticed that most of the year, the company’s FCF has been below zero except there was a sharp increase of FCF in 2021. Further investigation into their annual report discovered that the sharp increment was due to increase in the depreciation & amortization and stock-based compensation. These are non-cash items and they are not cash flow generated from normal business activities.

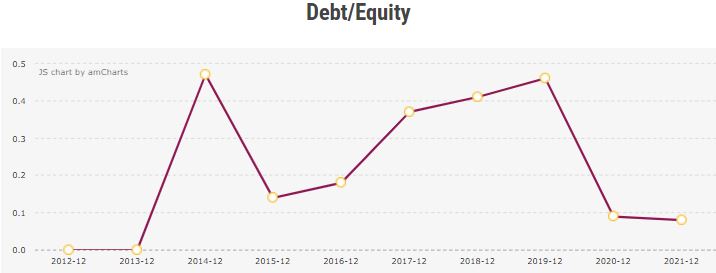

In their Debt/Equity Ratio, we noticed that the ratio has been below 0.5. According to Value Investing Methodology, the Debt/Equity ratio should be below 0.5, meaning that for every $100 of equity, the company cannot take more than $50 of debt. As the ratio has been below 0.5 for the past few years, it is considered that the company is not over-leveraged.

ANY POTENTIAL RISKS?

From the financial numbers, we learned that the company has a history of losses and accumulated deficit throughout the years since it launched IPO in 2015 at $19 per share. The company’s financial fundamentals are not strong and has not been showing to be profitable as of this writing (May 2022).

Other than that, Teladoc also faces stiff competition with other telemedicine companies that are providing similar telemedicine services. Should they encounter loss of clients or fail to retain and recruit qualified clinicians, this may affect their revenue as a significant part of revenue was generated from Access Fee from both patients and health providers.

With rapid technological change, Teladoc will need to keep on innovating and developing new applications and services to provide a seamless experience for their Clients and healthcare providers to use their platform. Should they be unable to keep up with the fast-paced technological development, the users may consider changing to another telemedicine platform to provide healthcare services.

CONCLUSION

In conclusion, even though Teladoc is one of the largest global providers for telemedicine and are passionate about the whole-person virtual healthcare, the bleak financial numbers and stiff competition within the telehealth industry may drive hesitation among investors and are strongly recommended to perform further due diligence before investing their hard-earned money into the company.

Whether Teladoc will bounce back from the negative financial numbers and become the healthcare information backbone of the US as per suggested by Cathie Wood, only time will tell.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.