Have you ever wonder how to enhance the resilience of your investment portfolio while minimizing risk?

Warren Buffet, renowned for his investment wisdom, has suggested this prudent approach:

Allocate 10% of your cash to short-term government bonds and the remaining 90% to a highly cost-efficient S&P 500 index fund.

Many individuals have encountered this concept of fortifying their portfolios with low-risk bonds but may find themselves uncertain about how to embark on this journey. If you’ve ever pondered this, you’re not alone.

In this article, we will explore one of the AAA rating bonds offered by the Money Authority of Singapore (MAS) – Singapore Savings Bonds (SSB).

Read on to delve deeper into SSB and determine whether this bond aligns with your portfolio diversification objectives!

WHAT IS SSB?

SSB represents a secure and adaptable investment option tailored for individual investors. It offers a unique feature known as “step-up interest” where returns increase progressively over time. In essence, the longer you hold the bond, with a maximum maturity period of 10 years, the higher the interest rate climbs.

Investors have the flexibility to commit their funds for this 10-year duration and retain the freedom to redeem their principal at any point during the investment period without incurring penalties.

As a result, SSB can be considered a financial safety net for both investors and the general public. This allows them to safeguard their savings while preserving the value of their nest egg.

This approach presents an excellent avenue for investors to diversify their investment portfolio and build long-term financial security, all the while earning regular interest on their idle cash.

Here are some advantages to consider when evaluating whether SSB is the right investment opportunity for you.

BENEFITS OF SSB

SSB enjoys complete backing from the Singaporean government, resulting in an impeccable AAA rating. This assurance means that investors can have full confidence in the security of their investment, with no concerns about enduring permanent capital losses.

A second enticing aspect of investing in SSB is the option to commit funds for up to a decade, benefiting from incremental or “step-up” interest rates. Consequently, the longer individuals choose to invest in SSB, the higher their potential returns will be.

Furthermore, SSB offers flexibility in terms of the investment period, permitting investors to redeem their principal at any time without incurring penalties.

HOW DOES SSB WORKS?

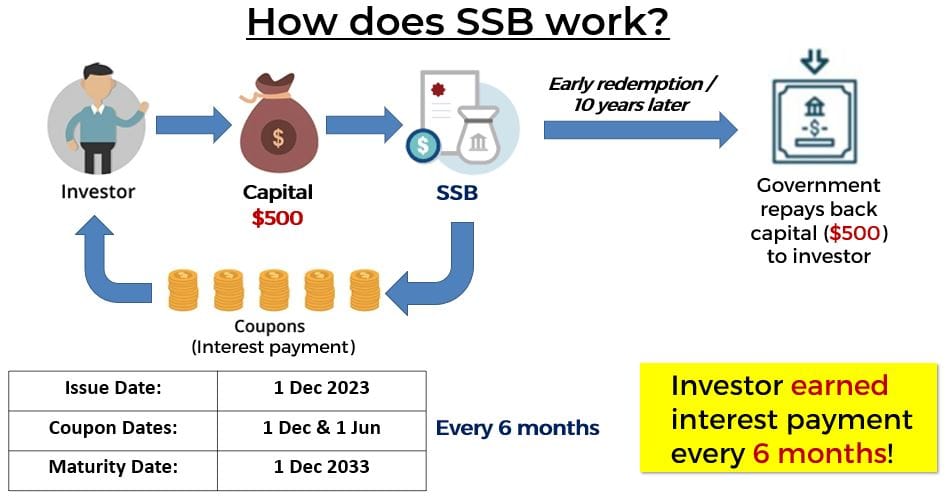

To gain a clearer understanding of how SSB operates, the following diagram illustrates the step-by-step process of how SSB functions:

Example for SSB offered in November 2023 (SBDEC23 GX23120Z)

- If an investor has excess funds and want to invest in SSB, they can purchase the bonds using either cash or their Supplementary Retirement Scheme (SRS) funds.

- Upon successfully applying for and allocating their investment in SSB, the investor will start receiving interest payments every 6 months for the duration of their investment.

- This cycle will continue until the investment is either redeemed prematurely or reaches maturity after 10 years. Consequently, investors can anticipate receiving their full principal amount while also earning interest payments every 6 months.

STEP-UP INTERESTS

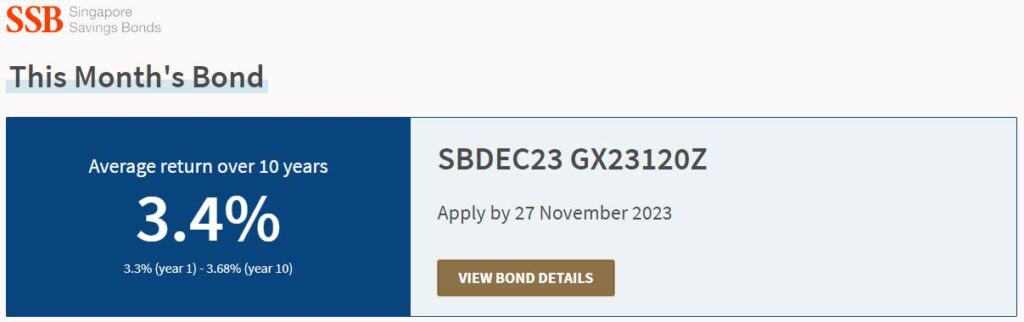

The MAS regularly publishes the monthly average 10-year bond yield on their website. As of November 2023, the average 10-year bond yield stands at 3.4%.

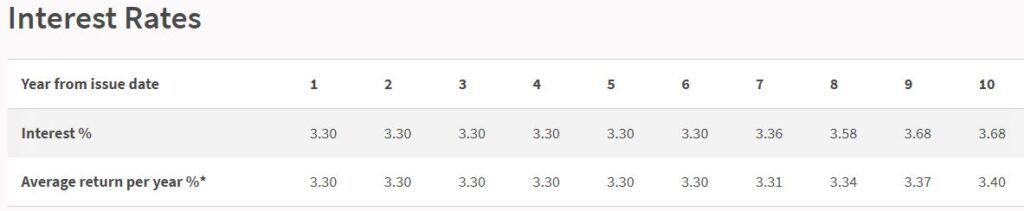

This chart below shows the the annual interest rates presented on the MAS website.

Interest rates for SBDEC23 GX23120Z

Upon closer examination of the specifics of the annual returns for the SSB bond, it becomes apparent that from the first year to the sixth year, the interest rate earned is approximately 3.30%.

As time progressed, we’ve observed a gradual upward trend in the bond’s interest rate. Specifically, it has risen from 3.30% in the earlier years to 3.36% in the seventh year, 3.58% in the eighth year, and eventually reaching 3.68% for both the ninth and tenth years.

For individuals who opt to keep their funds invested in SSB until it matures after a 10-year period, the average return on their investments amounts to 3.4% over the entire decade.

HOW TO BUY SSB?

One can easily start to invest with a low minimum investment of $500 and a maximum cap of $200,000 per individual. Individuals who are above 18 years old, including foreigners, can apply for the SSB bonds.

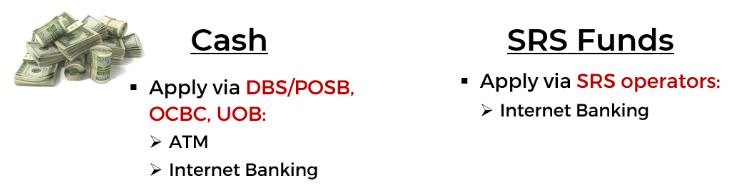

SSB can be easily bought with cash or SRS funds, but not accessible through CPF funds. If you wish to invest MAS bonds with CPF funds, find out more in our articles on T-Bills.

The bond is issued every month on the MAS website and there is a $2 non-refundable transaction fee for each application.

APPLICATION WITH CASH

To invest in SSB with cash, one will need to have a bank account with DBS/POSB, OCBC and UOB.

In addition, they will also need to apply for an individual CDP securities account, activating the Direct Crediting Service on the SGX website.

With these accounts in place, they can then conveniently apply for SSB through ATM machines or Internet Banking.

APPLICATION WITH SRS FUNDS

To apply for SSB using SRS funds, one must open an SRS account with one of the three SRS operators (DBS/POSB, OCBC, and UOB). It’s essential to note that only one SRS account can be maintained and penalties may apply if one attempts to have more than one SRS account.

For SRS application, one can apply through their SRS operator’s internet banking portal. Do take note that in-person applications at bank counters are not accepted.

HOW TO REDEEM SRS FUNDS?

One can easily redeem their principals from their investment in SSB bonds via 2 methods:

1. Hold to maturity (10 years)

No action required as principals will automatically be credited into their bank account that is linked to their CDP account (cash application) or SRS account.

2. Early redemption

Investors have the flexibility to redeem their principal at any time without incurring penalties, but a $2 transaction fee applies to redemption requests.

The redemption process depends on the initial investment method, whether it was made using cash or SRS funds:

Methods for SSB’s early redemption

This means that if one had previously applied the SSB with SRS funds, the early redemption request can only be done with the SRS funds method.

In addition, it’s important to bear in mind that the redemption of your principal amount will only be credited to your account by the second business day of the following month.

Therefore, immediate access to your redeemed principal is not possible upon submitting the redemption request.

An example of the redemption request done in November 2023 is shown below:

Redemption timeline for SBDEC23 GX23120Z

CONCLUSION

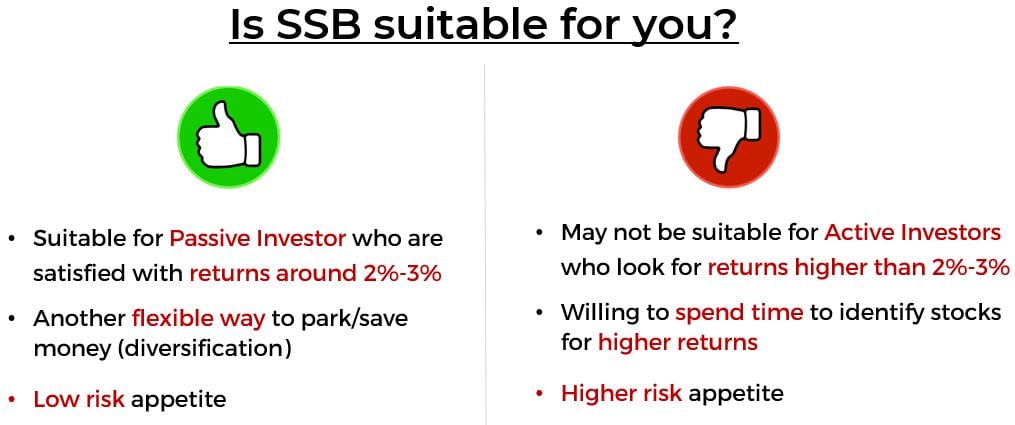

As a conclusion, to determine if SSB is suitable investment option for you, we have prepared a simple comparison chart for your reference:

(Kindly note that this is not a recommendation to invest in SSB as we do not take into the account of individual’s risk tolerance)

If you’re looking to grow your income beyond the 2%–3% returns offered by SSBs, one potential option is investing in S&P 500 companies, which have historically delivered returns exceeding 3%. However this option may require you to spend more time to identify and evaluate potential stocks.

To learn how to identify companies that are both safe and profitable, our Value Investing Masterclass will teach you how to apply a proven methodology to screen through thousands of companies, uncovering potential gems and understanding the key criteria for selection.

Join us in our masterclass by clicking on the banner below to learn more how to:

- Identify 3 sources to generate potential passive income even if you are new to investing.

- Start investing even with minimal capital.

- Identify alternative sources of revenue to systematically replace or supplement your income.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.