Competition in the EV space is at a boiling point and the two most talked about rivals are Tesla & NIO. Tesla is an established EV manufacturer with strong branding and a charismatic CEO. NIO is a 6-year young company taking the Chinese EV market by storm and it also has plans for global expansion. NIO is Tesla’s primary rival in China’s premium luxury EV market. Read our deep dive into the EV industry.

There are several differences in the strategy and approach of both companies. While Tesla enjoys the attention accorded to Elon Musk by his loyal army, Nio’s CEO, William Li, is one with a relatively low profile. Tesla has taken advantage of selling its green regulatory credits to turn profitable, whereas Nio is still a loss-making company. Watch our live recorded coverage of Tesla and the EV industry here:

CHINA’S 41% GLOBAL EV MARKET SHARE

Tesla operates in China as well, while Nio hasn’t encroached upon the international markets in a very meaningful manner, having just begun selling in Norway. This makes Tesla the frontrunner globally. However, Tesla recently faced some flak and resistance from Chinese regulators and Nio stands to gain the most from this tiff. If tesla is pushed out of China, Nio’s growth prospects seem strong since China is a huge EV market and expected to grow multi fold with the government push for zero emission vehicles.

NIO’S ES8 VS TESLA MODEL X

The ES8 range varies from 355km – 580km depending on battery size, while Model X has a range of 547km – 580km

The Model X can sprint from 0-100 km/h in 2.8 seconds, while the ES8 can do it in around 4.9 seconds. The Model X is surely faster but it comes at a premium of approx. $20,000.

Both the Model X and ES8 are SUVs which can seat up to seven people.

The ES8 is cheaper in price as compared to the Model X with a starting price of $65,000 for the ES8 vs $100,000 for a basic Model X.

Users can control several features in the Model X through a 17-inch touchscreen inside the car. Further, Tesla sends wireless updates to its vehicles for new features and performance upgrades.

The ES8 has a 10.4-inch touchscreen, heads-up display, and voice-activated system called Nomi that can control features like music and navigation.

According to CleanTechnica, the ES8 heavily outsells (by 30% units) the Model X in China. In the first half of 2021, there were 2,451 NIO ES8 sales beating the 1,886 units for the Model X. Since mid-2018, NIO has completed 22,910 ES8 sales vs 17,904 for the Tesla Model X — a difference of 5,000 units.

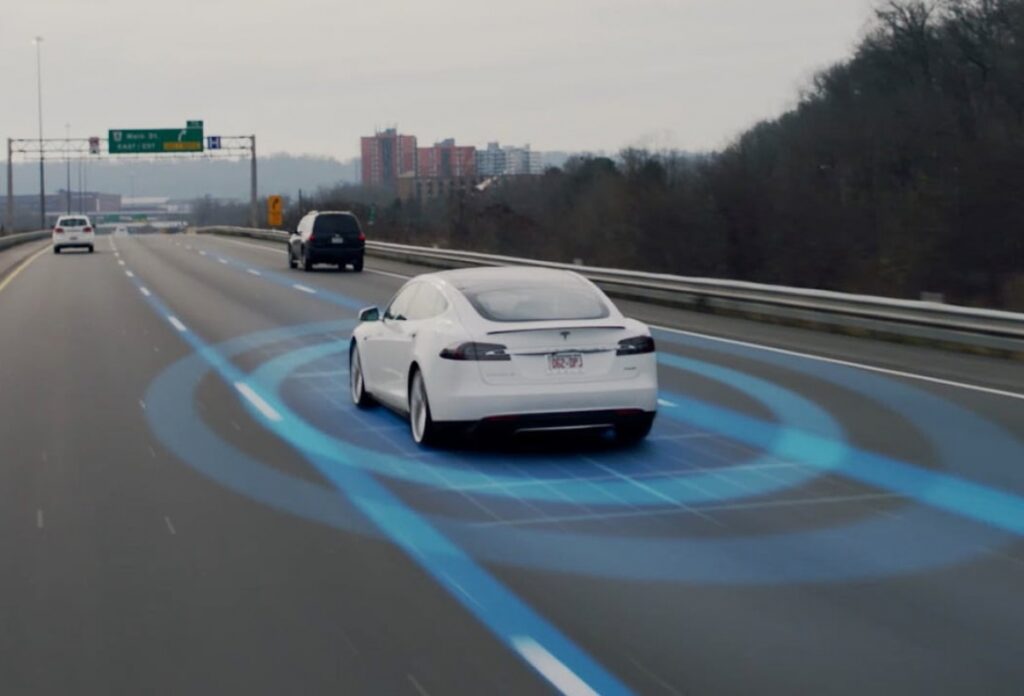

TESLA’S AUTOPILOT VS NIO PILOT

Tesla’s autopilot is a driver assistance system that can handle acceleration, braking, and steering under some circumstances with driver supervision. It uses cameras, radar and ultrasonic sensors to support two major features: Traffic-Aware Cruise Control and Autosteer.

In addition to its Autopilot capabilities, Tesla has been offering what it calls “full self-driving” features that include auto park and auto lane change.

NIO Pilot is the company’s SAE level 2 semi-autonomous system that offers ADAS features. Several over the air updates throughout 2018 and 2019 has enhanced NIO Pilot with features such as lane keeping, adaptive cruise control, lane departure warning, automatic emergency braking, highway pilot, traffic Jam pilot, auto lane change and more.

According to ARK Investment, the substantial earnings opportunity for EV platforms is in the provision of autonomous ride-hailing service, rather than in the making of the vehicles. According to estimates, the cost of ride hailing would be significantly reduced when autonomous driving replaces human drivers. And since labor is more expensive in US than China, the difference would be more apparent in US. Hence, the profit margins would be higher in US which Tesla would be expected to capture. Maybe this is why Tesla commands such a high valuation.

CHARGING

Nio doesn’t have the largest market share in the EV space, but it does have a superior battery swapping technology which is Nio’s 3-minute solution to faster charging. All a customer must do is locate one of the 500+ battery swapping stations in the country through the app, get in line and when it’s their turn, back the car into the station and in approx. 3 minutes, they’ll be driving out with a fully charged battery in the car. As on September 2021, NIO has performed over 4,000,000 battery swaps. Nio has guided that there will be 700 stations by 2021 and 4,000 by the end of 2025.

BaaS offered by Nio is a key selling point which allows customers to own the car and not the batteries, as well as have access to upgraded batteries. It also allows Nio to sell the cars at a lower upfront cost. This may allow Nio to sell more cars while still earning a steady income from selling BaaS subscriptions.

Tesla did contemplate battery swapping but finally settled on their supercharging network which has now grown to include 2500+ Supercharger Stations with 25000+ Superchargers. Tesla has invested heavily in charging infrastructure as it has in cars. Initially Tesla offered free charging but as the popularity of the cars grew, they have started monetizing it. When it comes to charging time, the Tesla Supercharger, which is exclusive for Tesla owners, takes about 15 minutes to charge for 200 miles (321km).

DELIVERIES

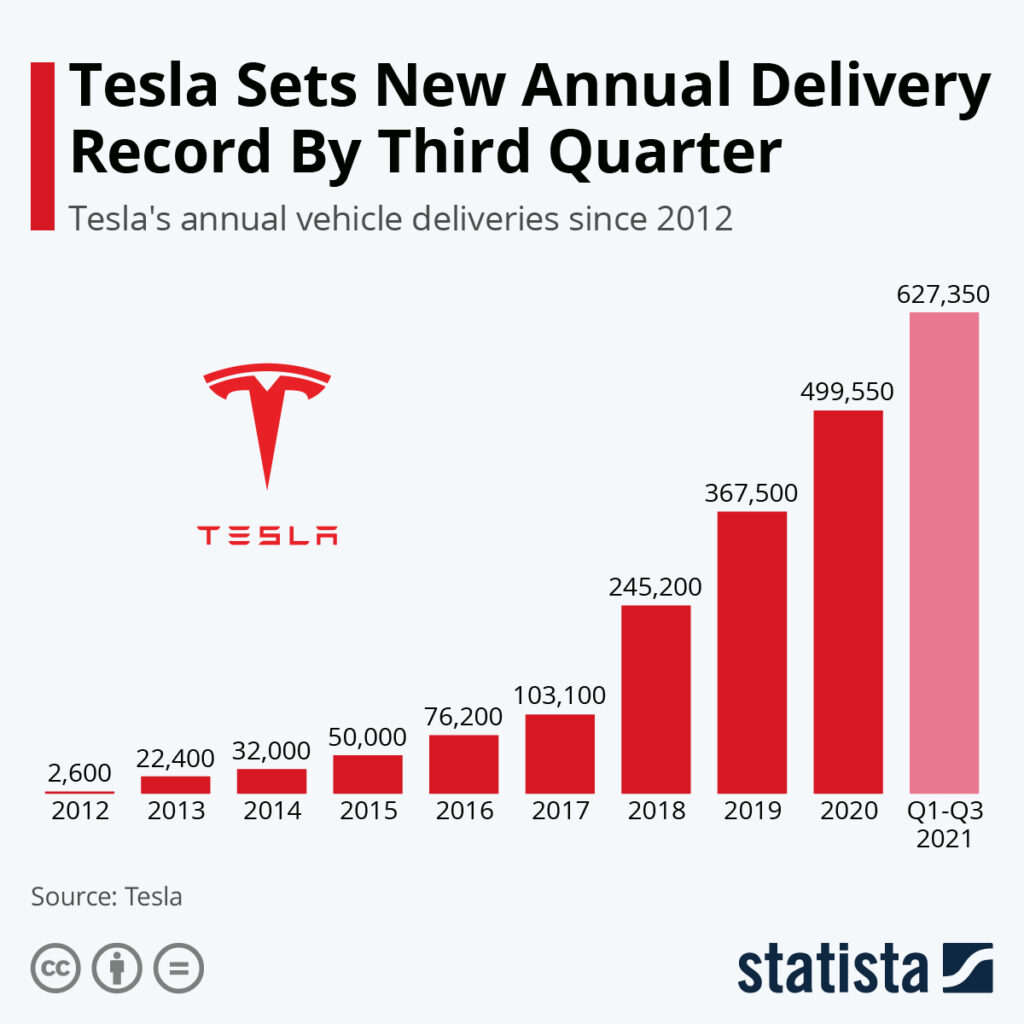

In September 2021, NIO delivered 10,628 vehicles globally, an all-time high monthly record representing a robust growth of 125.7% year-over-year.

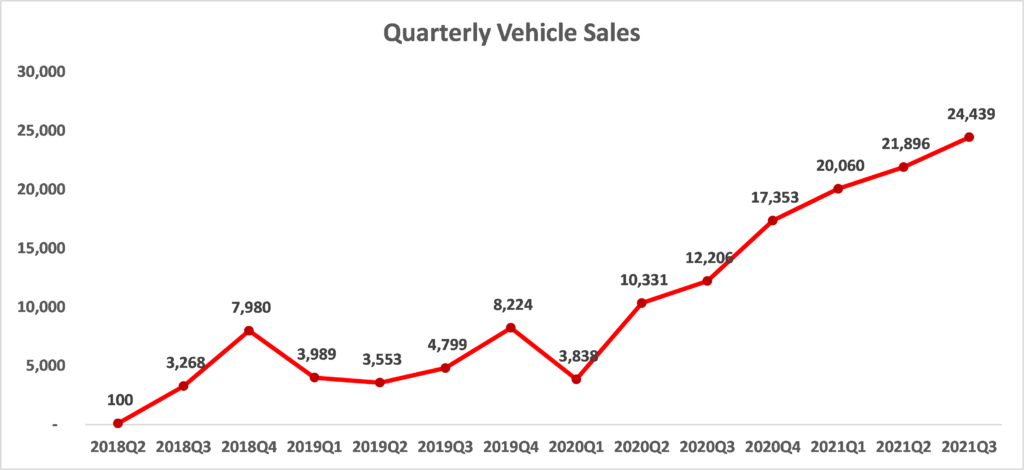

Nio Quarterly Vehicle Sales

NIO delivered 24,439 vehicles in the third quarter of 2021, representing an increase of 100.2% year-over-year.

Tesla reported total deliveries of 241,391 vehicles in Q3,2021 which is an increase of 73% YoY. So compared to NIO, the growth in deliveries was lower for Tesla.

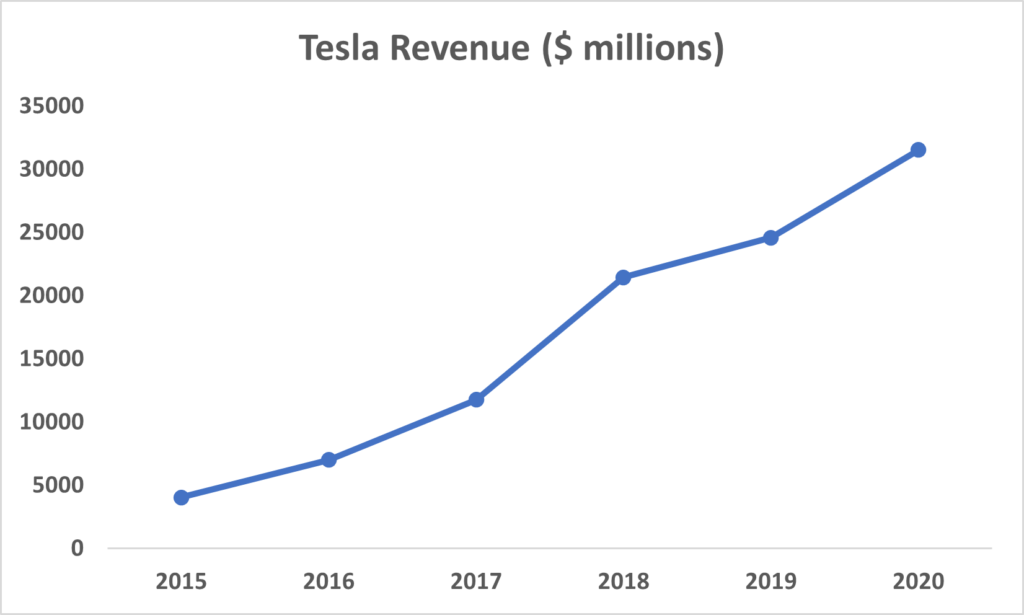

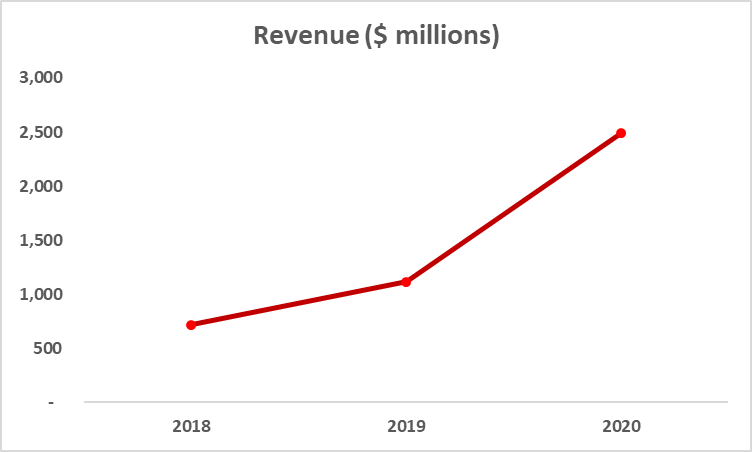

Tesla Revenues

REVENUE

For Tesla, total revenue grew 57% YoY in Q3, and 98% YoY in Q2 of 2021. Whereas Nio reported a 127% YoY rise in revenue for the second quarter of 2021. So, Nio has a higher growth rate in revenue compared to Tesla.

Nio Revenues

Going forward, analysts expect a higher growth from Nio than Tesla because Tesla is a much larger company and Nio is still young.

PERFORMANCE

Tesla reported a net income of $1,142 million in Q2 of 2021 (up 998% YoY). Nio is yet to turn a profit (net loss decreased 50% YoY to $90.9 million in Q2 of 2021), but its sales have been rising consistently, which is a glimmer of hope for investors.

VALUATION

Tesla’s PS ratio is 23.42 while that of Nio is 13.74. This makes Tesla’s multiple almost 70% higher!

The enterprise value of Tesla is $860 billion while that of Nio is $60 billion. This means that investors perceive Tesla as more than 10 times more valuable than Nio despite the growth rates for Nio being higher as seen above.

Compared to Tesla, Nio seems to be a bargain for value investors given its higher growth trends.

CONCLUSION

In the US and globally, Tesla is still dominating but it is under pressure in China with Nio performing well. The question investors have is that which company has better growth prospects? Both companies have sky high valuations and fierce competition from local players and traditional companies in their respective markets. However, considering that Nio is still young and budding, and the hyper-growth Chinese markets that it primarily operates in, the upside for Nio looks rosy. On the flipside, Tesla’s global head-start, improving profitability and margins, superior brand and leading tech features make it a safer bet.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.