HOW THE COMPANY MAKES MONEY

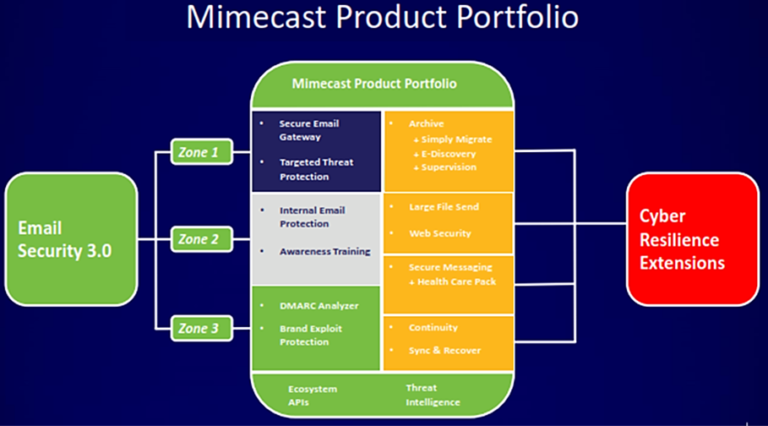

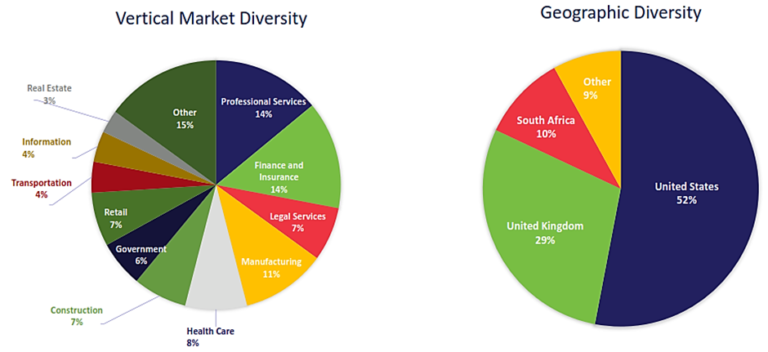

In short, Mimecast’s mission is to make email safer for business. They achieve this by providing software-as-a-service (aka SaaS) for small enterprise in managing their email and corporate information. Apart from helping business in handling emails, they also facilitate in archiving, offering Web security, awareness training and risk management services along with cloud security. In other words, they have innovated their own proprietary cloud architecture and provide the aforementioned services on subscription basis. To date, Mimecast has 12 offices with around 1700 employees and over 35,000 clients. Despite being listed in Nasdaq (ticker symbol: MIME) just about five years ago, it is interesting to note that the company was founded way in 2003 by Peter Bauer and Neil Murray, thus having being operated about 17 years. The following diagram shows the product portfolio of Mimecast and their inter-relation between email security and cyber resilience:

WHAT’S ONE THING UNIQUE ABOUT THIS COMPANY

As mentioned earlier, they provide various services to their clients and with ever-changing security environment especially in the cloud technology, it is imperative to stay updated and mitigate the risks efficiently. The following highlights Mimecast’s core products:

Mimecast Email Security

- This system comes along with Targeted Threat Protection that consists of cloud-based services to protect against potential threats via emails

Mimecast Web Security

- Via this system, clients can configure their policies and protect themselves against unwanted Web activities (both user-initiated and malware-initiated ones)

Mimecast Mailbox Continuity

- This system allows their clients to continue in either sending or receiving emails, especially during unwanted events, such as outage of primary email settings.

REVENUE TREND

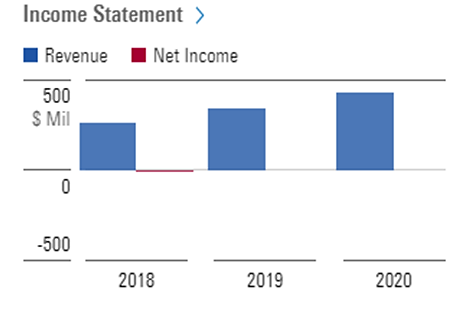

Mimecast has been performing well over the years especially in terms of revenue as shown below. In 2018, revenue was reported to be USD 261.9 million and it grew to USD 426.96 in 2020, reflecting a jump of 163% in just two years of time. The same trend can be seen in their net income whereby it was reported as USD (12.39) million in 2018 and it went up to USD (2.20) million in 2020, representing an increment of 82.24% within same time period. Similarly, their operating income was reported to be USD (4.41) million in 2018 and it grew to USD 2.3 million in 2020, again showcasing an improvement of 152%.

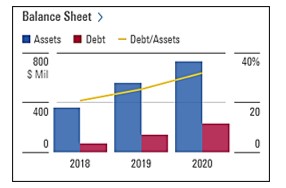

Apart from income statement, Mimecast’s balance sheet also appears solid whereby in 2018, the asset was reported to be USD 358.4 million and this figure grew to USD 729.83 in 2020, representing an improvement of 203%. As the portion of the assets grew, so did Mimecast’s liabilities in which in 2018, USD 256.71 million was reported and this number increased by 193% to USD 497.78 million in 2020. The growth shown here translates to increasing equity whereby in 2018, it was reported to be USD 101.69 million and by 2020, this portion grew by 228% to USD 232.06 million. Being in the cloud technology sector, Mimecast had also taken increasing debt which was reported to be USD 73.14 million in 2018 and by 2020, this amount was shown as USD 229.91 million. The same trend was also seen in terms of debt/asset ratio as shown as yellow line, thus indicating that Mimecast is investing in its business for future growth.

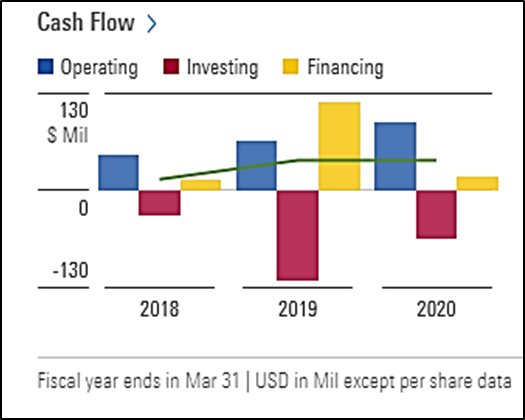

Looking into the allocation of Mimecast’s cash flow, it was shown that USD 46.41 of operating cash flow was reported in 2018 and this amount grew to USD 90.54 million in 2020, which is an increment of 195%. The allocation of investing cash flow indicated outflow of money whereby in 2018, it was reported to be USD (35.02) million and it grew to USD (65.54) million in 2020. Their financing cash flow showed an uptrend in whereby USD 3.16 million was reported in 2018 and spiked up to USD 116.99 million in 2019 before dropping to USD 17.73 million in 2020.

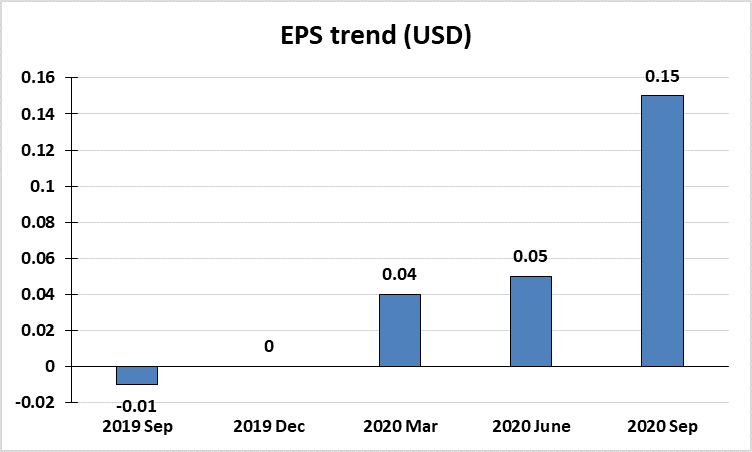

EARNINGS PER SHARE TREND

WHAT TOOK PLACE IN THEIR PERFORMANCE RECENTLY?

- The revenue grew by 19% to USD 122.7 million based on year-on-year basis

- Addition of new net customers with total global customers of 39,200

- Retention rate of revenue by 105%

- The gross profit based on GAAP and non-GAAP basis was reported as 76% and 78%, respectively.

- An increase of Operating Cash Flow to USD 31 million as compared to USD 17.7 million in the previous year-on-year equivalent

- Free Cash Flow was reported to USD 21.6 million, as compared to USD 4 million in the previous year-on-year equivalent

- The revenue in the coming quarter is expected to be within the range of USD 126 million to USD 127 million.

- Adjusted EBITDA is expected to be with the range of USD 28 million to UDSD 29 million

- The operating cash flow is expected to be about USD 24 million

- The free cash flow is expected to be about USD 16 million

- For fiscal year 2021, the revenue is expected to be within the range of USD 490.5 million to USD 493.5 million

- For fiscal year 2021, the adjusted EBITDA is expected to be within the range of USD 109 million to USD 110.5 million

- For fiscal year 2021, the operating cash flow is expected to be within the range of USD 116.5 million to USD 118 million

- For fiscal year 2021, the free cash flow is expected to be within the range of USD 82.5 million to USD 84 million

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.